- Expectations of a Fed rate cut put pressure on the dollar.

- The Canadian dollar had a strong week as oil prices rose.

- Investors await US inflation data.

The USD/CAD weekly forecast indicates a downtrend. The dollar weakens on speculation of a Fed rate cut, while the greenback strengthens, driven by rising oil prices.

USD/CAD Ups and Downs

The USD/CAD pair had a bearish week, with the Canadian dollar defying the odds to rally against the US dollar. As the week began, market turmoil amid fears of a US recession initially lifted the dollar before the trend reversed.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

However, data on service sector activity and jobless claims painted a different picture of a resilient economy. As a result, recession fears have eased. However, Fed rate cut expectations remained high, putting pressure on the dollar.

On the other hand, the Canadian dollar had a strong week as oil prices rose. Meanwhile, Canadian employment data showed a mixed picture. More people lost their jobs, but the unemployment rate fell slightly.

Next week’s key events for USD/CAD

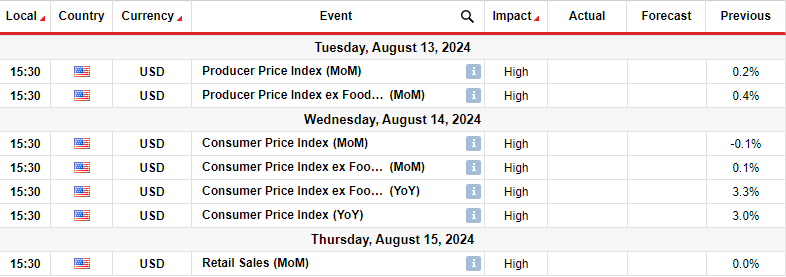

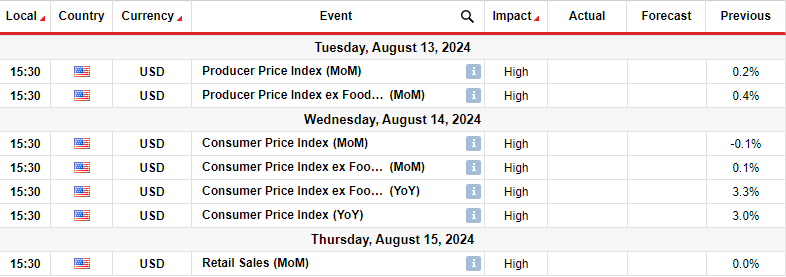

Next week, investors will focus on US data, including wholesale inflation and consumer and retail sales. These reports will have a significant impact on Fed rate cut expectations. In particular, economists expect the consumer price index to further decrease to 2.9% in July. Meanwhile, the monthly figure could rise by 0.2% compared to -0.1% previously.

If the report shows pressure on cooling prices, it will solidify bets for a 50 bps rate cut in September. On the other hand, if inflation surprises to the upside, markets could reduce the expected size of rate cuts. Meanwhile, retail sales will show the state of demand and how strong the US consumer is.

USD/CAD Weekly Technical Forecast: Price below 22-SMA, signaling bearish dominance

On the technical side, the USD/CAD price has broken below the 22-SMA, indicating that the bears have taken control. Initially, the bulls were in control, pushing the price above the critical resistance level of 1.3802. Although the price made a higher high, the bulls failed to sustain the move, allowing the bears to take control. As a result, the price fell below the key level of 1.3802.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

With the bears in the lead, USD/CAD could drop to retest the 1.3601 support level. A break below this level would confirm a new downtrend. Otherwise, the price will remain consolidated with support at 1.3601 and resistance at 1.3802.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.