- Data from Wednesday revealed weaker US economic growth in the first quarter.

- A measure of core US personal consumption expenditures jumped 3.7%.

- Investors are cautious ahead of today’s PCE price index report.

GBP/USD outlook remains bullish as dollar loses ground after disappointing gross domestic product report. However, the inflation data contained in the report caused a significant shift, dampening expectations for a Fed rate cut. As a result, investors are eager to get basic US PCE price index data.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

Data from Wednesday revealed weaker US economic growth in the first quarter. Gross domestic product grew at an annual rate of 1.6%, missing forecasts by 2.4%. This indicates a slowdown in the economy that would give policymakers confidence that inflation will reach the 2% target.

However, in the same report, a measure of core personal consumption expenditures rose 3.7%, beating forecasts for a 3.4% increase. The increase indicates higher than expected inflation. The Fed will be reluctant to cut interest rates if inflation remains stubborn and persistent.

Accordingly, investors are wary of today’s PCE price index report. The GDP data raised fears that today’s report will also show a stronger-than-expected rise in inflation.

After the GDP report, markets cut the likelihood of a Fed rate cut in September to 58 percent from 70 percent. Meanwhile, the odds of a cut in November rose to 68%. This puts the Fed in a worse position than the Bank of England, which could cut in June or August. Consequently, there could be more downside in the GBP/USD pair.

GBP/USD key events today

- Core US price index PCE m/m

- USA revised UoM consumer sentiment

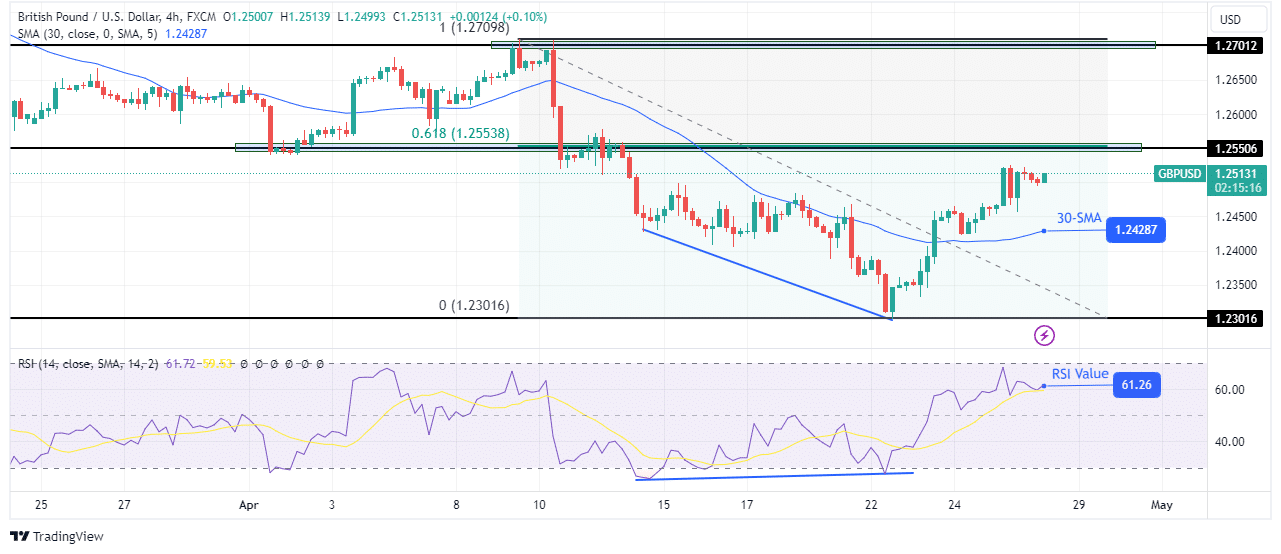

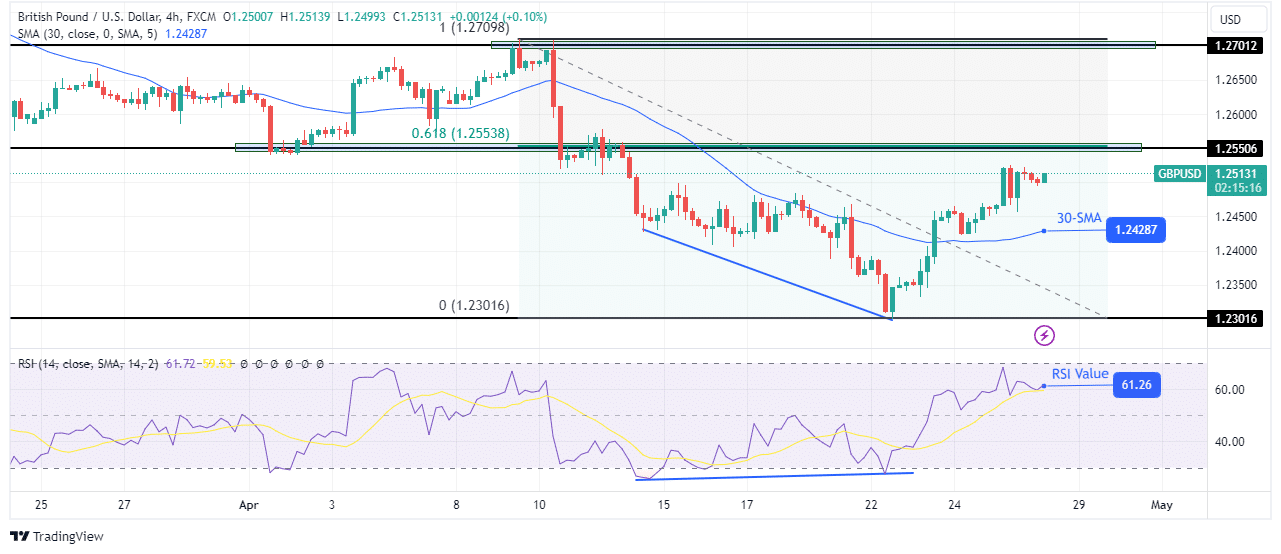

GBP/USD Technical Outlook: Bulls are approaching a solid resistance barrier

On the technical side, the GBP/USD price is bullish as it climbs higher above the 30-SMA. At the same time, the RSI indicates solid bullish momentum as it trades well above 50. The recent change in sentiment has allowed the bulls to target the critical resistance level of 1.2550. This would allow the price to retrace 61.8% of the previous decline.

-Are you looking for automated trading? Check out our detailed guide-

However, this means a strong barrier of resistance. If the price fails to break above, it could pause to retest the 30-SMA. Meanwhile, if bullish momentum remains strong, a break above 1.2550 would allow the price to target resistance at 1.2701.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money