- Most Fed policymakers agreed to cut borrowing costs by 50 basis points.

- The U.S. consumer price index rose 2.4% year-on-year, above estimates.

- Markets have reduced the chances of a November Fed rate cut.

The weekly EUR/USD forecast is bearish due to a continued shift towards a more cautious outlook for Fed policy following warmer CPI data.

EUR/USD ups and downs

EUR/USD had a bearish week and the dollar strengthened as expectations of a Fed rate cut eased. Market participants absorbed data on inflation and employment. Furthermore, minutes from the FOMC meeting showed that most policymakers agreed to cut borrowing costs by 50 basis points.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

The consumer price index rose 2.4% year-on-year, above estimates for a 0.1% increase. Accordingly, markets have reduced the chances of a November Fed rate cut. Meanwhile, jobless claims rose more than expected, showing some weakness in the labor market.

As the week ended, wholesale inflation data came in lower than expected, weakening the dollar slightly.

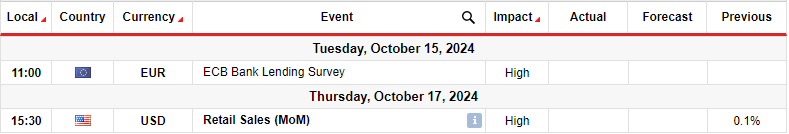

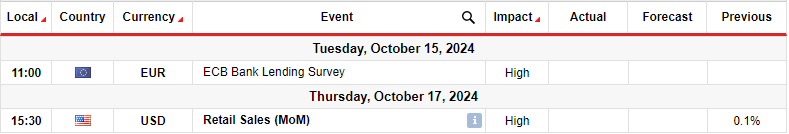

Next week’s key events for EUR/USD

Next week will be slow for EUR/USD in terms of economic news, with the ECB’s bank lending survey and the US retail sales report. Market participants will focus on the US retail sales report, which will show the state of consumer spending and provide clues about the Fed’s next policy move. Recent economic data from the US has shown resilience.

As a result, market participants cut bets on a November Fed rate cut of 25 basis points. Furthermore, there is a chance that the Fed will keep interest rates unchanged. IF sales jump, rate cut bets will continue to fall, boosting the dollar. On the other hand, if sales significantly miss forecasts, there would be more pressure on the Fed to reduce borrowing costs.

EUR/USD weekly technical forecast: Price reverses after double top

On the technical side, the EUR/USD price has broken below the main bullish trend line. At the same time, the price is trading well below the 22-SMA, showing that the bears are in the lead. Meanwhile, the RSI is heading towards the oversold region, indicating solid bearish momentum.

–Are you interested in learning more about making money on forex? Check out our detailed guide-

The price made a double top near the 1.1202 resistance level. Moreover, the RSI made a bearish divergence to show weaker bullish momentum. As a result, the bears pushed the price below the 22-SMA, the 1.1000 level and the bullish trend line. This move pushed the price to a lower low, confirming the downtrend. Therefore, EUR/USD could fall to the support level of 1.0801 next week.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.