- KSAU/USD broke out of the flag pattern, signaling further declines.

- A new lower low triggers a larger correction.

- US data could bring sharp changes today.

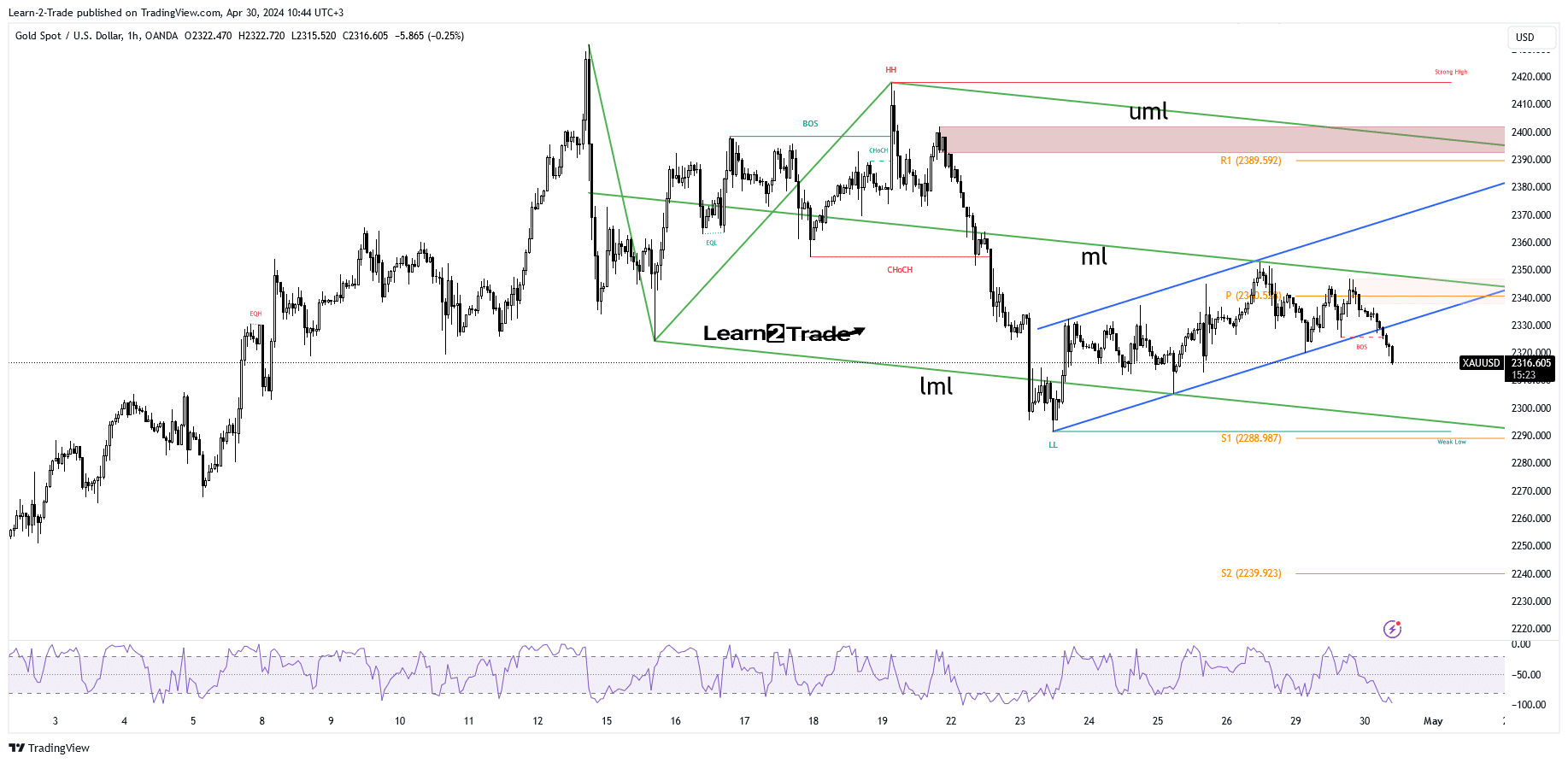

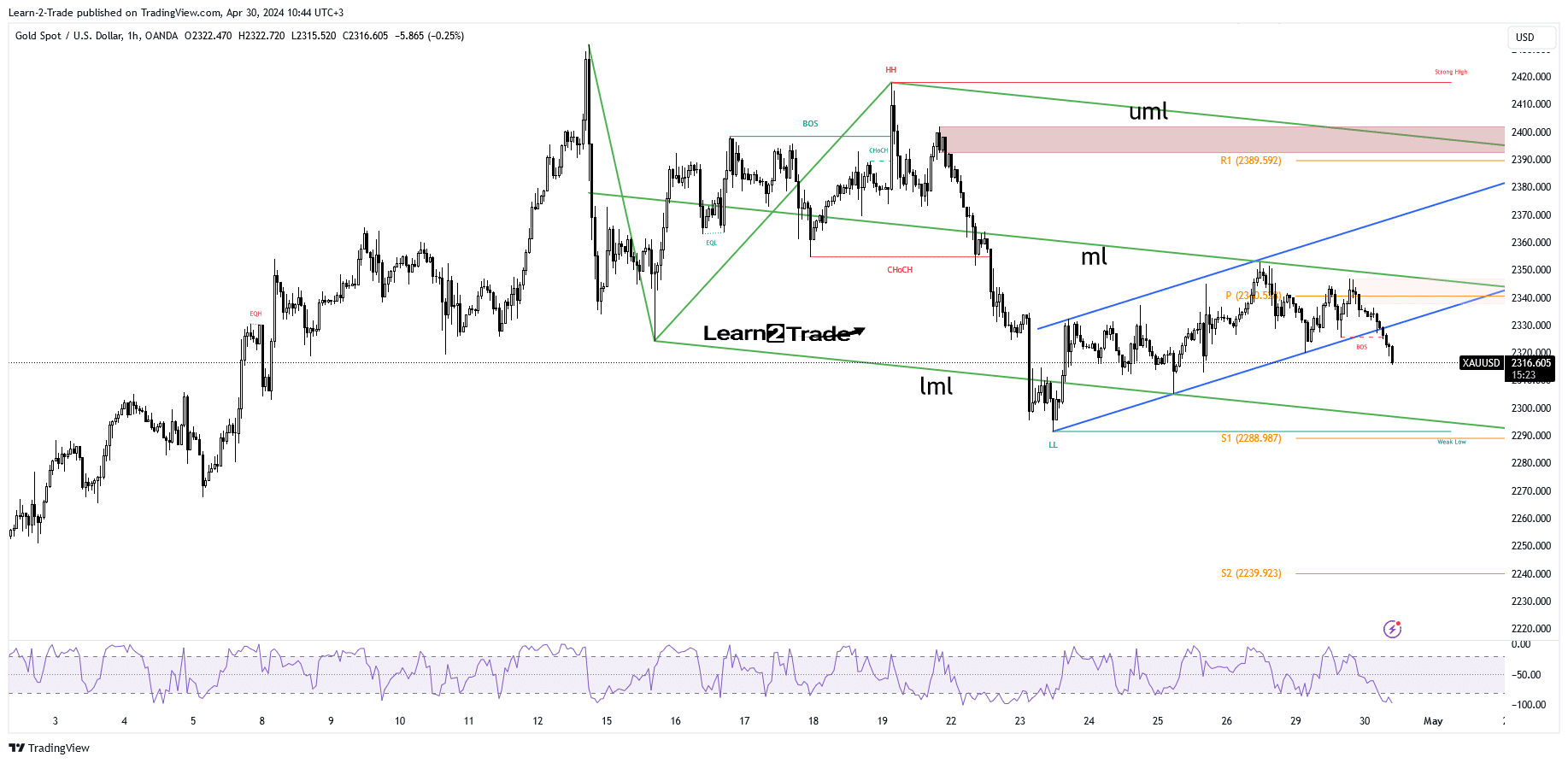

The price of gold is trading in the red at $2,316 at the time of writing. The metal looks poised to approach new lows in the short term.

Price tried to pull back higher after the recent selloff. However, the bottom pressure remains high. So there is a likelihood of a deeper fall in the cards.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

XAU/USD edged lower after Australian retail sales reported a 0.4% decline versus an expected 0.2% rise. At the same time, private sector loans rose by 0.3%, less than the estimated growth of 0.4%.

In addition, China’s manufacturing PMI and non-manufacturing PMI also reported poor data. Sellers are strong even after the Eurozone released mixed data today. The CPI Flash Estimate rose by 2.4%, in line with expectations.

The Core CPI Flash Estimate reported an increase of 2.7%, which exceeded the forecast of 2.6% growth, while the Prelim Flash GDP was better than expected.

Later, Canadian GDP is expected to grow 0.3% in February after growing 0.6% in January. Also, the US will release CB Consumer Confidence, Chicago PMI, HPI, Employment Cost Index and S&P/CS Composite-20 HPI data. Positive economic numbers should boost the dollar, so the yellow metal could reach new lows.

Gold Price Technical Analysis: Selling

Technically, KSAU/USD has finished its temporary rally and is now under intense selling pressure. As you can see on the hourly chart, the resistance is right below the median line of the descending forks.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

It broke out of the upper channel (flag pattern), confirming a potential continuation down. The lower median line (lml) and weekly S1 2,288 represent potential downside targets. A new lower low could trigger more declines.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.