- GBP / USD Sunday forecast is a treasure bear in the middle of the central bank divergence.

- The Middle East Crisis continues to strive to the pound, adding gain in the US dollar.

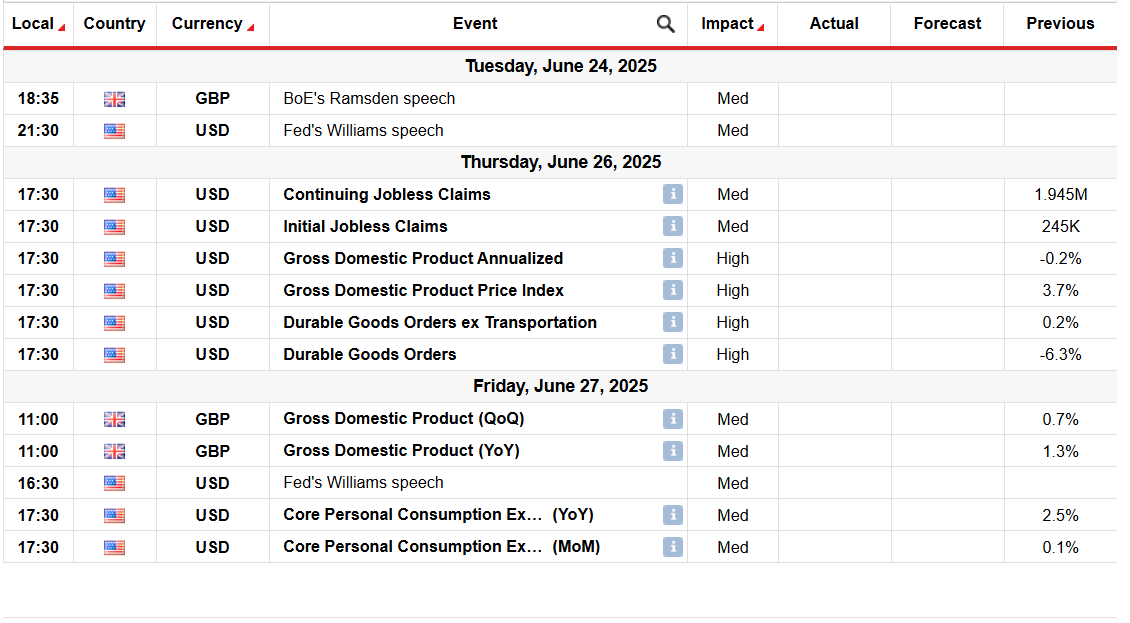

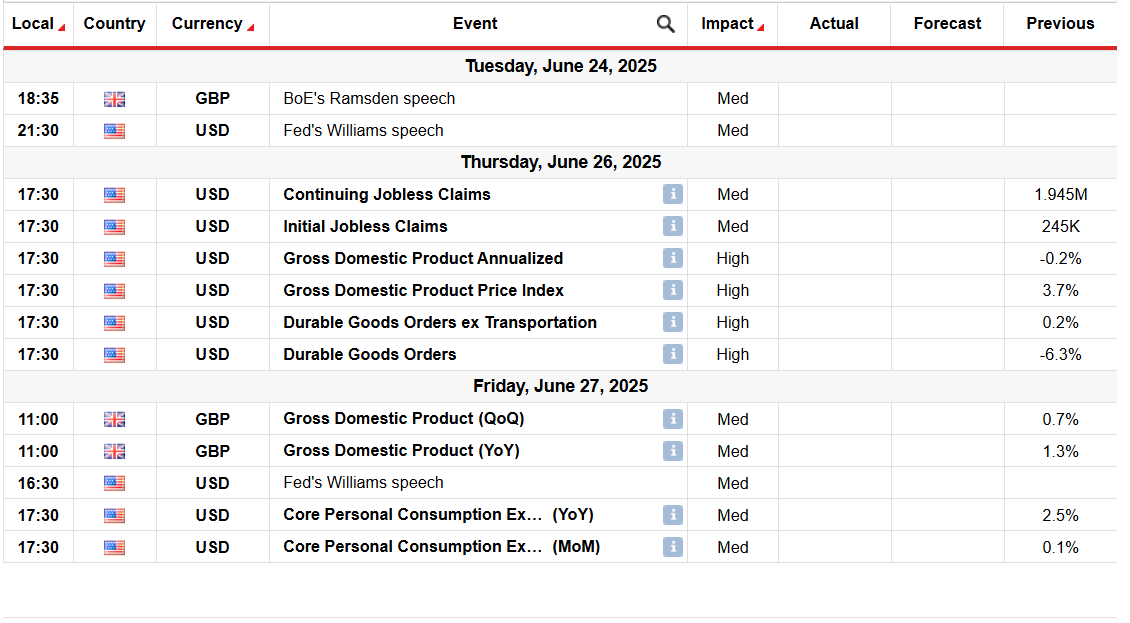

- Participants in the market are appointed to the PMI readings and American GDP and inflation data.

The British pound managed to partially regain his losses from the American dollar after the couple strayed on the monthly low from 1,3400. The downside came after the dollar picked up strength in the middle of escalating the tension of the Middle East. Moreover, the diverging signals of the Central Bank also strive for GBP / USD.

–Are you interested in learning more about the next cryptocurstical to explode? See our detailed guide-

Sunday started with a bookle coming from Iranian-Israel War worsening the global risk. The fears of oil disorder over Hormuz’s anxiety launched a broader risk aversion that pushed in a safe haven in the American dollar. The recovery of the dollar further supported the tone of Harksh Hral such as the Fed who held unchanged and reiterated the dependence on the data for the next rates.

President Trump held an aggressive attitude against Iran, referring to an unconditional surrender. He approved military action against Iran, but he kept him for two weeks before taking the decision. This was temporarily deselated tension and provided some temporary support for risky assets.

This feeling of feelings allowed the pound to recover from monthly orders. Meanwhile, banks of delays in England has already been a price. The Central Bank held rates at 4.25%, and Goe Gveror hinted at future cuts. However, Split MPC votes gave a falconious signal while six members voted for retention as three members voted for the cut.

However, the recovery of the pound was shaded by weaker data on selling in the UK, which showed a decline of 2.7% in May, raising concerns about consumer demand in the UK.

Key events for GBP / USD next week

We look forward to, traders will focus on the commentary of the Central Bank and the readings of the PMI on both sides of the Atlantic. The American core PCE index, US GDP and lasting data on goods orders are also important for viewing.

GBP / USD Sunday technical forecast: Customers are exhausted under 20th

The GBP / USD daily shows a mild bear scenario because the price remains below the 20-day SMA level. Earlier in the week, the price briefly broke the key support zone at 1,3400, but it was able to recover. However, the price tested 20-day SMA and turned the winnings on Friday. Shows a sign of customer exhaustion. However, the main support 1,3400 continues to support a couple.

–Are you interested in learning more about forex indicators? See our detailed guide-

Level 1.3400 violation may bring level 1,330 as a goal before 1,3265. The daily Daily RSI is nearby 50 years, which does not currently show a clear bias. However, the probability of lowering interruptions is higher.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.