- The golden weekly forecast is Bullish in the middle of a geopolitical tension.

- Cooling data on American inflation, which strive on the dollar, enhanced demand for gold.

- The market participants now look at FOMC meeting minutes.

Tag Weekly forecast is becoming strong bulls, and about $ 3,500 is about 3,500 times. A recent geopolitical tension arising from the conflict of Israel-Iran took the price above $ 3,400, marking a fresh multi-day tip at $ 3,445 before retiring later on Friday.

-If you are interested in forex trading and then read our guide to start-

The Mecter American dollar demand, in the middle of colder data of the US CPI data, amplifiers are golden posturance. The stage is now set for a precious metal for volatile next week as a trader is eagerly waiting for the Fed Policy meeting.

The yellow metal remained sideways, because the week began, closed by optimism around the American store in London. The negotiators agreed on the framework to preserve the tariff truce and easy export control, including those on rare earthen metals. The announcement of the American President for Relaxation of Controls at many Chinese products has also raised danger, limiting upside down for gold.

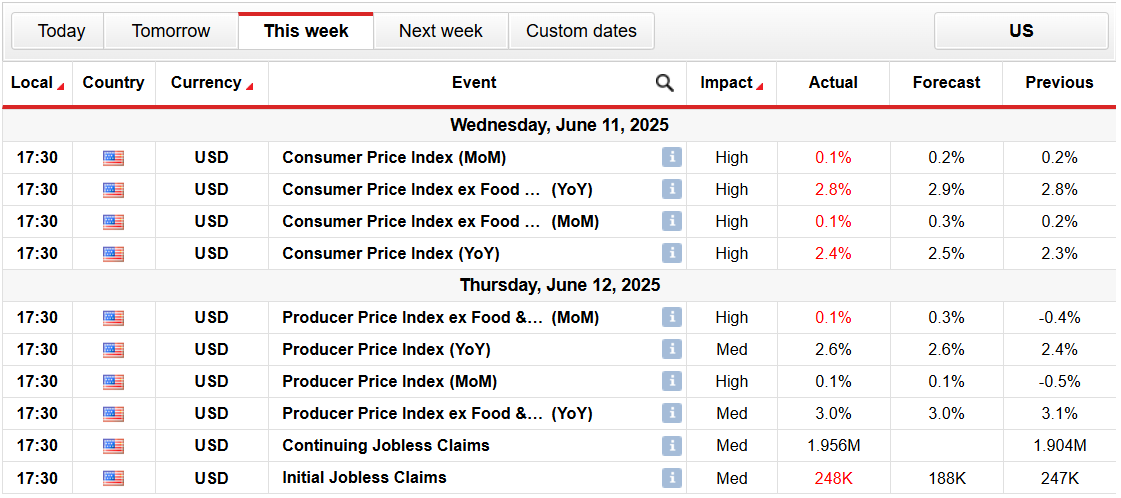

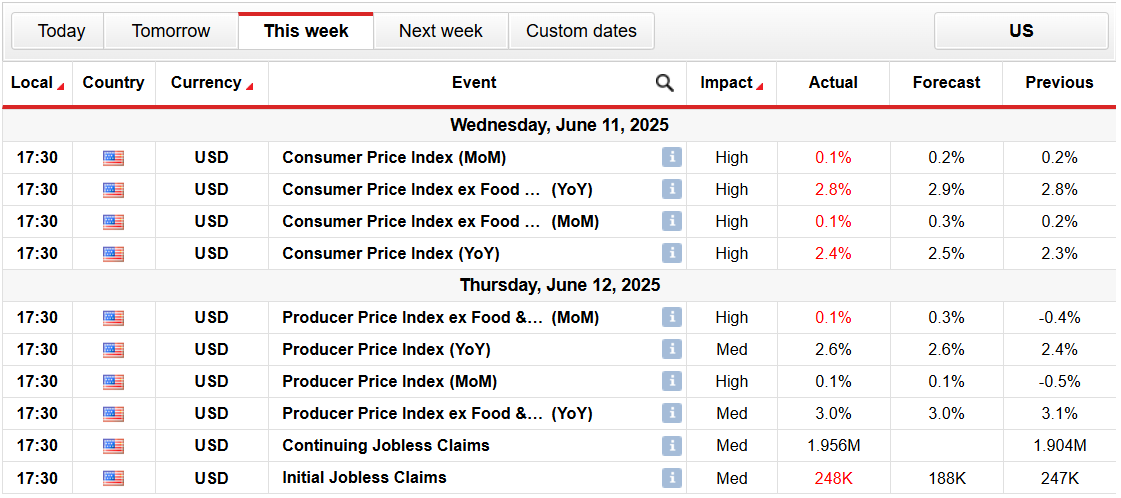

Momentum moved in favor of gold during the middle week, because the US CPI data for can slip, with the title inflation to 0.1% m / m and 2.4% I / I. Basic inflation also missed an estimate. The data started a sharp decline in the US dollar, resulting in 1% winnings wednesday. The bikala trend continued on Thursday, because the American PPI and the unemployed data were weak enough to maintain sales pressure on Greenback. The data speculated speculation about FEDs more Briefed attitude.

However, the decisive catalyst was an attack of Israel to Iran’s nuclear facility and military officials. The Israeli Prime Minister announced the launch of a “Lion’s labor rise”, noticing the attack will continue until needed. Iran also moved and warned the United States and Israel of serious consequences. The situation sent a golden price above $ 3,400.

Main events for gold next week

All eyes are now at interest rates of the Federal Reserve and the updated edition of the Summary of Economic Screenings (Sep) on Wednesday. Although no changes in interest rates are expected, the new Dot plot is key to watching. The US dollar can further weaken if at the end of 2025. They repeat their call to two installments. A Havkish Tilt, signal one incision, can strengthen Greenback, and gold can see the return.

The comment of Fed Faild Jerome Powell will also be carefully observed. The breeze tone can speed up the dollar sales, pushing gold at fresh all the time.

Gold weekly technical forecast: The bulls are pushed to $ 3,500

The daily card of gold shows that the price briefly interrupted the double top in $ 3,440. Downsion remains well supported by 20-day SMA and the growing RSI at 63.0. The price is slowly going according to $ 3,500 (high time high).

– Did you look for the best intermediaries in AI? See our detailed guide-

At the party, $ 3,400 levels are still strong support for gold per night of $ 3,320, where the 20-day SMA resides. The interruption below the level can be cut off according to $ 3,300.

Looking for forex trading now? Invest in Ethorro!

67% of retail orders lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.