- US manufacturing activity improved, while service activity declined.

- The US jobs report showed a stronger-than-expected increase in employment in March.

- Traders lowered expectations for the Fed’s first rate cut in June.

The weekly EUR/USD forecast tilts to the bearish side as investors adjust their expectations for a Fed rate cut following the upbeat jobs report.

EUR/USD ups and downs

Last week, EUR/USD fluctuated but ended with gains following a series of economic reports from the US. Investors focused mainly on employment and PMI data, which showed a mixed picture of the economy. Manufacturing activity improved, while service activity declined. Meanwhile, jobless claims rose, while the NFP report beat forecasts.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

Initially, unemployment services and claims announced increased expectations of a rate cut, which led to a rise in the EUR/USD pair. However, the week ended with a strong US jobs report showing a stronger-than-expected increase in employment in March. At the same time, the unemployment rate fell, revealing a still tight labor market. Consequently, traders lowered expectations for the Fed’s first tapering in June.

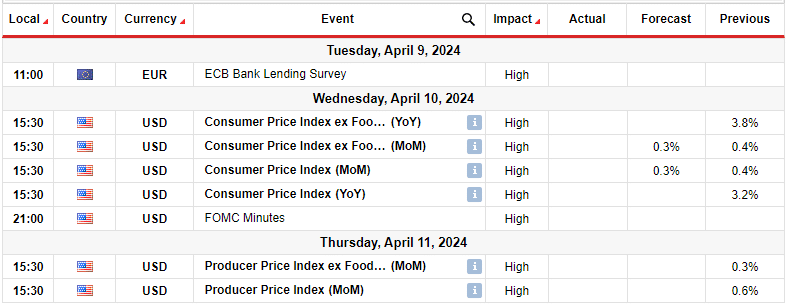

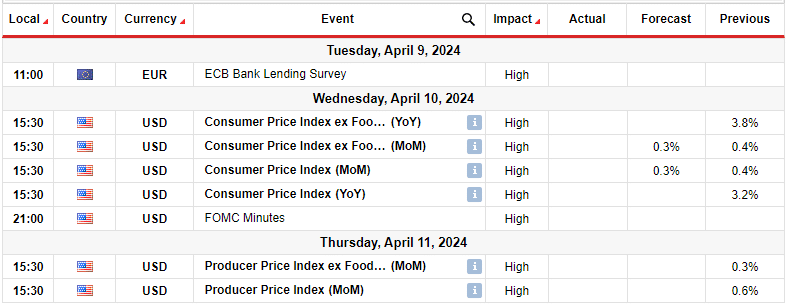

Next week’s key events for EUR/USD

Consumer and producer price indices in the US will show the state of inflation in the country. This insight will shape the Fed’s rate cut outlook. Economists expect the CPI to fall from 0.4% to 0.3%. Falling inflation would support expectations that the Fed will cut interest rates in June. However, there is also a chance that the figure will exceed forecasts. That would dampen expectations of a rate cut, especially after an upbeat jobs report.

Meanwhile, traders will also look to minutes from the FOMC meeting, which may contain clues about the outlook for interest rates.

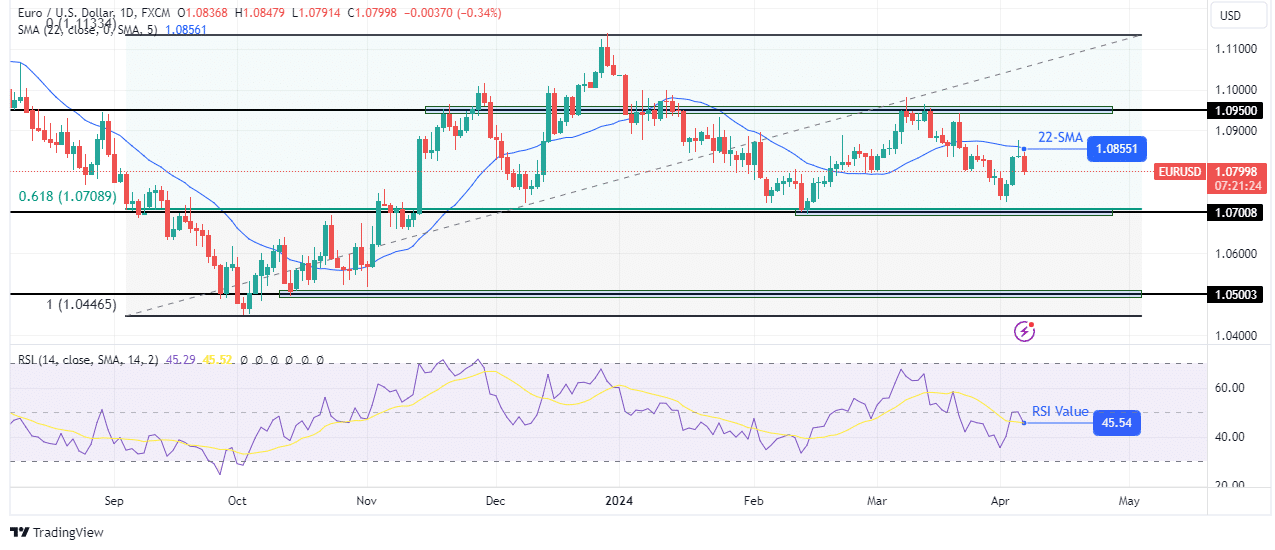

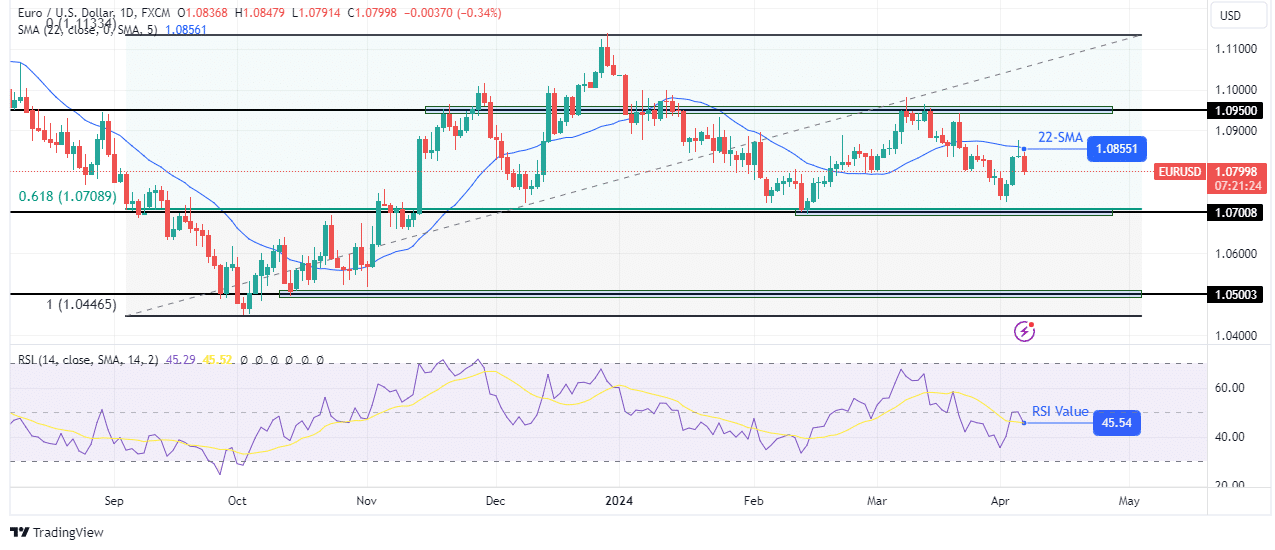

EUR/USD Weekly Technical Forecast: Price retreats as 22-SMA resistance remains strong

On the technical side, the EUR/USD price is falling after finding strong resistance at the 22-SMA. Furthermore, the price is trading with the nearest support at 1.3200 and the nearest resistance at 1.3800.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

The bullish trend recently reversed when the price started trading below the 22-SMA and the RSI below 50. The bulls tried to regain control at one point but failed to push above the key resistance level of 1.0950. This allowed the bears to push the price back below the 22-SMA before retesting it as resistance.

And now, the bears are targeting support at 1.0700. A break below this level would confirm the continuation of the downtrend. Furthermore, the price would be free to retest lower support levels such as 1.0500.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.