- On Friday, oil prices rose temporarily after the initial shock that Israel had attacked Iran.

- Economic data points to higher upside potential for the USD/CAD pair.

- Markets expect the Bank of Canada to cut interest rates ahead of the Fed.

With the Canadian dollar extending its gains from last week, the outlook for USD/CAD remains bearish despite falling oil prices. On Friday, oil prices rose temporarily after the initial shock that Israel had attacked Iran, fueling the frenzy. However, the move backfired significantly after Iran played down the significance of the attack.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

Although the USD/CAD pair has retreated from recent peaks, economic data points to more upside potential. Therefore, the bullish trend may still be intact. Data last week revealed that inflation in Canada eased more than expected. This has put the Bank of Canada’s rate cut outlook at slight odds with that of the Federal Reserve.

Inflation in the US has remained stubborn, beating forecasts for the past few months. As a result, policymakers have changed their stance and are willing to keep interest rates higher for longer. Accordingly, markets expect the Bank of Canada to cut interest rates before the Fed. This outlook puts the Canadian dollar in a weaker position than the US dollar.

The only other thing that can strengthen the lunatic is rising oil prices. However, at this point, tensions between Israel and Iran have eased. With such peace of mind, oil traders can focus on the demand side. Unfortunately, the outlook for demand, especially in China, remains poor and is weighing on oil prices.

USD/CAD Key Events Today

Investors will be watching developments in the Middle East war as neither the US nor Canada will release major reports today.

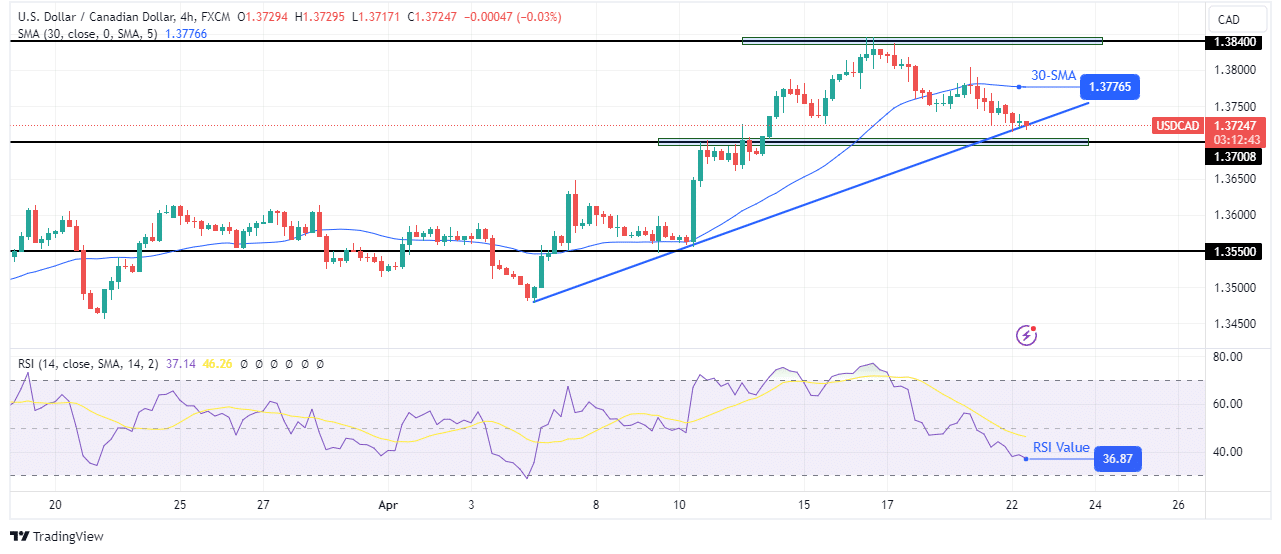

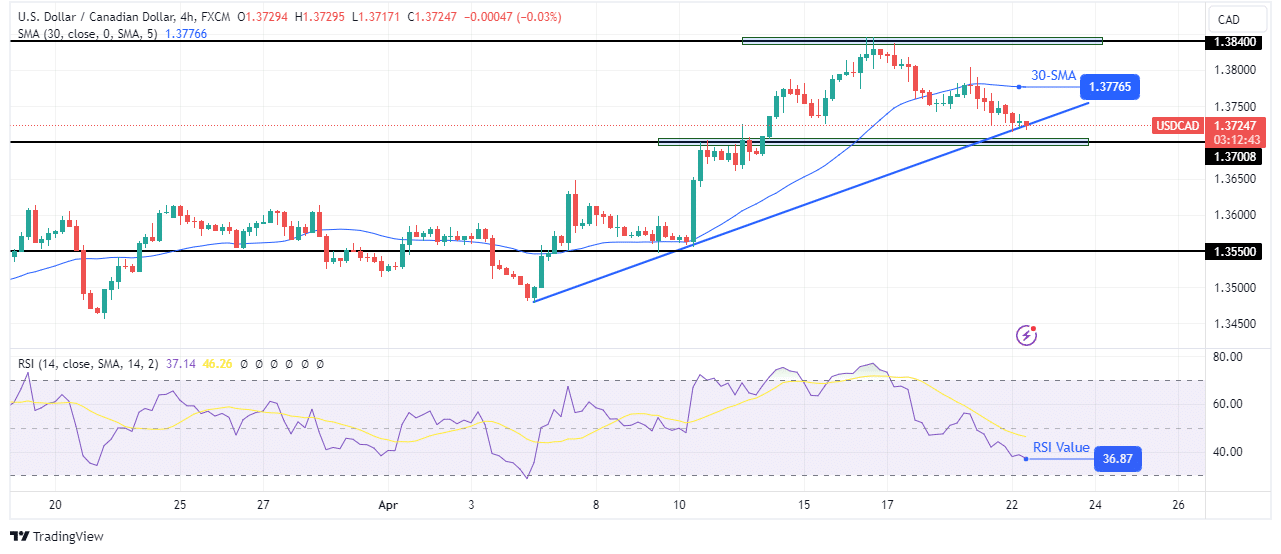

USD/CAD Technical Outlook: Price meets bullish trendline support

On the technical side, the USD/CAD price has broken below the 30-SMA to retest its bullish trend line. Earlier, the price was trading in a steep bullish trend above the SMA which paused at the key level of 1.3840. Although sentiment has turned bearish, bears can only confirm a reversal if the price breaks below the trend line. Otherwise, it could act as support to push the price to new highs.

-Are you looking for automated trading? Check out our detailed guide-

A break below the trend line and the key support level of 1.3700 would allow the price to retest the key support level of 1.3550. On the other hand, if it acts as a support, the price is likely to break above the resistance level at 1.3840.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money