- The Fed cut rates by 50 bps, kicking off the easing cycle with a bang.

- Inflation in Canada eased more than expected on a monthly basis.

- Canadian retail sales jumped, showing solid consumer spending.

The weekly USD/CAD forecast shows a slow decline as the Fed follows the Bank of Canada in cutting borrowing costs.

USD/CAD Ups and Downs

The USD/CAD pair ended the week lower as the greenback fell after the FOMC policy meeting. Data before the meeting and economists’ estimates indicated a gradual pace of rate cuts. Meanwhile, market participants estimated a 65% chance of an aggressive start.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

On Wednesday, the Fed cut rates by 50 basis points, kicking off the easing cycle with a bang. The dollar fell against most of its peers. However, the decline from the lunatic was minor as the BoC could also cut interest rates.

Meanwhile, data from Canada showed a mixed picture. Inflation decreased more than expected on a monthly basis. On the other hand, retail sales jumped, showing solid consumer spending.

Next week’s key events for USD/CAD

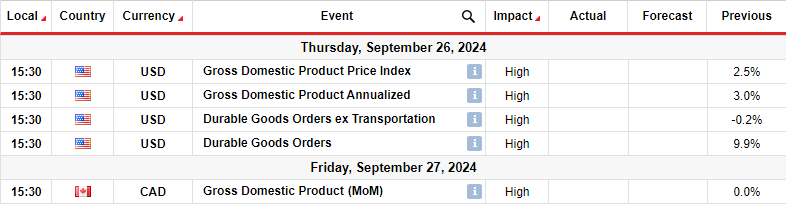

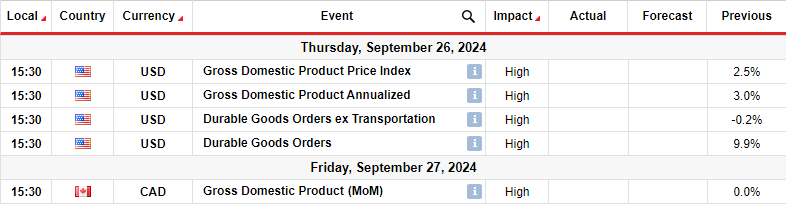

Next week, the US will release data on gross domestic product and core durable goods. Meanwhile, Canada will only release GDP data. US GDP data will show the health of the economy, which could affect the Fed’s outlook.

A healthy economy could reduce expectations for interest rate cuts because the Fed would not have to be too aggressive. On the other hand, if GDP shows a weak economy, it could raise expectations for a rate cut in November.

Meanwhile, in Canada, the Bank of Canada may increase the size of future rate cuts to reflect the Fed’s recent move. The GDP report will also influence the outlook for future policy moves in Canada.

USD/CAD Weekly Technical Forecast: Price action suggests a bearish reversal

On the technical side, the USD/CAD price is trading slightly above the 22-SMA, which is a sign that the bulls are in the lead. However, the price shows that the bias may change soon. Notably, the RSI is trading below 50, supporting bearish momentum.

-Are you looking for the best CFD broker? Check out our detailed guide-

Moreover, the price made a bearish candle after a break at the key resistance level of 1.3600. It also briefly touched the 0.382 Fib retracement level which also acted as resistance. The bears could regain control in the coming week if the price breaks below the 22-SMA. USD/CAD could then fall to support at 1.3450. A break below this level would signal a continuation of the previous downtrend.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.