- UK inflation fell from 3.4% in February to 3.2% in March.

- Governor Bailey said the drop in inflation was in line with the central bank’s forecasts.

- There is more caution about rate cuts in the US.

Things are looking up in the GBP/USD forecast as the pound recovers after a smaller-than-expected drop in inflation. At the same time, the dollar is falling as investors pause on the recent data-driven rally.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

On Wednesday, the UK released data showing higher-than-expected inflation, leading to a drop in expectations for a rate cut. Inflation fell from 3.4% in February to 3.2% in March. However, economists were expecting a bigger drop to 3.1%. As a result, traders reduced bets on a BoE rate cut. Currently, they expect the first cut in August or September. Still, there is more clarity about the BoE’s rate cut prospects than the Fed’s.

Following the report, Governor Bailey said the decline was in line with the central bank’s forecasts. Furthermore, he said inflation is on a downward trend and will reach the central bank’s target.

Meanwhile, Fed policymakers are less certain about the direction of US inflation. Recent data suggests a pause at levels above the central bank’s target. Moreover, the economy remains resilient despite higher interest rates. Therefore, there is more caution regarding rate cuts in the US.

In addition, Fed Chairman Powell said that restrictive policy conditions are likely to last longer. With no clear timing for the first cut, investors are betting on some time in the fourth quarter. Some experts even believe the Fed may not cut in 2024 if inflation remains stubborn.

GBP/USD key events today

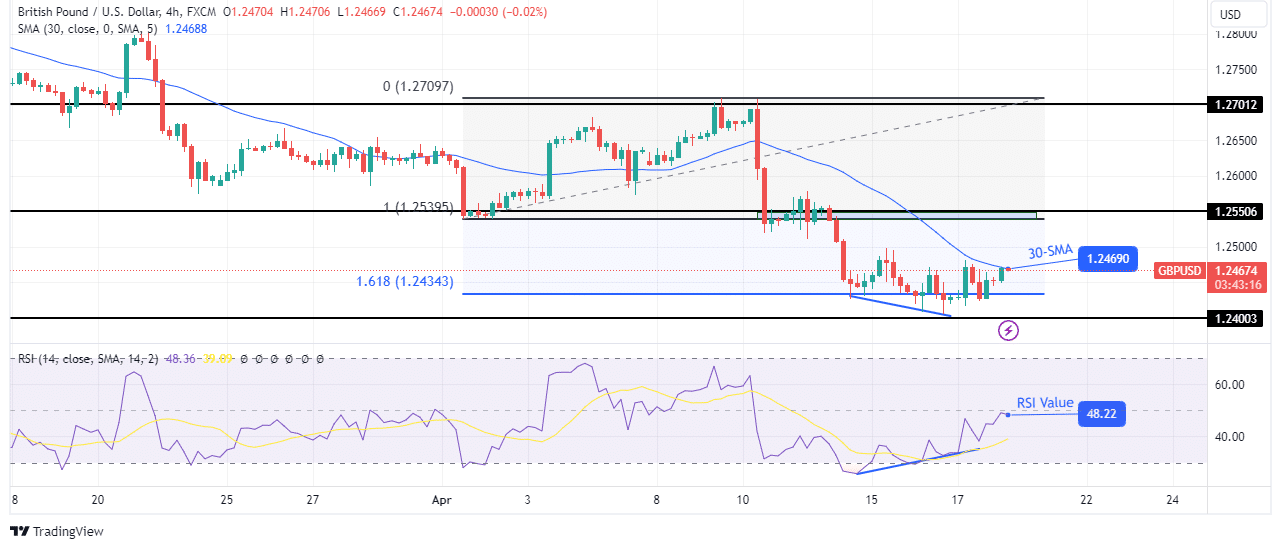

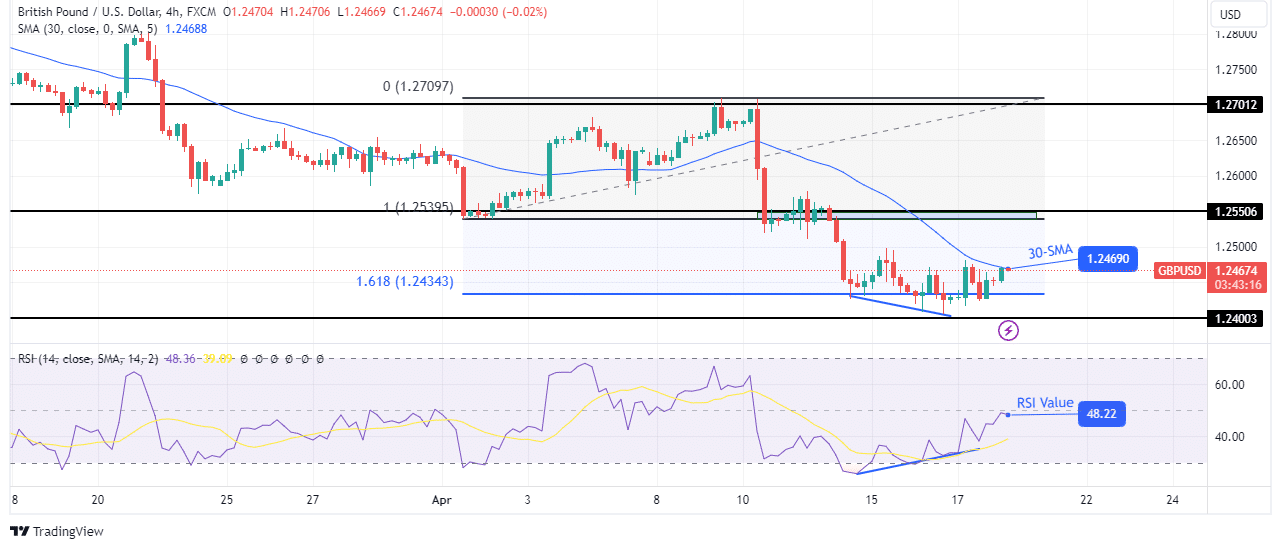

GBP/USD Technical Forecast: Bears weaken at 1,618 Fib extension level

On the technical side, the GBP/USD price is consolidating between the 30-SMA and the key level of 1.2400. Meanwhile, the bias is bearish as the range is below the 30-SMA and the RSI is in bearish territory below 50. However, the price failed to close strongly below the Fib extension level at 1,618.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

Furthermore, the RSI has made a bullish divergence, indicating weaker bearish momentum. Accordingly, the bulls may be preparing to make a big move to break above the 30-SMA. This would signal a change in bias to the bullish side. Furthermore, the price would likely retest the key level of 1.2550. However, if the bears regain strength, the price will fall below 1.2400.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.