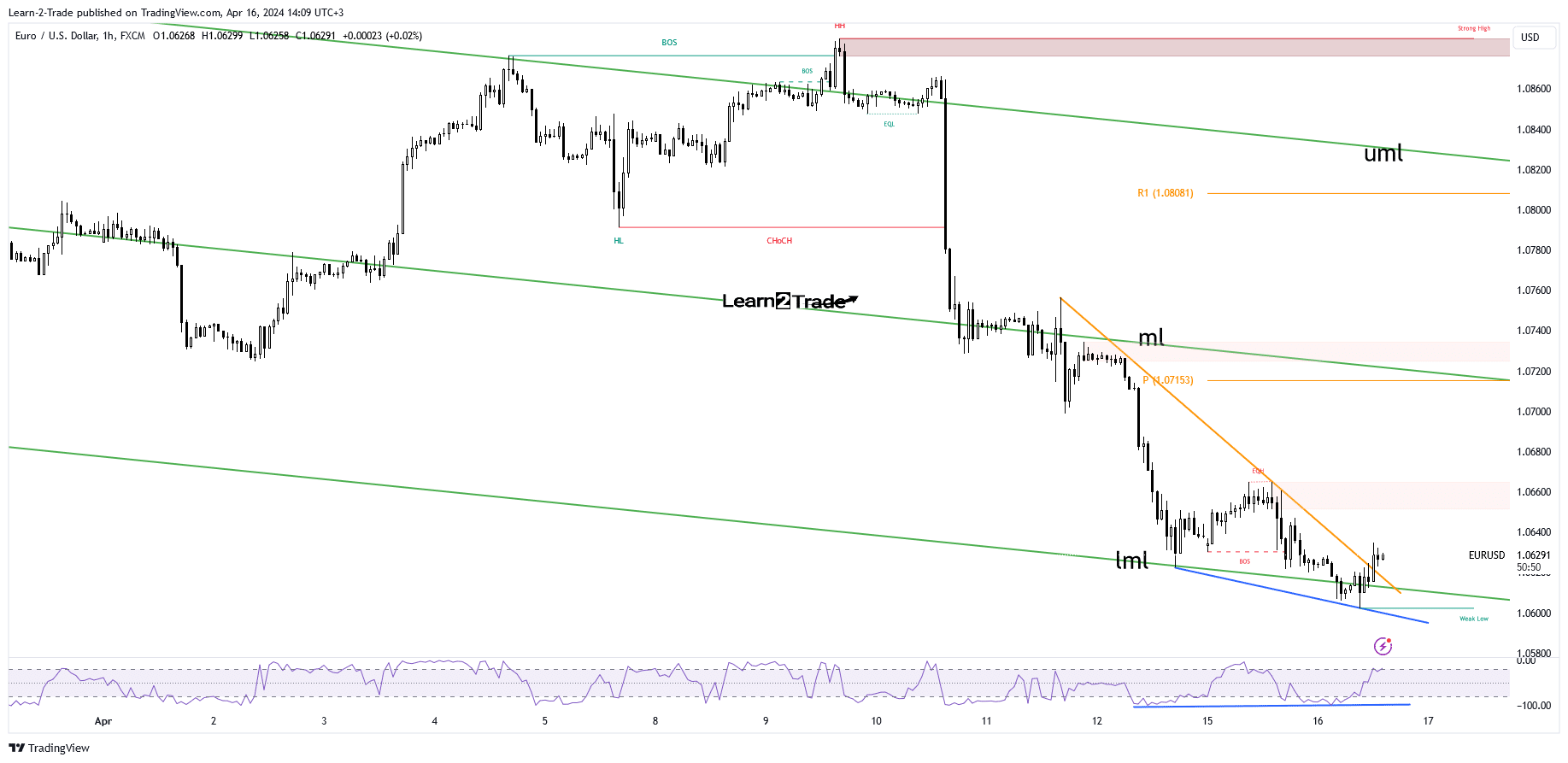

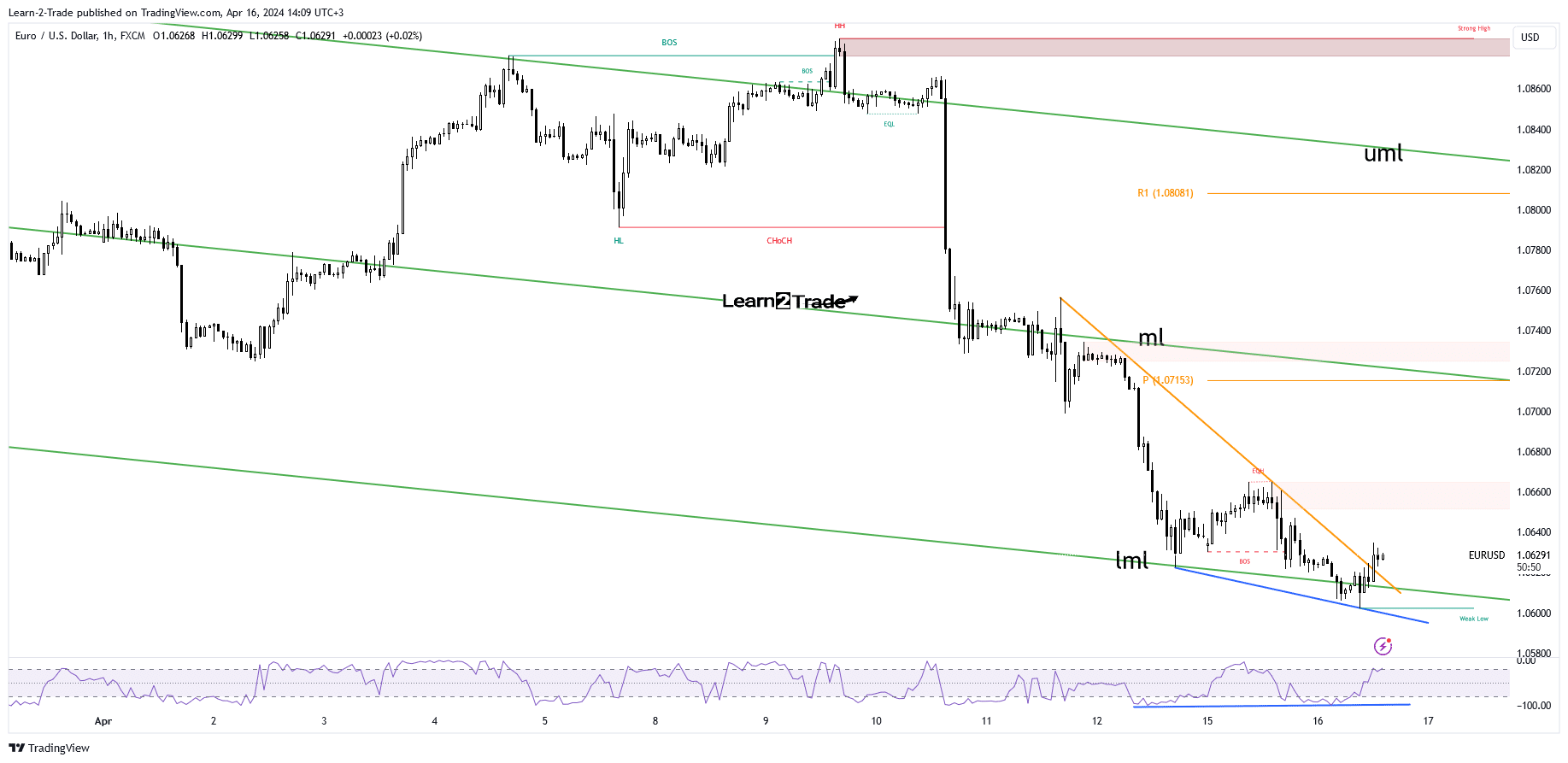

- A fall to 1.06 was announced by exhausted sellers.

- Fundamentals should be decisive today.

- Taking 1.0665 activates a higher rally.

EUR/USD is trading in the green at 1.0640 at the time of writing. The pair looks positive to recover some of the recent losses. However, the US dollar remains bullish, and further growth should force the euro to lose ground.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

The currency pair reached a new low of 1.06023 today. Pressure on the downside was high as US retail sales data came in better than expected. The Retail Sales indicator rose 0.7% versus the 0.4% estimate, while Core Retail Sales rose 1.1%, beating the 0.5% forecast.

The Euro received a helping hand today from the Eurozone ZEV Economic Sentiment, which reached 43.9 points, above the estimated 37.8 points, and the German ZEV Economic Sentiment indicator jumped from 31.7 points to 42.9 points, above 35. 9 forecast.

Later, the Canadian inflation figures could bring sharp movements in this market as well. The US will also release data on industrial production, capacity utilization, building permits and housing starts. Bad economic data should weaken the dollar.

Technical analysis of EUR/USD price: The return

From a technical point of view, the EUR/USD price failed to break the psychological level of 1.06, signaling the exhaustion of sellers.

The pair failed to stay below the lower middle line (lml) of the descending villa and has now crossed above the immediate descending line, indicating a potential rebound.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

Price action also signaled a bullish divergence. However, it is premature to talk about a trend reversal as the pair is far from bullish territory. I think just taking 1.0665 can activate a much larger momentum.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.