- Data on Friday revealed warmer-than-expected euro zone inflation in May.

- The core PCE price index report revealed a drop in US inflation

- Investors are eagerly awaiting the non-farm payrolls report.

The weekly EUR/USD forecast is bullish as inflation in the Eurozone unexpectedly rises, in contrast to falling inflation in the US.

EUR/USD ups and downs

EUR/USD had an almost flat week but closed well above its lows. The week began with a rise in the dollar following the release of better-than-expected consumer confidence data. However, the euro was on the front foot again when data showed US GDP fell in Q1, raising expectations that the Fed will cut rates in September.

–Are you interested in learning more about tips for Forex traders? Check out our detailed guide-

Furthermore, Friday’s data revealed warmer-than-expected inflation in the eurozone in May. CPI rose from 2.4% to 2.6%, beating forecasts for a 2.5% increase. This slightly dampened expectations for an ECB rate cut next week, boosting the euro. More support came from falling US inflation, as shown by the core PCE price index report.

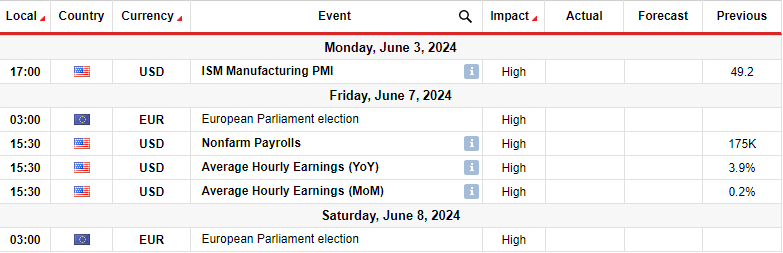

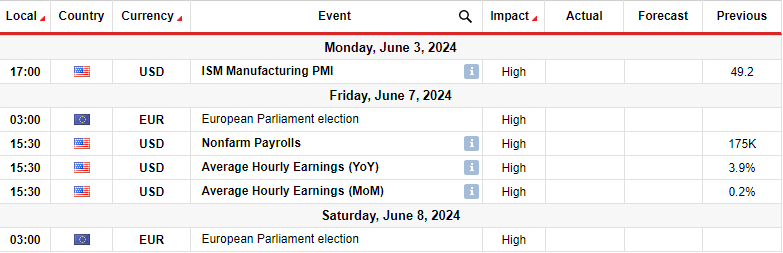

Next week’s key events for EUR/USD

Next week, the US will release data on business activity in the manufacturing sector. In addition, investors will look to non-farm payrolls reports for clues about Fed policy. Meanwhile, in the Eurozone, traders will monitor the outcome of the European parliamentary elections.

The US jobs report comes as there is uncertainty about Fed policy. The latest monthly report revealed softer labor market conditions that raised expectations for a rate cut in the US. Another such report would signal the start of a downturn in the sector that would put pressure on the Fed to start reducing borrowing costs.

EUR/USD Weekly Technical Forecast: Bulls are looking for a new high above the resistance trend line

On the technical side, the EUR/USD price has broken above a strong bearish trendline and is looking to make a higher high. Moreover, it respected the 22-SMA as support, showing that the bulls are in control. At the same time, the RSI is rising after finding support at the 50 level, which is a sign of strong bullish momentum.

–Are you interested in learning more about forex brokers? Check out our detailed guide-

However, the price must break above the 1.0900 resistance level before making a new high. A break above this level would pave the way for the bulls to retest the resistance at 1.1101. However, if the resistance remains firm, the price could fall below the 22-SMA to retest the recently broken trendline before continuing higher.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.