- The US CPI report showed a drop in inflation which led to an increase in bets on a Fed rate cut.

- Investors have raised the odds of a Fed rate cut in September to 70%.

- Investors will be watching inflation data from Canada.

The weekly USD/CAD forecast points south as Fed tapering bets increase ahead of fresh clues on the BoC’s policy outlook.

USD/CAD Ups and Downs

The USD/CAD pair had a bearish week as the dollar fell on signs of easing inflation. The week started with the US PPI report, which was higher than expected. However, it had the opposite effect on the dollar, showing that investors appreciated such an outcome. On Wednesday, the US CPI report showed a drop in inflation, raising expectations for a rate cut by the Fed. Investors have raised the odds of a Fed rate cut in September to 70%. Moreover, they now expect two cuts this year.

–Are you interested in learning more about forex indicators? Check out our detailed guide-

Next week’s key events for USD/CAD

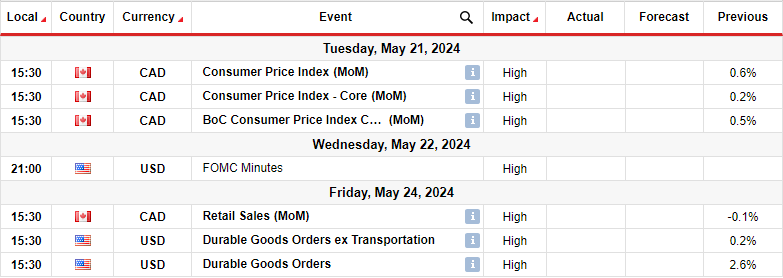

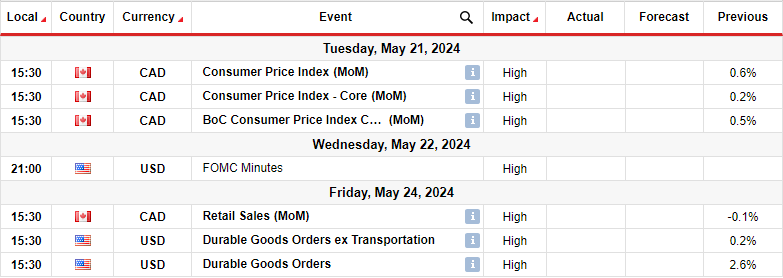

Next week, investors will be watching inflation and retail sales from Canada. Meanwhile, the minutes from the FOMC meeting and the durable goods orders report will be read from the US. Canada’s inflation report will guide markets on BoC rate cut prospects.

At this point, investors are confident that the Bank of Canada will cut rates in June. In particular, inflation continued to decline as the economy slowed. Because of this, there is more pressure on the BoC to cut rates than any other major central bank. So another bad report would solidify bets for a June cut. However, if inflation beats forecasts, this could lead to lower rate cut expectations.

Meanwhile, the FOMC meeting will provide clues about policymakers’ bias toward rate cuts. On the other hand, durable goods orders will show the state of demand in the economy.

USD/CAD Weekly Technical Forecast: Bears Challenge Key Support Trendline

On the charts, USD/CAD is at a key support trend line. It is trading below the 22-SMA with an RSI below 50, indicating bearish sentiment. However, the bears can only take full control if the price breaks below the support trendline and starts making lower highs and lows.

–Are you interested in learning more about the next cryptocurrency to explode? Check out our detailed guide-

However, if the shallow bullish trend holds, USD/CAD will bounce off the trendline, break above the 22-SMA and retest the 1.3800 resistance level. A break above this level would confirm the continuation of the bullish trend. Meanwhile, a break below the trend line would allow the bears to revisit the 1.3502 support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.