- Fed Chairman Powell said policymakers need more confidence that inflation is falling.

- Inflation in the US fell in June for the first time in four years.

- Investors have increased the odds of a September rate cut to 93%.

The EUR/USD weekly forecast is bullish as the dollar falls after a softer-than-expected US inflation report.

EUR/USD ups and downs

The euro had a bullish week with the dollar ending lower on rising Fed rate cut expectations. At the same time, there was relief as the cloud of political uncertainty lifted in France after the latest round of elections.

–Are you interested in learning more about Forex brokers? Check out our detailed guide-

During the week, Fed Chairman Powell struck a cautious tone, saying policymakers needed more confidence that inflation was falling. As a result, the dollar strengthened. However, this move was reversed when the US consumer inflation report was released.

Inflation fell in June for the first time in four years. This surprised economists who had expected it to rise. As a result, investors have increased the odds of a September rate cut to 93%. Meanwhile, wholesale inflation accelerated in June.

Next week’s key events for EUR/USD

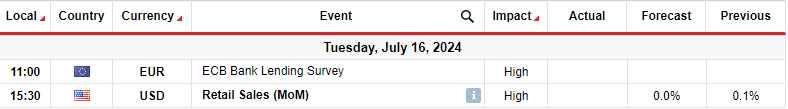

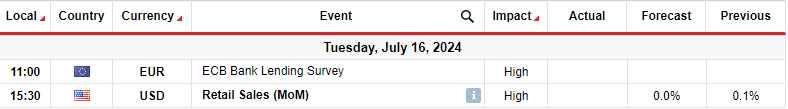

Next week’s calendar for EUR/USD will be light with the ECB Bank Lending Survey and the US Retail Sales report. After a week of big inflation data, markets will focus solely on the state of US consumer spending.

The recent trend is poor economic numbers that show weakness in the economy. Therefore, chances are high that this will continue. Falling retail sales will put more pressure on the Fed to start lowering interest rates.

On the other hand, if the report beats estimates, it could lead to a drop in Fed rate cut expectations. Still, it would be one positive report after a string of bad ones.

EUR/USD Weekly Technical Forecast: Bulls prepare to break through resistance at 1.0900

On the technical side, the EUR/USD price has reached the key resistance level of 1.0900 after a strong bullish move. This put the price well above the 22-SMA supporting the bullish bias. At the same time, the RSI is quickly approaching the overbought region, showing an increase in bullish momentum.

–Are you interested in learning more about Crypto Signals Telegram Groups? Check out our detailed guide-

In the coming week, there is a good chance that the price will break above 1.0900 to reach a higher high. This would confirm a new bullish trend after the first higher low near the key 1.0700 level. Furthermore, it would pave the way for a rally to the 1,618 Fib extension level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.