- Canada released data showing a drop in retail sales in February.

- There is more pressure on the Bank of Canada than the Fed to cut interest rates.

- The recovery in oil prices supported the Canadian dollar.

The USD/CAD forecast points to the downside as the Canadian dollar recovers from a slide triggered by disappointing economic data. Significantly, the recovery came on the back of a recovery in oil prices as investors weighed the risk of escalating Middle Eastern tensions.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

Canada released data on Wednesday showing retail sales fell in February. Sales fell 0.1% compared with an expected increase of 0.1%. As a result, markets have raised bets that the Bank of Canada will cut rates in June. This led to a significant drop in the Canadian dollar, which allowed the USD/CAD pair to rise. However, the pair is now falling after the initial reaction to the news.

The difference in politics and economic outlook between Canada and the US continues to grow. Unlike Canada, the latest US retail sales report beat forecasts and showed a strong economy with strong spending. Meanwhile, consumer spending in Canada has fallen and the economy is weaker.

At the same time, inflation in the US has halted its decline, while it continues to decline in Canada. Consequently, there is more pressure on the Bank of Canada than on the Fed to cut interest rates. Investors believe the BoC will cut rates in June or July. Meanwhile, the Fed could implement its first rate cut in September.

Elsewhere, a recovery in oil prices supported the Canadian dollar on Thursday. Oil rebounded after a big drop in the previous session triggered by worries about US demand. Although tensions in the Middle East have eased, the risk of escalation remains and is likely to keep oil prices high.

USD/CAD Key Events Today

- US GDP growth q/q

- US unemployment claims

- USA pending house sales m/m

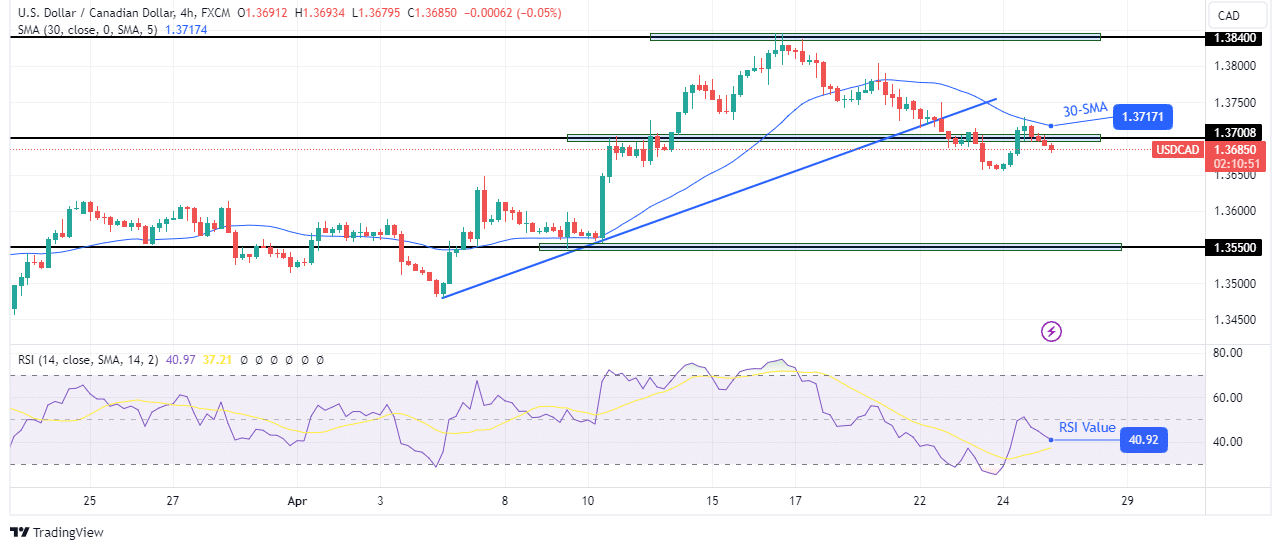

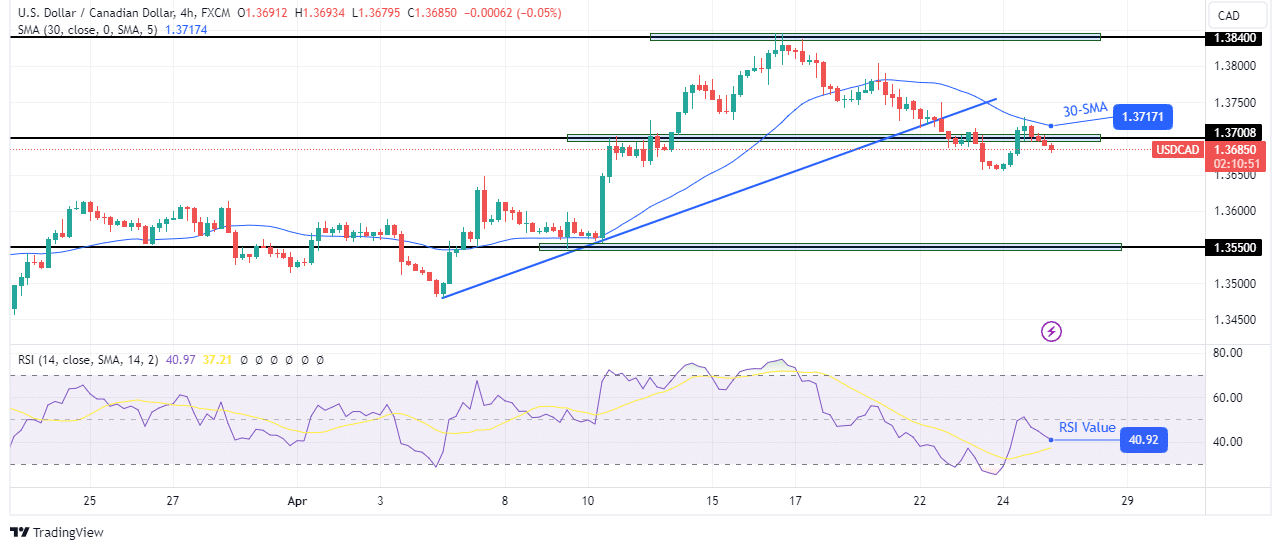

USD/CAD Technical Forecast: Break of the trendline signals a new downtrend

On the technical side, USD/CAD has broken below its bullish trendline, confirming a bearish reversal. This comes after the bullish move stalled at the key resistance level of 1.3840. Bears took the first break below and retesting the 30-SMA. They confirmed the reversal when the price broke below the trend line and the key level of 1.3700.

-Are you looking for automated trading? Check out our detailed guide-

At the same time, the RSI is now trading below 50 in bearish territory, supporting the downtrend. The bears are now targeting the next barrier at 1.3550.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money