- The dollar strengthened amid increased bets on a Trump presidency.

- Data from the US showed an unexpected jump in retail sales.

- Traders expect the Bank of Canada to implement a 50 basis point rate cut next week.

The weekly USD/CAD forecast points to solid bullish sentiment as traders price in a big BoC rate cut. Also, VTI prices were also under pressure.

USD/CAD Ups and Downs

The USD/CAD pair had a bullish week as domestic data supported the US Dollar and weakened the Loonie. At the same time, the dollar strengthened amid increased bets on a Trump presidency.

–Are you interested in learning more about Australian forex brokers? Check out our detailed guide-

Data from the US showed an unexpected jump in retail sales, pointing to a strong economy. Meanwhile, inflation in Canada fell more than expected, fueling bets on a rate cut. At the same time, traders bought the greenback with increased bets that a Trump victory would boost inflation.

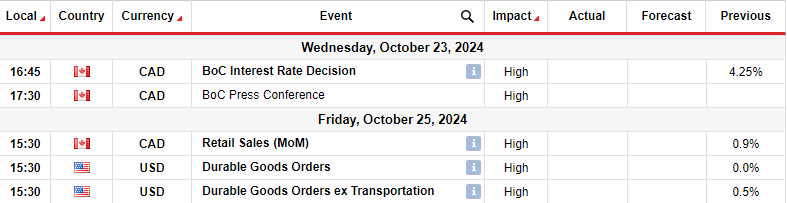

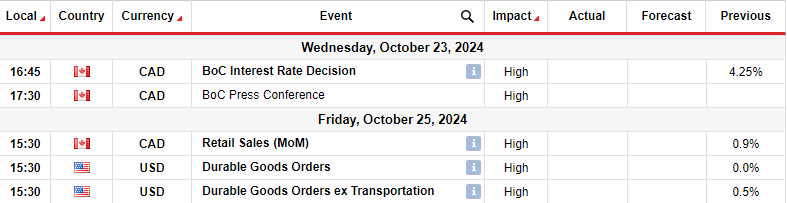

Next week’s key events for USD/CAD

Market participants will focus on the Bank of Canada’s policy meeting next week. Furthermore, Canada will release its retail sales report. On the other hand, the US will release data on durable goods orders.

Traders expect the Bank of Canada to implement a 50 basis point rate cut next week. This would be the fourth cut, which should stimulate economic growth. High interest rates have made the Canadian economy a poor country. At the same time, inflation was reduced to 1.6%, which motivated the central bank to reduce borrowing costs.

Meanwhile, US durable goods data will show the state of economic demand. Recent US data revealed a resilient economy that boosted the dollar.

USD/CAD Weekly Technical Forecast: Bullish momentum stalls at 1.3825

From the technical side, USD/CAD the price had a strong bullish rally and is currently facing the key resistance level of 1.3825. Moreover, the price is trading well above the 22-SMA, a sign that the bulls are in power.

If you are interested in guaranteed stop loss brokers, check out our detailed guide-

The pair is climbing steeply, with price action showing very few bearish candles. The bulls broke above the SMA and the 1.3600 resistance level and are now challenging 1.3825. However, after a long rally without a pullback, the price could pause to allow the SMA to catch up.

A break above the resistance at 1.3825 will pave the way for a retest of the key psychological level of 1.4001. On the other hand, if the price reverses at the resistance level of 1.3825, it could return to the support level of 1.3600.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.