- The US economy grew by 2.8% in line with expectations.

- The core US PCE price index rose 0.3%, in line with expectations.

- Optimism about Trump’s victory and policy change has faded.

The weekly GBP/USD forecast hints at a rebound for the pound as weak Trum trade puts downward pressure on the dollar.

GBP/USD Ups and Downs

The pound had its strongest week since September as the dollar retreated from its peak on Trump’s trade waning. Data during the week showed that the US economy grew by 2.8 percent as expected. Meanwhile, the core PCE price index rose 0.3%, in line with expectations. Consequently, market participants were more confident that the Fed would cut rates in December.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

Meanwhile, optimism about Trump’s victory and policy changes faded, sending the dollar and Treasury yields lower. Markets will now wait to see if Trump enacts his policy proposals in the coming year

Next week’s key events for GBP/USD

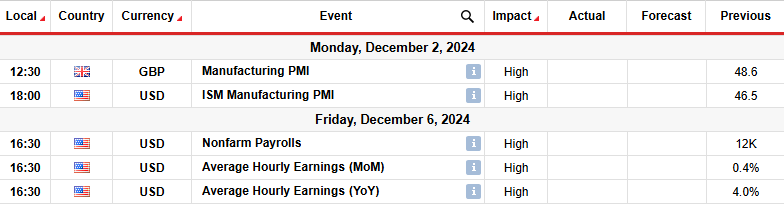

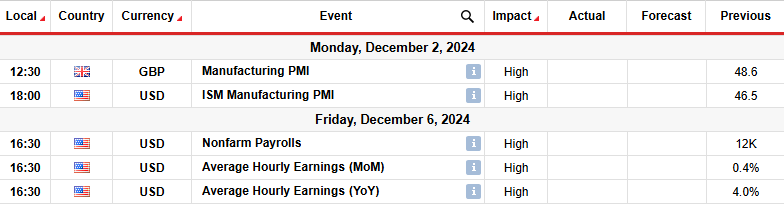

Next week, the UK will release data on business activity in the manufacturing sector. Flash data recently showed the economy slowing, pushing market participants to raise the likelihood of a more aggressive rate-cutting cycle from the Bank of England.

Meanwhile, US reports will include manufacturing PMI and a non-farm payrolls report. Recent flash PMI points to robust business activity in November. Therefore, there is a chance that this trend will continue, reducing the likelihood of a Fed rate cut in December.

Meanwhile, the non-farm payrolls report will show the state of the labor market. If job growth remains as sluggish as last month, it will raise expectations for a rate cut in December. On the other hand, if job growth jumps, the Fed could end the year with a break.

GBP/USD weekly technical forecast: 1.2500 support calls for pullback

From the technical side, GBP/USD price recovered to retest the 22-SMA resistance after finding support at the 1.2500 level. The bounce also allowed the price to retest the resistance level at 1.2750. Therefore, there is a strong bull barrier that could cause the price to go lower.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

If the bears return to the 22-SMA, they will aim to make a new low below 1.2500, continuing the downtrend. On the other hand, there is a small chance that the bulls will break above the SMA next week. Such an outcome would signal a reversal and allow the price to return to the resistance level of 1.3007.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.