- Powell said the Fed needs more confidence that inflation will hit its target.

- Investors cut the odds of a Fed rate cut from 76% to 73%.

- Australia’s index of business conditions fell two points in June.

AUD/USD price analysis reveals a positive outlook, boosted by a drop in the dollar following Powell’s cautious comments in his latest speech. Meanwhile, the Aussie was flat after data revealed worsening business conditions in June.

–Are you interested in learning more about Bitcoin price prediction? Check out our detailed guide-

After last week’s US jobs report, investors eagerly awaited Powell’s speech to see if policymakers gain confidence to cut rates. However, when he spoke, he said the Fed needed more confidence that inflation would hit its target. Only then can policymakers be ready to implement a rate cut.

However, Powell noted that the risk of a deterioration in the labor market is growing. Therefore, the central bank must balance inflation with growth. After his speech, market participants cut the odds of a rate cut from 76% to 73%.

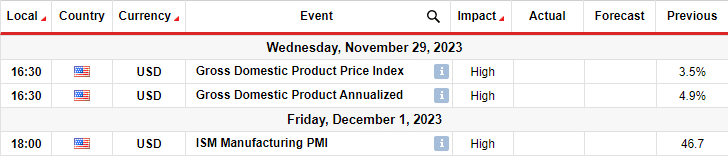

According to experts, Powell and other policymakers are likely to maintain their cautious tone as there are several more economic reports ahead of the September meeting. Notably, the US will release three more inflation reports and two employment reports.

Investors will be watching the US consumer inflation report on Thursday to see the state of price pressures. Further easing will boost confidence in September’s cut.

On the other hand, data from Australia on Tuesday showed that the business conditions index fell by two points in June. However, business confidence rose by six points, showing that companies are confident about the future. The Reserve Bank of Australia could be the last major central bank to cut interest rates. Therefore, high borrowing costs are likely to continue to hurt businesses.

AUD/USD key events today

- Fed Chairman Powell testifies

AUD/USD Price Technical Analysis: Exhausted bulls face 0.6750 barrier

On the technical side, the AUD/USD price is trading near the key resistance level of 0.6750. It is above the 30-SMA and the RSI is trading in bullish territory, supporting the bullish bias. The bulls recently broke above the key resistance level of 0.6700 with a strong candle. However, the bullish move weakened near 0.6750.

–Are you interested in learning more about crypto robots? Check out our detailed guide-

Therefore, the bulls need a new momentum boost to make a higher high and continue the uptrend. If they fail, the price is likely to break below the 30-SMA and move to revisit the 0.6700 support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.