- A weekly forecast for USD / CAD suggests increasing probability for a pause bottle in June.

- Pricing traders 27% chance of breaking down the hi in the June meeting.

- Participants in the market are concerned about the situation in the USA debt.

A weekly forecast for USD / CAD proposes more likely to be another bank of Canada Pause in June.

UPS and Downs of USD / CAD

The cheese / CAD pair had a bear Sunday like the Canadian dollar strengthened and the American dollar fell. Loonie had a strong week after Canada reported warmer-expected inflation numbers. The data has led to a sharp drop in the bank’s rate expectations. Currently traders price prices 27% chance of reducing the price at the June meeting.

–Are you interested in learning more about Canadian forex brokers? See our detailed guide-

Meanwhile, the dollar fell that market participants were worried about the situation in the USA. Moody reduced the country’s credit rating because of its huge debt. Meanwhile, Trump policies can add a great debt.

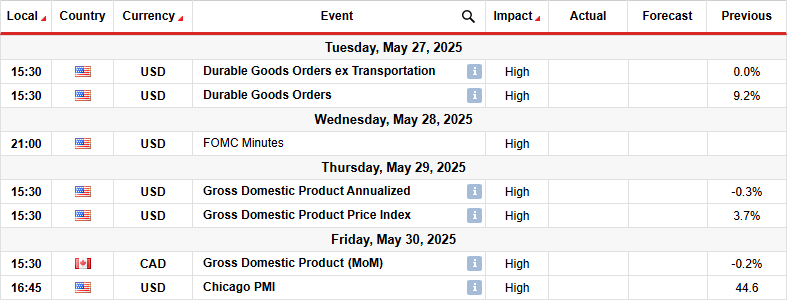

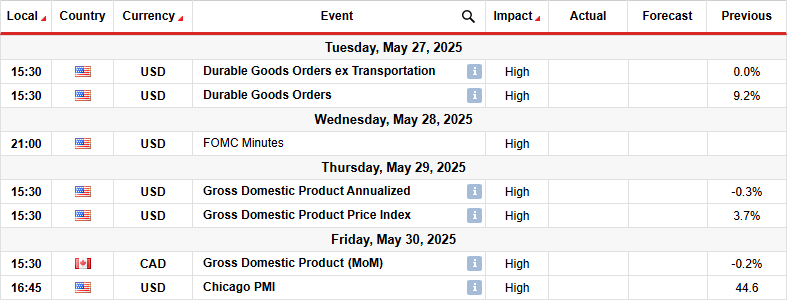

Key events next week for USD / CAD

Next week, the United States will publish key reports that show the state of the economy. They include permanent orders of goods and gross domestic product. Moreover, market participants will pass through a few minutes of FOMC meetings on future moves.

Previous GDP reading has revealed 0.3% contraction in the economy. The next week is less than expected than expected next week would point to a weakness that could be pressed to feed at lower borrowing costs.

Moreover, traders will watch the Canadian GDP report, which will also shape Outlook for reducing the Hi products. After this week, ruin inflation inflation, the expectations of the installment have significantly dropped, with greater probability once more in June.

USD / CAD Sunday technique Technical forecast: Support for about 1,3400

On the technical page, the price / CAD price was terminated and closed below the support level for support 1,3800, confirming the continuation of trends reduction. At the same time, the price now trades below 22-SMA with RSI closer to the covering region, suggesting strong bear bias.

–Are you interested in learning more about high brokers? See our detailed guide-

Earlier, the price traded in the new trend before pausing the level of support from 1,3800. Here it is that it confirmed the weekend weekend and the price. As a result, the bulls showed up to push the price above the 22nd.

However, the jump was short because the price is paused on the 1,4000 key to psychological levels. It allowed the bears to return and make lower. Given the solid bias for the bear, the price can be lowered to the support level of 1,3400 next week.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.