- The Vestible GBP / USD forecast shows a strong American work sector.

- Data on jobs in the United States pointed out faster than the expected economic decline.

- The United States added 177,000 new jobs in April.

GBP / USD Sunday forecast is a slightly bear, because a strong American work sector confirms the cautious ton of Fed.

UPS and Padua GBP / USD

GBP / USD price ended the week down after it was climbing new heights. Initially, the function that was gathered against the dollar amidst reduced American economic data. However, this changed after robust employment data at the end of the week.

– Did you look for forex robots? See our detailed guide-

American numbers on free working work workspaces, pirated employment and job-free receivables indicate faster than the expected economic decline. However, the business activity in the production sector was better than expected. Moreover, the report of Nefarma salary discovered 177,000 new jobs in April compared to estimates of 138,000.

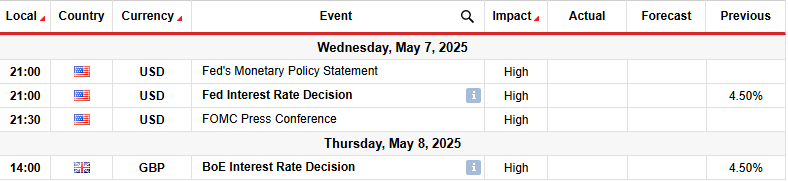

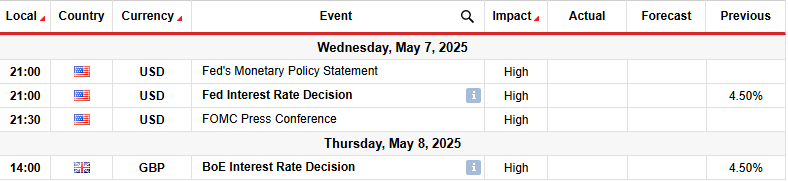

Key events next week for GBP / USD

Next week, market participants will focus on Fed and England bank meetings. Economists expect the Fed to keep interest rates unchanged, while the English bank probably reduce 25-BPS rates.

The Fed kept a cautious tone, and Powell said it was not in a hurry to reduce interest rates. However, recent decline data falls can push the central bank in June. Meanwhile, Boe is a conscious influence of Trump tariffs. The weaker growth of Global and Great Britain will probably push policies creators to consider faster cycle relief.

GBP / USD Sunday technique Technical forecast: Multiply pause after recent swing

On the technical side, GBP / USD price paused after reaching the level of resilience at 1.3401. Moreover, the price of trade above the 22nd and RSI is above 50 years, suggesting bias bias. The GBP / USD maintained a bakery trend, making a higher height and a string. At the same time, the price respected the trendy line as support.

– Did you ask for the best CFD broker? See our detailed guide-

The latest swing began on trendline support and level 1,2702. However, the move slowed near the level 1,3401. The bulls have tried to break over the level twice, but failed. Meanwhile, RSI made a slightly bearing divergence, signaling the return that continues.

The price could be ready to retire 22-SMA again. The deeper withdrawal would restart Trendline support. Billish bias will remain if the price remains above SMA or Trendline. Meanwhile, the Usttrend will continue to interrupt above Resistance 1,3401.

Looking for forex trading now? Invest in Ethorro!

67% of retail orders lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.