- The US released another higher-than-expected inflation reading.

- Investors have pushed back the timing of the Fed’s first rate cut to September.

- Markets are almost entirely pricing in the ECB’s first rate cut in June.

Hot inflation data pushed the EUR/USD forecast to the downside as the dollar strengthened on falling rate cut expectations. Meanwhile, investors await the ECB’s policy meeting, during which the central bank could signal the start of interest rate cuts in June.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

On Wednesday, the US posted another higher-than-expected inflation reading. This was the third month of high price growth, indicating that the progress of inflation has stalled. Inflation rose 0.4% in March, beating forecasts for a 0.3% rise.

Moreover, the inflation report came after an upbeat jobs report, which showed a strong economy. Demand remains strong in the US. This is why the Fed has to keep interest rates high for longer. Otherwise, inflation could be stuck at levels above the central bank’s target.

After the report, investors pushed back the timing of the first rate cut to September. In addition, investors now expect only two rate cuts in 2024 as opposed to three.

Meanwhile, the outlook for the ECB is quite different. Markets are almost completely pricing in the first rate cut in June. Inflation in the Eurozone is likely to reach the 2% target by the end of the year. At the same time, the economy slowed down significantly compared to the American one. Therefore, there is more pressure on the ECB to cut rates.

However, the ECB is likely to keep rates on hold at its policy meeting and signal the start of a rate cut.

EUR/USD key events today

- European Central Bank policy meeting

- US PPI report

- US unemployment claims

- US 30-year bond auction

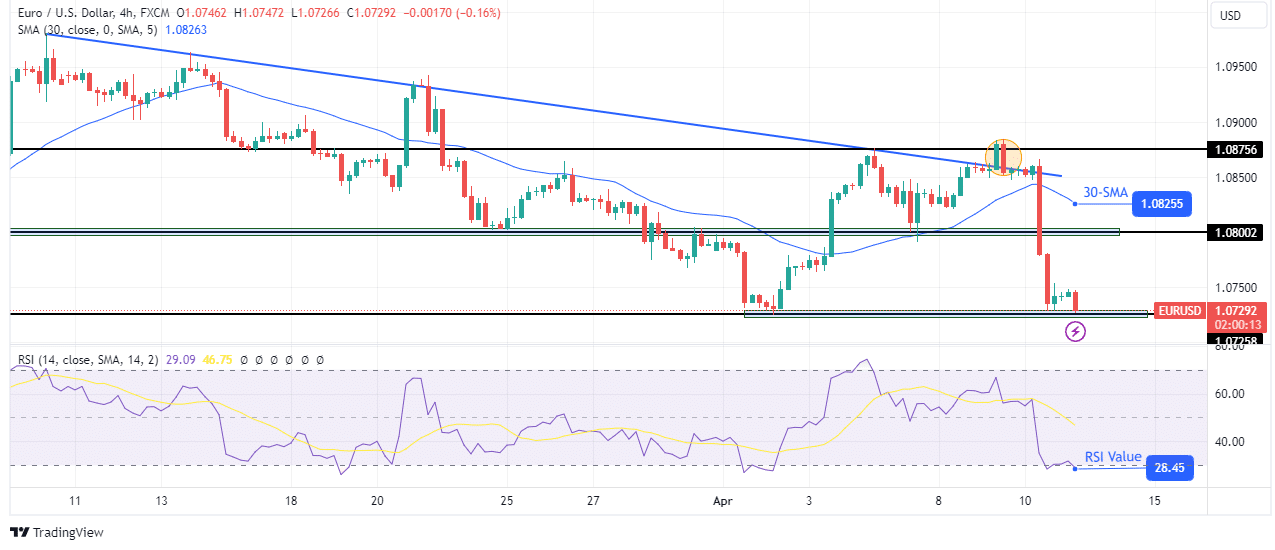

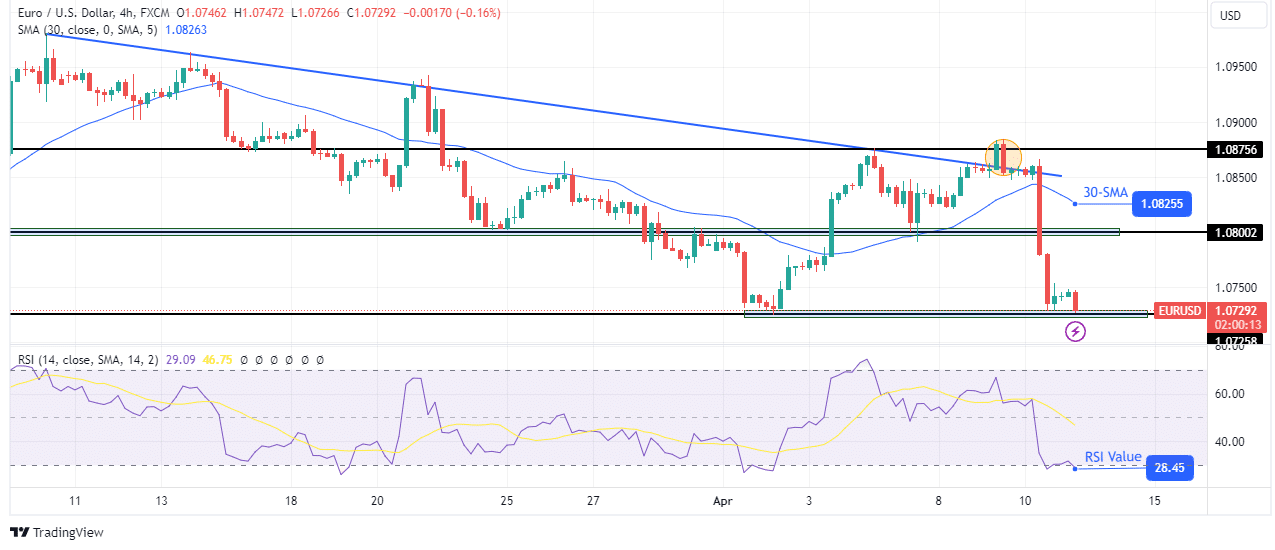

EUR/USD Technical Forecast: Price falls sharply after false breakout of trend line

On the technical side, EUR/USD fell sharply after finding strong resistance at the key 1.0875 level. The price is now trading well below the 30-SMA with the RSI in the oversold region, showing huge bearish momentum.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

Before the decline, the bulls tried to break above a strong resistance trend line. However, the price quickly reversed after forming a bearish engulfing candle. Consequently, this move turned out to be a false breakout, leading to a steep decline. The price broke below the key support of 1.0800 and is now testing 1.0725. However, after such a strong move, it could pull back before continuing lower.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.