- The pound remains one of the top performing currencies against the US dollar.

- The Fed is more willing to cut borrowing costs than the Bank of England.

- US GDP data shows the economy grew by 3.0%.

GBP/USD price analysis tilts slightly bearish as the pound retreats from recent highs amid dollar strength. The US dollar strengthened on Thursday after data revealed a strong economy despite high interest rates. However, investors remained cautious on Friday ahead of US inflation data.

-Are you interested in learning more about the Live Forex Calendar? Click here for details –

The pound remains one of the top performing currencies against the US dollar. It is up 4% so far this year. The recent rally came as markets bet on more rate cuts in the US this year than in the UK. At the same time, the British economy has recovered from last year’s downturn, which has brightened the outlook for the future.

Recent remarks by policymakers at the Jackson Hole Symposium revealed that the Fed was more willing to cut borrowing costs than the Bank of England. At the same time, market expectations point to a reduction of a total of 100 basis points by the Fed and 65 basis points by the BoE.

However, this outlook could change with incoming data. Experts believe that the pound is vulnerable as any changes could sharply reverse the trend.

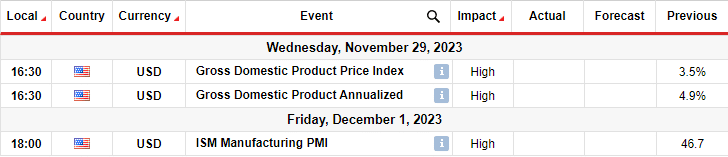

GBP/USD fell on Thursday as the dollar strengthened following better-than-expected US economic data. GDP data showed the economy grew by 3.0%, above estimates of 2.8%. The figures erased fears of a recession and reignited hopes of a soft landing by the Fed.

Meanwhile, jobless claims were lower than expected, revealing a stable labor market. Market participants are now looking to the core PCE report for more clues on the outlook for a rate cut.

GBP/USD key events today

- Core price index US PCE m/m

GBP/USD Technical Price Analysis: Struggle Below 30-SMA

On the technical side, the GBP/USD price has fallen below the 30-SMA, indicating a possible reversal. However, the RSI remains slightly above 50, indicating that the bulls are still fighting for control. The price changed direction after the bearish RSI divergence signaled the weakness of the bullish trend.

-Are you interested in learning about forex signals? Click here for details –

However, the bears found strong support at the 1.3150 level. This allowed the price to rally and retest the recently broken SMA. If the bears remain in charge, the price will make a new low below 1.3150. On the other hand, if the bulls come back stronger, GBP/USD will break above the SMA.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.