- The AUD / USD Weekly Forecast shows an increase in demand in the dollar.

- Feeded stated the rates unchanged as expected.

- The Trade Agreement between the US and UK had facilitated the fears of trade.

The Weekly Forecast AAUD / USD shows that there will increase demand in the dollar because market participants are hoping for American-Chinese trading agreement.

UPS and DOWNS AUD / USD

A couple of AUD / USD had a bear week as Fed kept interest rates unchanged and noticed that the appearance of the economy was left uncertain. At the same time, the dollar bounced higher on the optimism of trade.

–Are you interested in learning more about MT5 brokers? See our detailed guide-

Feeded stated the rates unchanged as expected during today’s meeting. Moreover, Powell maintained his careful tone saying that there was still no clarity on the direction of the economy. Meanwhile, the trade agreement between the United States and the United Kingdom facilitated the fears of trade. In addition, he raised hopes another job between China and the United States who would end the current trade war.

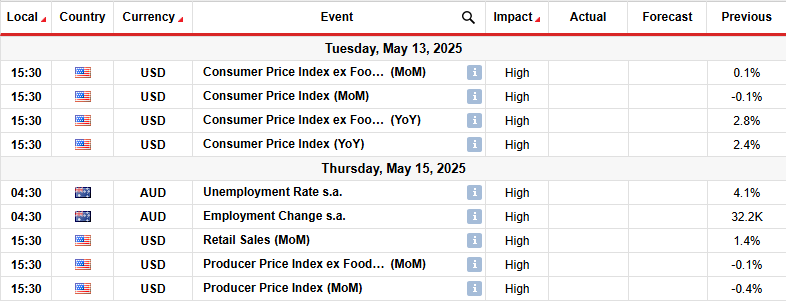

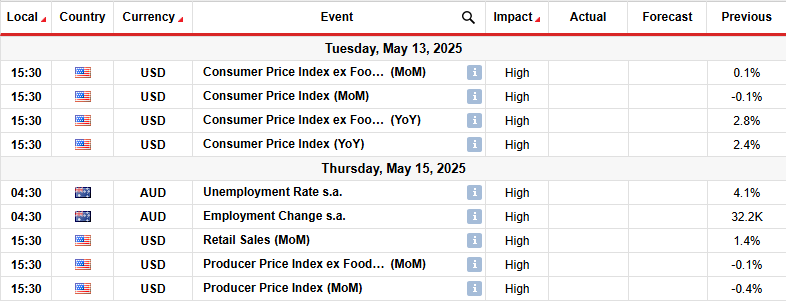

Key events next week for AUD / USD

Next week, the tradient will analyze inflation and retail sales. At the same time, Australia will release its employment information, shaping the spare banks of the Australia speeds. The Fed is waiting to see if Trump Tariffs warmed the price of price in economics. Meanwhile, policy makers are also waiting to see the state of economic demand.

The reflex of inflation and less sales highlight the effects of Trump tariffs on the economy. The Fed would then have to make inflation and growth. However, the signs of the recession forcing policy makers to reduce interest rates.

AUD / USD Sunday technique Technical forecast: Bulls run the passage of the range

On the technical page, the price of AUD / USD has drifted back to retire a key zone of support and resistance after recent interruption. The price is seated above the SMA, and the RSI is over 50, showing that the bulls are in lead.

–Are you interested in learning more about Thailand forex brokers? See our detailed guide-

The AUD / USD maintained lateral crossing between 0.6200 and resistance to 0.6351, often piercing the level. At the same time, the price chopped through SMA. At one point, the bears strengthened enough to start breaking. However, the price is soon reverse into the range area, confirming the false passage.

This move gave the bulls enough confidence to break over the resistance zone. The price is currently following this zone and SMA. If the bulls are ready for a new trend, the price will bounce more next week, probably affected resistance to 0,6602.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.