- The US manufacturing PMI fell from 48.5 in June to 46.8 in July.

- US job growth slowed in July.

- The dollar remained strong on safe-haven demand.

The weekly USD/CAD forecast is bullish as the dollar rises amid heightened geopolitical tensions and economic uncertainty. However, Friday’s poor US NFP erased some of the week’s gains.

USD/CAD Ups and Downs

Ludi had a bullish week despite weaker-than-expected US data. At the same time, the Fed took a more dovish tone at its meeting on Wednesday. Notably, the US manufacturing PMI fell from 48.5 in June to 46.8 in July. Consequently, there were fears that the economy was slowing down rapidly.

-Are you looking for automated trading? Check out our detailed guide-

Meanwhile, US job growth moderated in July, with the unemployment rate rising to 4.3%. In the last week, bets on a Fed rate cut have risen, with policymakers opening the door for a September cut. However, the dollar remained strong due to safe-haven demand. Tensions in the Middle East have increased with the assassination of the leader of Hamas, pushing investors to buy the dollar.

Next week’s key events for USD/CAD

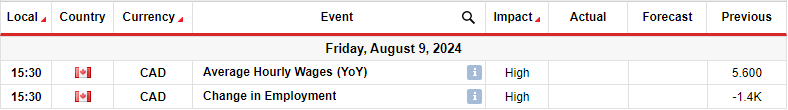

Next week, Canada will release its monthly employment data, shaping the outlook for rate cuts. Last month’s report showed a sharp slowdown in the labor market, sparking fears of further economic deterioration. Canada lost 1,400 jobs when economists had predicted an increase. These numbers increased pressure on the Bank of Canada to cut rates. Consequently, investors bet heavily on interest rate cuts, which weighed on the Canadian dollar.

At the July meeting, the BoC cut rates and took a more dovish view. Economists expect another rate cut at the September meeting. Therefore, if the jobs report shows further weakness, bets on a rate cut in September will increase. On the other hand, if employment recovers, there will be less pressure on the Bank of Canada to cut rates.

USD/CAD Weekly Technical Forecast: Solid Bullish Momentum

On the technical side, the USD/CAD price broke above the 1.3802 resistance level to make a higher high. The breakout comes after a sharp bullish move from the support level at 1.3601. Initially, bears and bulls were equally aligned. Price made strong bearish and bullish candles.

-If you are interested in Forex day trading, please read our getting started guide-

However, the last swing had only bullish candles, indicating that one side is stronger. Accordingly, the price easily broke through the resistance level of 1.3802. It retested the 1.3802 level as support to confirm a breakout before making a higher high. This points to a new bullish trend that could continue next week, with a break above the key 1.3901 level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.