- US service sector PMI data showed expansion.

- US jobless claims fell, pointing to a still tight labor market.

- The pound fell as markets mulled the Bank of England’s first interest rate cut.

The GBP/USD weekly forecast is slightly bearish despite the recent rally, as the Bank of England appears more confident of further rate cuts.

GBP/USD Ups and Downs

The pound had a weak week but closed well above its lows. The pair started the week lower as investors ditched risk assets amid fears of a US recession. Data for the previous week showed weaker than expected economic performance.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

However, this changed with US services sector PMI data, which showed expansion. Meanwhile, jobless claims fell, pointing to a still tight labor market. Still, investors have already priced in a more significant Fed rate cut of 50 basis points in September.

In addition, the pound fell as markets pondered the Bank of England’s first interest rate cut.

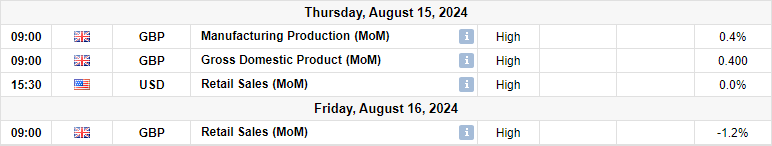

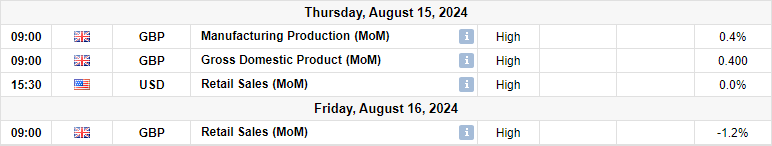

Next week’s key events for GBP/USD

The pound could see significant volatility next week due to US and UK inflation data and retail sales. In addition, the UK will release data on employment, GDP and manufacturing output. Markets will focus on consumer inflation reports, shaping the outlook for monetary policy in the UK and US.

The Fed wants to start its cycle of interest rate cuts in September. Inflation in the US is on a downward trend, and the economy is starting to crack. Therefore, further easing of inflation will give policymakers enough confidence to cut interest rates.

Meanwhile, the Bank of England recently implemented its first rate cut. However, most policymakers believe that core inflation remains high. However, they gained enough confidence to start reducing their borrowing costs.

GBP/USD Weekly Technical Forecast: Bears look for support at 1.2620

On the technical side, the GBP/USD price is trading below the 22-SMA with the RSI below 50. Therefore, the bears are in control. However, the price made higher highs and lows on a larger scale, indicating a bullish trend.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

After breaking the support at 1.2800, the bears are now eyeing the 1.2620 level. Initially, GBP/USD made a higher low at this level. So it’s a strong barrier. However, if the bears break this level, the price will make a lower low, breaking the bullish trend pattern. In this case, GBP/USD would confirm a new bearish trend. On the other hand, if the level holds firm as support, the bulls could re-emerge to make a new high.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.