- Powell indicated that policymakers were more confident about lowering inflation.

- The US reported better-than-expected sales in June.

- The ECB kept rates on hold but gave no clear guidance on the future.

The EUR/USD weekly forecast is bullish as Fed policymakers gain confidence that inflation will hit target, weakening the dollar.

EUR/USD ups and downs

The EUR/USD pair had a bearish week. However, prices hit new highs during the week as the dollar fell. Notably, the dollar was weak at the start of the week, as Powell indicated that policymakers were more confident about lowering inflation.

–Are you interested in learning more about Forex indicators? Check out our detailed guide-

As a result, investors have become more confident that the Fed will cut rates in September. This pushed the dollar down, allowing the euro to rise. Moreover, even though the US reported better-than-expected sales for June, the dollar continued to fall.

However, the trend reversed towards the end of the week as the euro fell after the ECB policy meeting. The central bank kept rates on hold but gave no clear guidance on the future, saying it would depend on data. This created uncertainty about the prospect of a rate cut, weighing on the euro.

Next week’s key events for EUR/USD

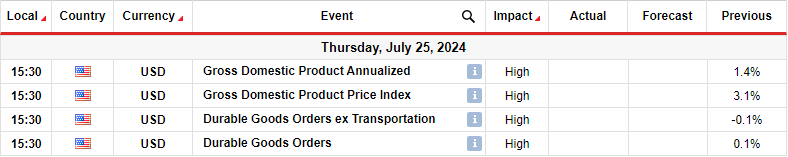

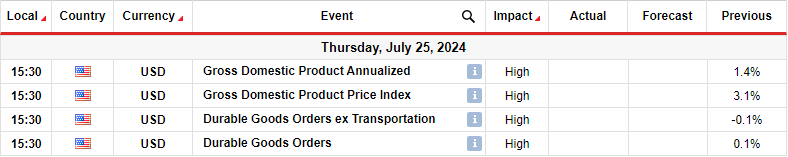

Next week, investors will focus on data from the US, including gross domestic product and durable goods. These reports will continue to shape the outlook for Fed rate cuts. Significantly, the markets are fully pricing in the rate cut in September.

The latest GDP report showed an increase of 1.4%, slightly better than estimates. However, it was well below previous readings, indicating weaker economic activity. Further economic deterioration will put pressure on the Fed to reduce borrowing costs.

Durable goods orders will also show the state of demand, which will influence the outlook for rate cuts.

EUR/USD Weekly Technical Forecast: Price bounces back after hitting channel resistance

On the technical side, the EUR/USD price is pulling back after reaching channel resistance. Moreover, it confirmed the shallow bullish trend by making a higher high. Currently, the price is above the 22-SMA, showing that the bulls are in the lead. At the same time, the RSI is above 50, showing solid bullish momentum.

–Are you interested in learning more about the best Bitcoin exchanges? Check out our detailed guide-

However, since the price is trading in a shallow trend, the bears are almost as strong as the bulls. Therefore, the price may continue to decline next week, following support from the 22-SMA to retest the support level of the channel. The bullish bias will remain if the price continues to make higher highs and lows.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.