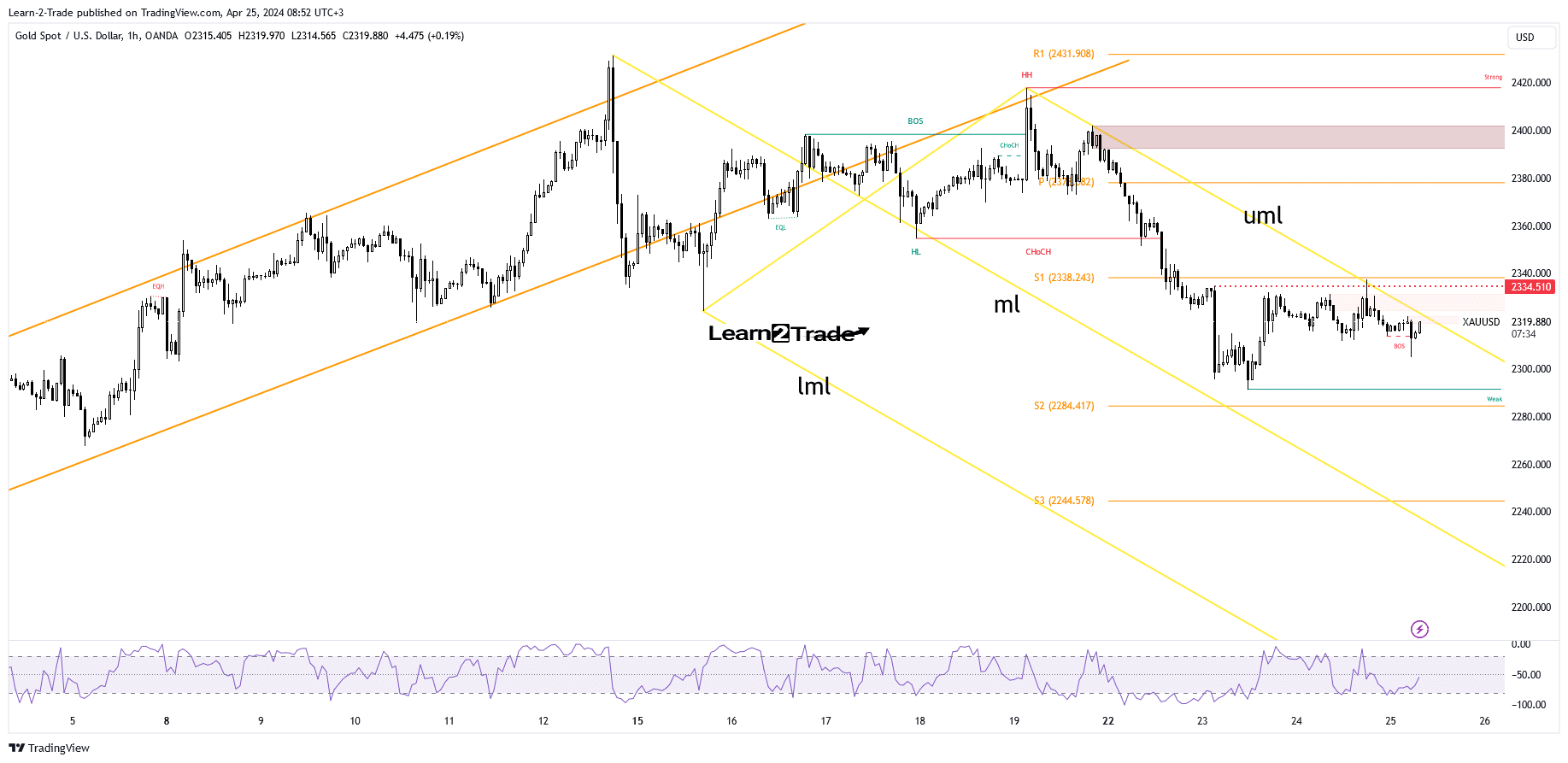

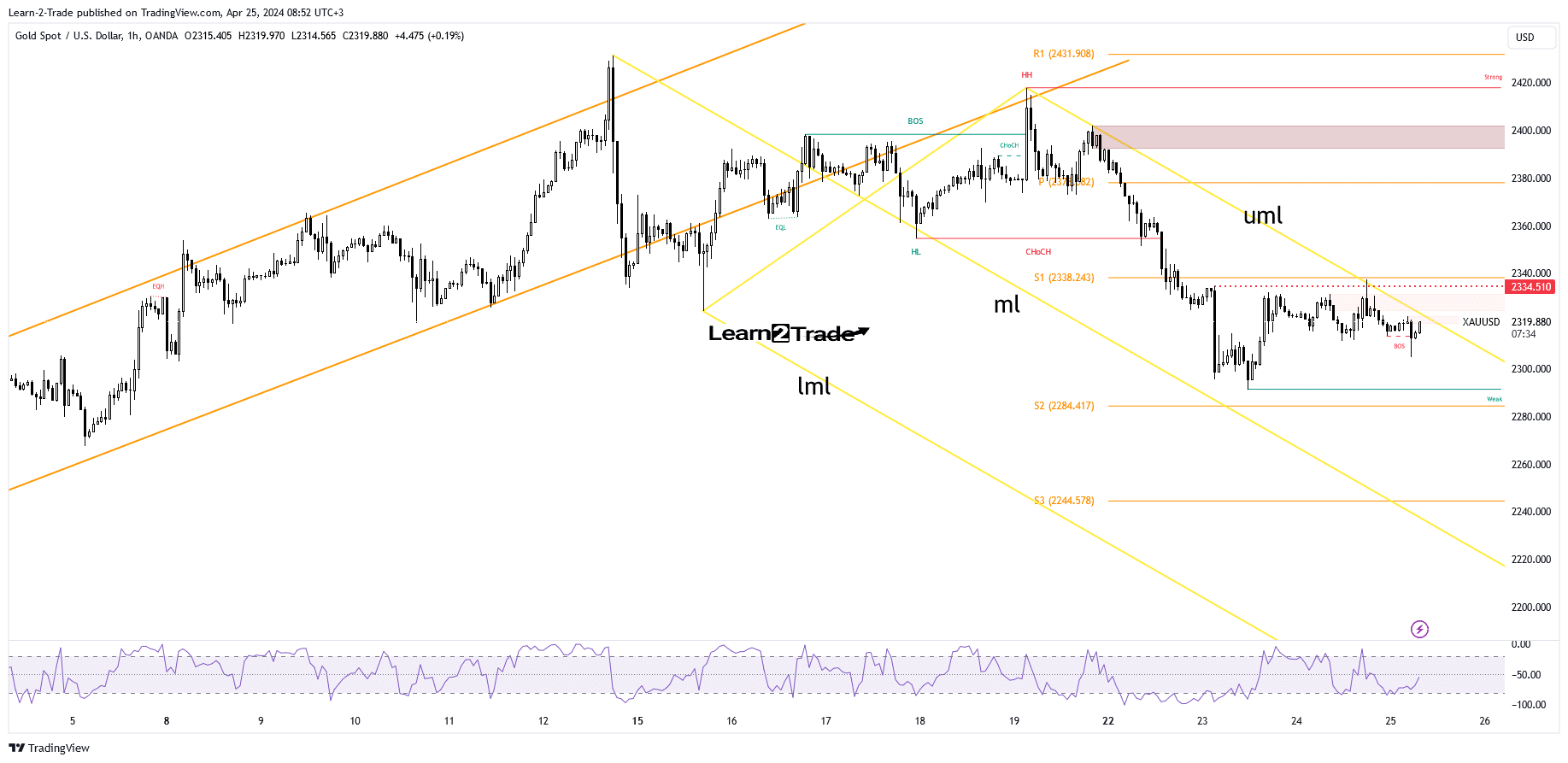

- The bias is bearish as long as it remains within the body of the descending fairies.

- US data should be decisive today.

- A new higher high triggers an upward move.

The price of gold is trading in the green at $2,319 at the time of writing. The precious metal is struggling to pull back higher after the latest sell-off.

However, downside pressure remains high as the US dollar remains on offer. Furthermore, Australia’s CPI qoq reported a 1.0% increase versus an estimate of 0.8% growth, while the y-o-y CPI rose 3.5%, beating the forecast of 3.4% growth.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

Gold is in a correction phase and could extend it. Although Canadian retail sales reported a 0.1% decline versus estimates of a 0.1% rise, while Core Retail Sales posted a 0.3% decline, traders had expected a 0.0% rise.

Also, US durable goods orders were better than expected yesterday, while core durable goods orders disappointed slightly. Today, US economic data should have a significant impact. Advance GDP can announce growth of 2.5% after growth of 3.4% in the previous reporting period. Jobless claims could jump from 212,000 to 214,000, while the pending home sales indicator could report a 0.3% increase.

In addition, data on the forward GDP price index, the merchandise trade balance and wholesale inventories will also be published.

Gold price technical analysis: retesting the broken level

The price of gold fell to just $2,291 in the short term, where it found demand again. In the short term, the price is moving sideways between this new low and the $2,334 level.

-Are you looking for automated trading? Check out our detailed guide-

The metal failed to reach the midline (ml) of the descending villas and weekly S2 (2,284), signaling exhausted sellers. However, as long as it remains within the body of the descending fairies, the bias remains bearish.

False breakouts through this barrier to the upside can herald another selloff. Only removing the upper middle line (uml) and making a new higher high could trigger an upward move.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money