- Powell’s hawkish speech dashed hopes for a 50 bps rate cut in November.

- Data from the US showed a tight labor market.

- Tensions in the Middle East have increased demand for the safe-haven dollar.

The weekly GBP/USD forecast shows a sudden shift in sentiment to the downside as the dollar regains its luster.

GBP/USD Ups and Downs

GBP/USD formed a solid bearish candle for the week as the dollar strengthened against the pound. It was a strong week for the dollar as data, remarks from policymakers and tensions in the Middle East supported the currency.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

The first catalyst for the dollar was Powell’s hawkish speech, which dashed hopes for a 50 bps rate cut in November.

Meanwhile, data from the US showed a tight labor market, with job vacancies and private employment rising more than expected. Moreover, the non-farm payrolls report revealed a bigger-than-expected jump in employment.

Elsewhere, tensions in the Middle East increased demand for the safe-haven dollar.

Next week’s key events for GBP/USD

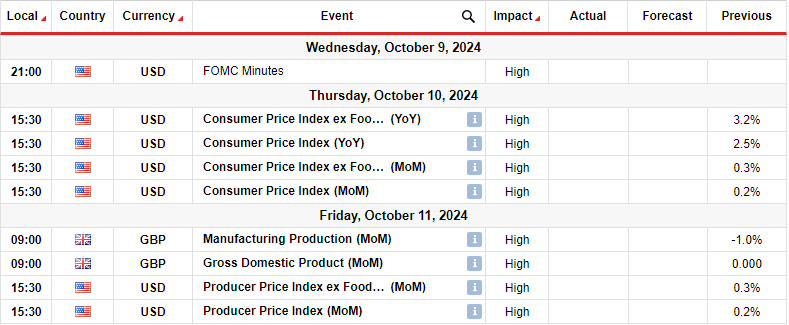

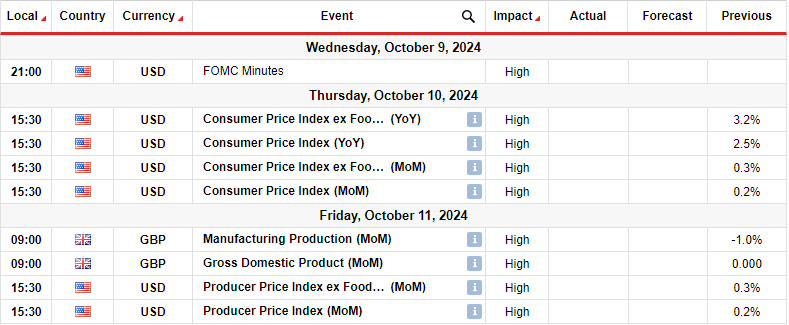

Next week, market participants will focus on the FOMC minutes. The minutes could contain clues about what policymakers might do in the future. At the same time, US CPI and PPI reports will show whether inflation is moving closer to the Fed’s 2% target.

Analysts believe that consumer inflation will further decrease from 2.5% to 2.3% in September. A larger-than-expected decline will put pressure on the Fed to reduce borrowing costs. As a result, bets for a 50 bps rate cut in November would increase. On the other hand, an unexpected jump would favor a smaller rate cut.

In the UK, market participants will focus on the manufacturing output and GDP report. A resilient economy will reduce bets on a BoE rate cut, while the reverse is true.

GBP/USD Weekly Technical Forecast: Bears break out of rising wedge pattern

On the technical side, the GBP/USD price has broken out of its bullish wedge to the downside. At the same time, it broke below the 22-SMA, indicating a change in sentiment. Earlier, the price made a series of highs and lows in a wedge pattern.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

However, the uptrend stalled when it reached resistance at 1.3400. Here, the RSI made a bearish divergence, indicating a weakening of the bullish momentum. Soon after, the bears became strong enough to break out of the bullish wedge. In the coming week, the price will face the support level of 1.3051. A break below would clear the way to support at 1.2701, strengthening the bearish bias.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.