- The RBA was not as hawkish as most expected.

- Australia recently released better-than-expected figures for Q1 inflation and employment.

- The dollar was weak after jobless claims jumped.

AUD/USD weekly forecast remains bullish. Dollar weakness could continue next week with focus on the US inflation report.

AUD/USD Ups and Downs

The AUD/USD pair had a marginally worse week as markets absorbed the outcome of the RBA policy meeting. On Tuesday, the Reserve Bank of Australia kept rates as expected. However, the central bank was not as hawkish as most expected.

–Are you interested in learning more about crypto robots? Check out our detailed guide-

Australia recently released better-than-expected figures for Q1 inflation and employment. As a result, economists expected the RBA to signal a possible rate hike. When they didn’t, the Australian fell. Meanwhile, the dollar also weakened after jobless claims jumped, confirming easing labor market conditions.

Next week’s key events for AUD/USD

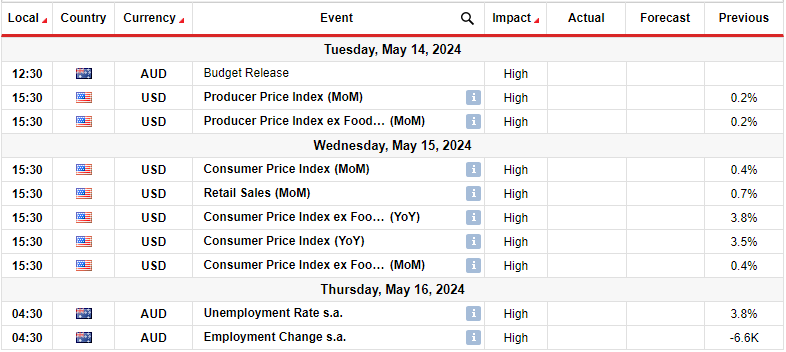

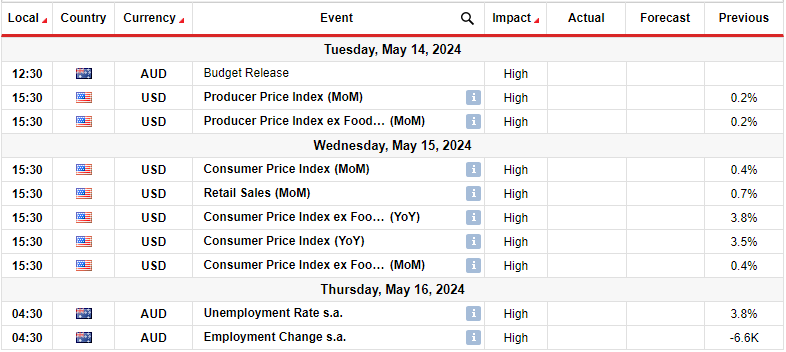

The main reports from the US next week will include inflation and retail sales. At the same time, investors will focus on employment figures in Australia. US PPI and CPI data will guide the Federal Reserve on the next step it needs to take on monetary policy. Higher-than-expected figures would mean further delays in rate cuts. On the other hand, lower-than-expected figures would increase the chances of a rate cut in September.

Meanwhile, Australian employment data will show the state of its labor market, which has remained resilient.

AUD/USD Weekly Technical Forecast: Bulls Pause Below Firm 0.6650 Barrier

On the daily chart, the AUD/USD price bias is bullish as it sits above the 22-SMA and the RSI is above 50. However, on a larger scale, the price has remained sideways for some time. Mainly traded between 0.6475 support and 0.6650 resistance level.

–Are you interested in learning more about buying Dogecoin? Check out our detailed guide-

The bears once tried to break out of this area but failed, making a false breakthrough. Now the price has returned to the resistance level. The level is strong as it sits between key Fib levels from 0.5 to 0.618. Therefore, the bulls face a solid barrier that could lead to another bounce lower.

In the coming week, the bulls will need a significant catalyst to break through this resistance zone. This would clear the way to the 0.6850 resistance level. However, if the resistance remains firm, the price is likely to fall to retest the 0.6475 support.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money