- The risk of UK inflation stalling above the central bank’s target has receded.

- UK inflation fell to 3.2% in March from 3.4% the previous month.

- UK services inflation remained relatively high at 6.0% in March.

Expectations for the GBP/USD forecast are bearish as the pound continues to slide following last week’s remarks from the Bank of England. At the same time, the recent decline in Fed rate cut delays kept the dollar on top.

-Are you looking for automated trading? Check out our detailed guide-

On Friday, the BoE’s deputy governor noted that the risk of UK inflation stalling above the central bank’s target had receded. Moreover, inflation could decrease more than the central bank forecast in February.

Notably, these remarks followed the recent release of UK inflation data. According to the report, inflation fell to 3.2% in March from 3.4% the previous month. Although the decline was smaller than expected, it was welcomed by policymakers. BoE Governor Andrew Bailey said inflation in the country was falling as expected.

However, services inflation in the UK remained relatively high at 6.0% in March. This could cause some policymakers to hesitate before calling for a rate cut. Another thing that could keep the Bank of England down is the prospect of a Fed rate cut.

Last week, Fed Chairman Powell confirmed that the central bank may have to keep tightening policy longer. The remarks followed a string of better-than-expected economic reports from the US. Now markets expect the Fed to start cutting interest rates in the fourth quarter. Consequently, this led to lower interest rate cut expectations for other major central banks.

GBP/USD key events today

No impactful economic reports coming out of the UK or USA today. Therefore, the pair could extend their move from Friday.

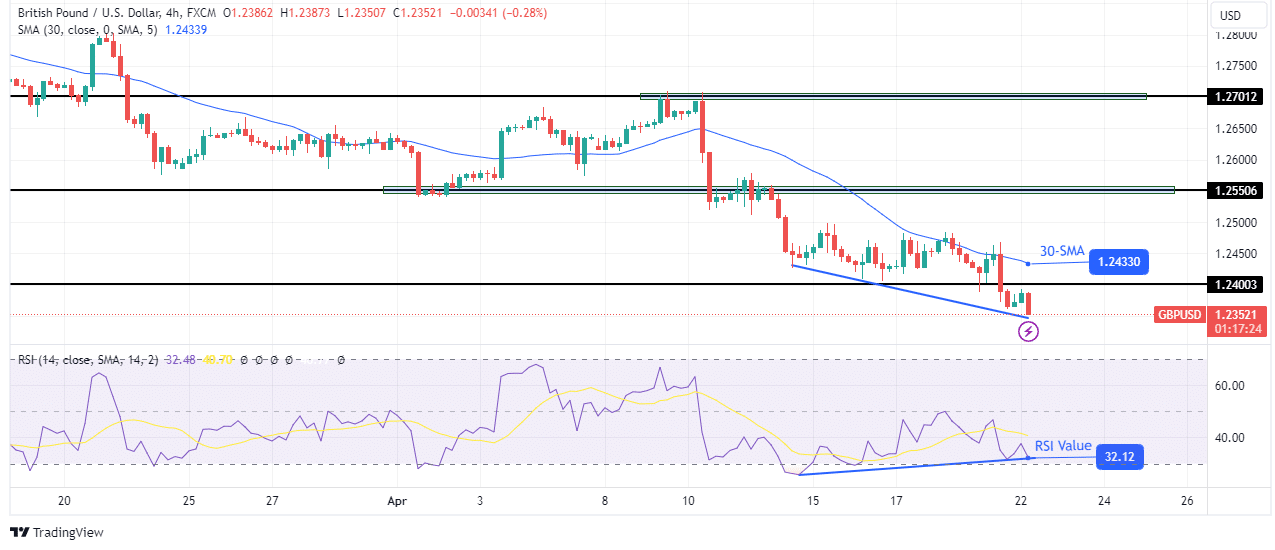

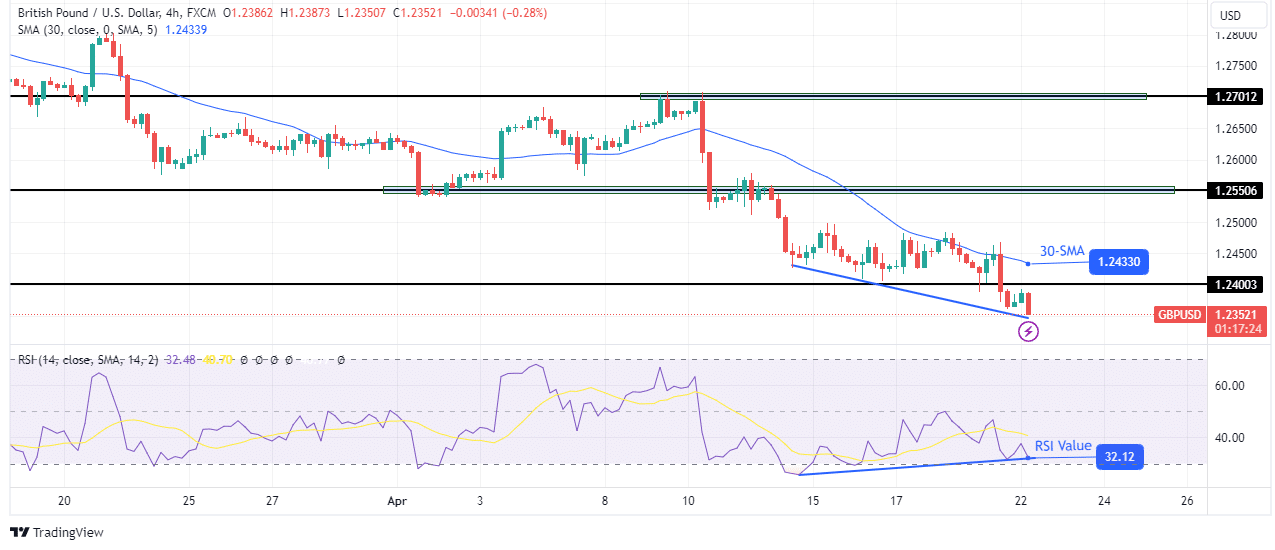

GBP/USD Technical Forecast: Weakening below 1.2400 barrier

On the technical side, the GBP/USD price is making new lows after the bears broke through the 1.2400 barrier. This decline indicates a continuation of the downward trend. However, as the price makes lower lows, the RSI has remained above its previous low, indicating a bullish divergence. This is a sign that the bearish momentum has weakened.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

Therefore, there is a chance that the bulls will re-emerge to reverse the trend. A break above the 30-SMA would allow the price to retest the critical level of 1.2550. However, if the bears regain momentum, the decline will continue to the next key support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money