- Tuesday’s data revealed a big jump in the eurozone’s services sector.

- The ECB’s Luis de Guindos confirmed the June rate cut.

- Any difference in policy between the Fed and the ECB could weaken the euro.

EUR/USD price analysis leans bullish as Euro gains ground on upbeat PMI data. Despite this positive momentum, investors’ focus remains on the likelihood that the European Central Bank will implement its first interest rate cut in June.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

Data on Tuesday revealed a big jump in the eurozone’s services sector, which offset a decline in manufacturing activity. Therefore, the composite PMI jumped, indicating a return to growth in the Eurozone. Despite the recovery in the economy, markets still expect the ECB to begin cutting interest rates ahead of the Fed in June.

Namely, ECB Vice President Luis de Guindos confirmed on Tuesday that the ECB will lower rates in June. However, he also said the central bank should be cautious after June and wait for signals from the Federal Reserve. It is clear that policymakers are concerned about a possible policy divergence with the Fed. Market participants significantly discounted expectations of a US interest rate cut after recent upbeat inflation data.

Moreover, policymakers changed their tone from dovish to bullish, saying they could extend interest rates higher. Therefore, markets expect fewer cuts, which could start in the fourth quarter. This is well after the ECB tapering in June. Any deviation with the Fed could cause the euro to fall significantly, which could undo some of the ECB’s business. A weaker euro would increase import costs and fuel inflation. As such, the ECB is likely to be patient after the first cut to see what the Fed does.

EUR/USD key events today

- US manufacturing PMI

- US flash services PMI

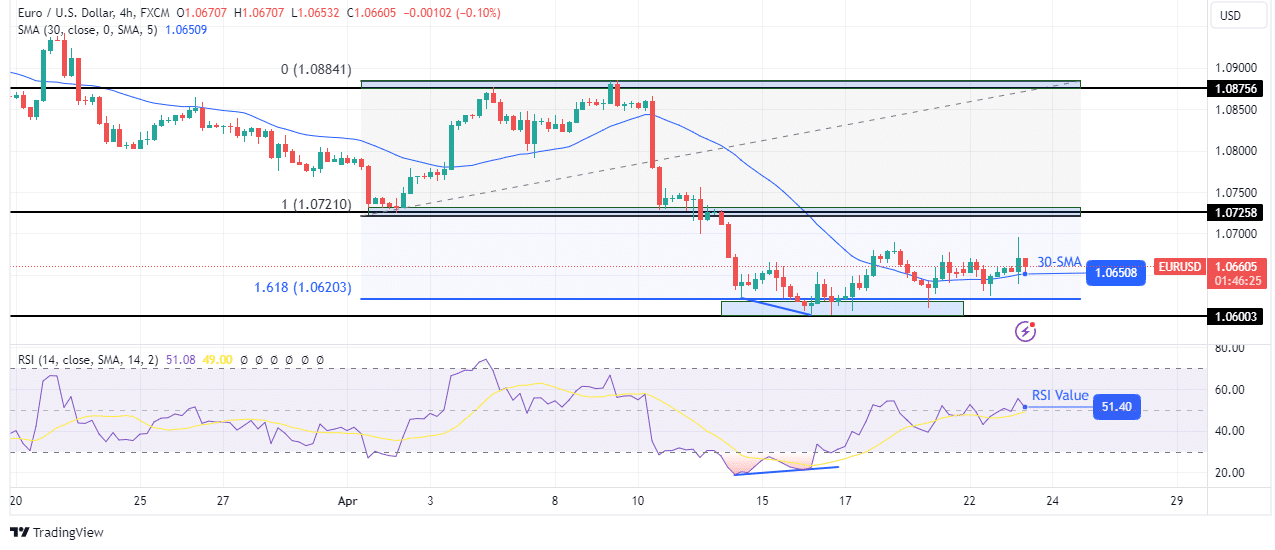

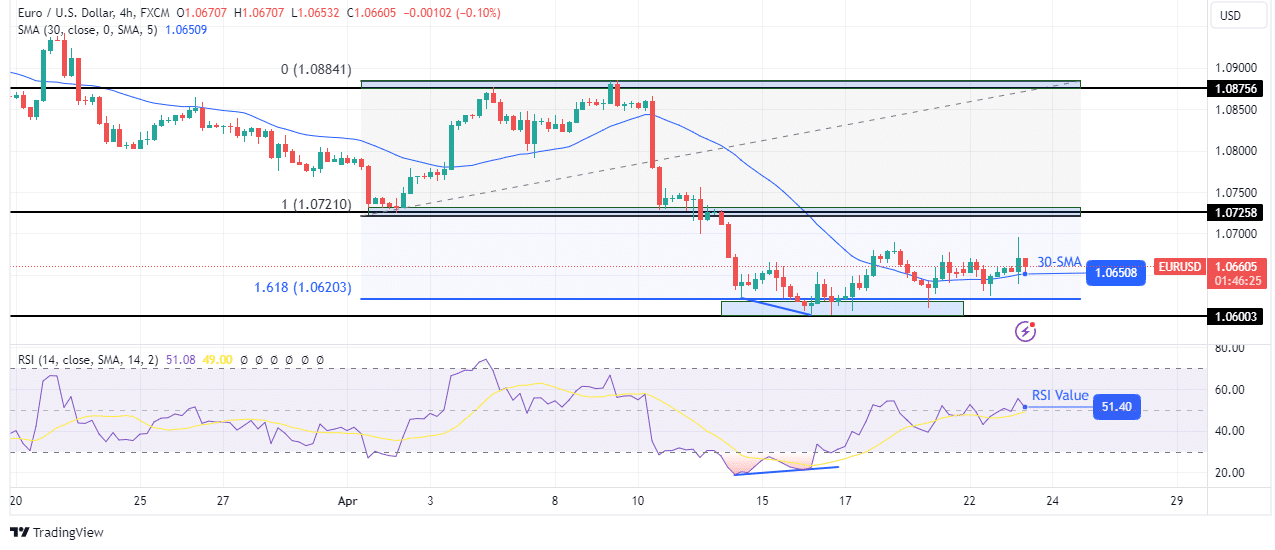

EUR/USD technical price analysis: Weaker pressure above 30-SMA

On the technical side, EUR/USD has started to trade above the 30-SMA, showing that the bulls have taken control. This comes after a break at the Fib extension level at 1,618 and a bullish divergence in the RSI.

-Are you looking for automated trading? Check out our detailed guide-

However, the new move is weak as the price is holding close to the SMA. At the same time, it makes small-bodied candles, showing weak momentum. If the bulls find their foothold above the SMA, they will retest the key level of 1.0725. Otherwise, the downtrend will continue below 1.0600.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money