- The EUR/USD weekly forecast was overshadowed as the US economy grew at a faster rate of 1.4% in Q1.

- The core US PCE report showed softer inflation.

- The primary focus next week will be the US monthly employment report.

The EUR/USD weekly forecast shows more upside potential as Fed rate cut expectations rise with softer inflation data.

EUR/USD ups and downs

EUR/USD had a mildly bullish week, during which the dollar fell. However, it was a slow week as there were few notable reports from the US. Since the beginning of the week, the main focus has been the core price index PCE. Other reports during the week included US GDP, consumer confidence and jobless claims.

–Are you interested in learning more about forex conventions? Check out our detailed guide-

The US economy grew at a higher rate of 1.4% in Q1. Meanwhile, even though consumer confidence fell, it came in more than expected. Jobless claims fell slightly, indicating strength in the labor market. Finally, the core PCE report was in line with expectations, showing softer inflation. As a result, expectations for a September cut have risen, weighing on the dollar.

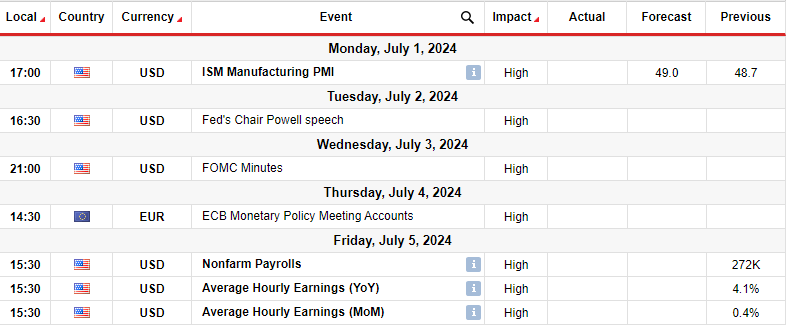

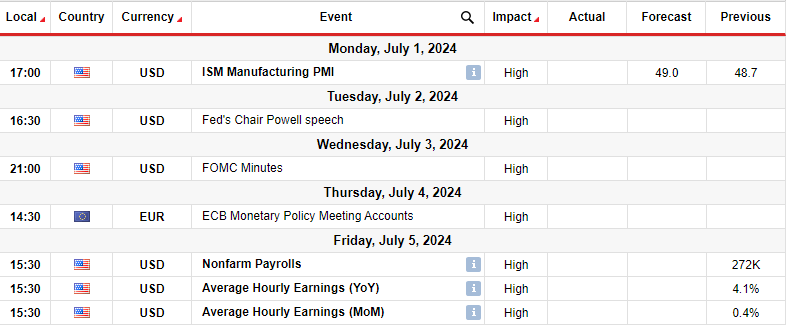

Next week’s key events for EUR/USD

Next week, the US will release key reports, including manufacturing business activity, FOMC meeting minutes and non-farm payrolls. At the same time, Fed Chairman Powell will speak on Tuesday. Meanwhile, in the eurozone, investors will review the minutes of the ECB meeting.

The primary focus next week will be the US monthly employment report, which will show the state of the labor market. Although inflation has eased in recent months, employment has remained strong. As a result, policymakers remained cautious about cutting rates. For June, economists expect 180,000 additional jobs. This would be down from the previous 272,000 and would pave the way for a rate cut.

Furthermore, ECB and Fed minutes will provide clues about the prospects for interest rate cuts for the US and the Eurozone.

EUR/USD Weekly Technical Forecast: Price retests trend line and 1.0700 support

On the technical side, the EUR/USD price recently broke above its resistance trend line. However, the move stalled at the key resistance level of 1.0900 before pulling back. The price broke below the 22-SMA to retest the recently broken trend line and key support level at 1.0700. Therefore, EUR/USD is currently in a strong support zone.

–Are you interested in learning more about Ethereum price prediction? Check out our detailed guide-

If this support remains firm, the price will jump higher to retest the resistance level at 1.0700. A break above this level would confirm the start of a bullish trend with a higher high.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.