- On Friday, the BoJ kept rates on hold as expected, giving room to the USD/JPI price.

- Traders panicked when the yen suddenly jumped for no apparent reason.

- US GDP increased by 1.6% in Q1, missing forecasts.

USD/JPI price analysis remains bullish as the bounce back quickly reversed amid BoJ inaction. Meanwhile, there was caution ahead of US inflation data that could shape the outlook for a Fed rate cut.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

On Friday, the BoJ kept rates on hold as expected. Moreover, policymakers have noted that inflation is clearly on track toward the central bank’s 2% target. This means the BoJ is likely to raise interest rates later in the year. However, investors were disappointed as there was no clear message on the policy outlook. As a result, the yen fell, allowing the USD/JPI pair to break through the $156.00 level.

Following the policy announcement, there were concerns that Japan would intervene to support the weak currency. Therefore, traders panicked when the yen suddenly jumped for no apparent reason. However, that move soon backfired. The last time the BoJ sold dollars to support its currency was in 2022. Recent weakness to 34-year lows has increased speculation that the central bank could intervene again in 2024.

The USD/JPY the price rose despite the weaker dollar. Notably, the dollar was weak after data from the previous session revealed a larger-than-expected decline in economic growth. In Q1 GDP increased by 1.6%, missing forecasts of growth of 2.4%.

A slowing economy increases the chances that the Fed will cut interest rates. However, the inflation figures in the report reveal a different story. Core inflation jumped, leading to a significant drop in Fed rate cut expectations. Investors will now watch the core PCE price index for more clues about the Fed’s policy outlook.

USD/JPI Key Events Today

- BOJ press conference

- The core US PCE price index

- US consumer sentiment

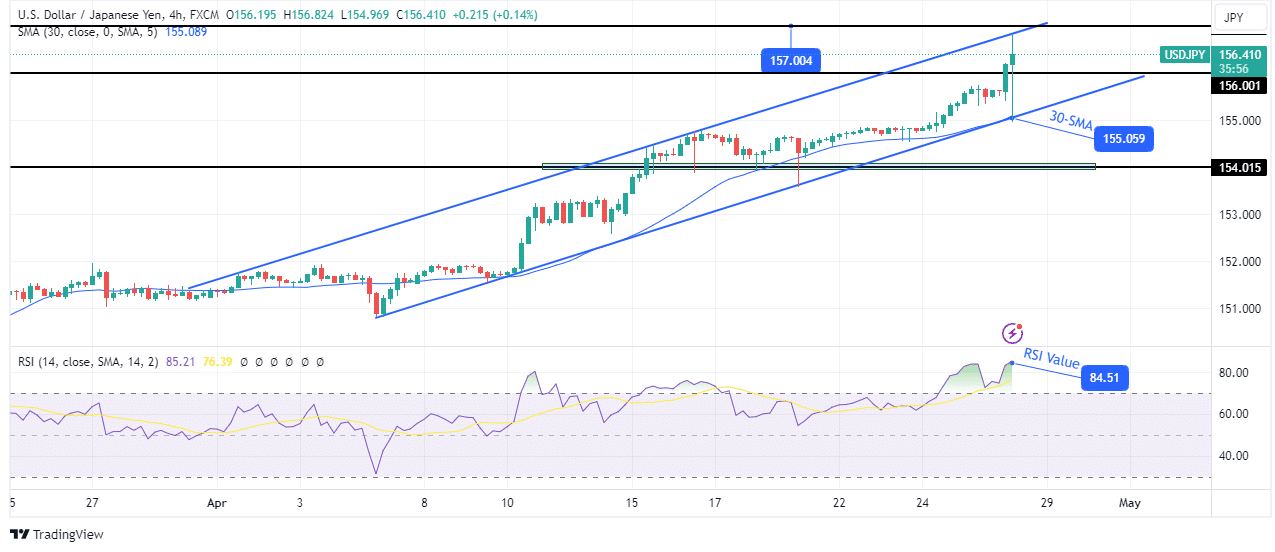

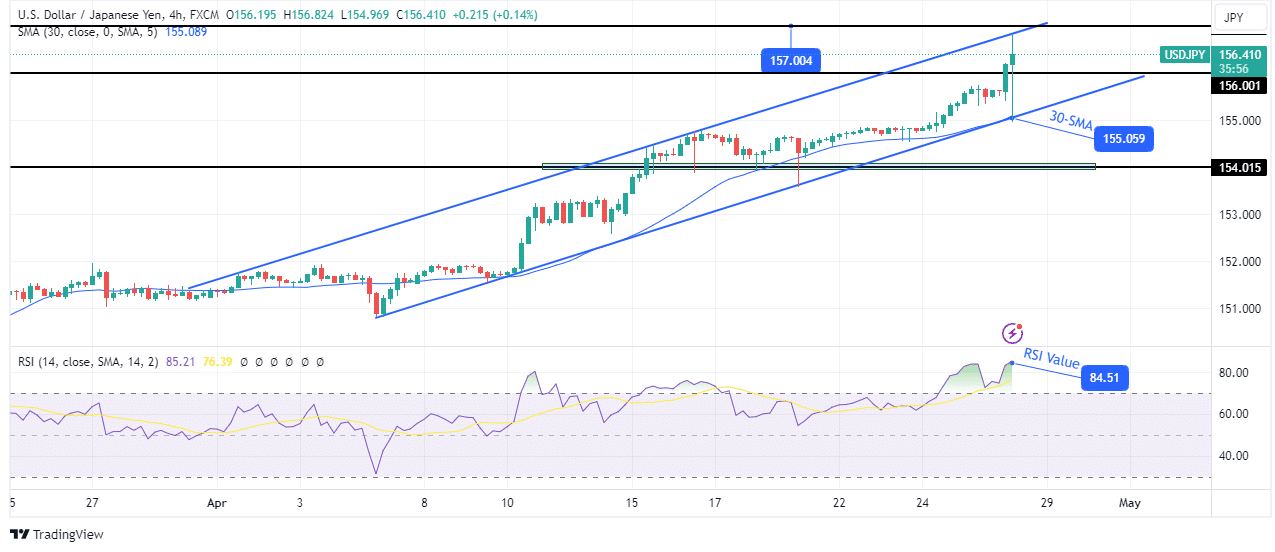

USD/JPI technical price analysis: bullish momentum is maintained within the channel

On the technical side, the price of USD/JPI made a moving candle that tested the support and resistance of its channel. At the same time, it retested the 30-SMA support. However, the bullish bias remains intact as the candle stabilized above the previous candle.

-Are you looking for automated trading? Check out our detailed guide-

The price is now above the critical level of 156.00 and could soon reach the resistance of 157.00. However, the RSI is well above 70, indicating that the price is overpriced. Therefore, it may pause or backtrack before proceeding further.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money