- GBP / USD remains under pressure in the middle of constant strength in the dollar and faded in color bets.

- The CPI UK surprised upside down, but the markets doubt that Boe will answer with other hiking.

- The focus of next week helps in the UK and the US PMIS, it is also probably likely to shape the GBP / USD?

The price of GBP / USD closed lower for the week, sliding from the region 1,3485 according to 1,3400, because the US dollar found fresh demand and expectations uniformed mitigation speed.

The main event was the CPI Print in the UK CPI, which came to warmer than expected to 3.6% IOI in relation to 3.4% forecast.

–Are you interested in learning more about ETF brokers? See our detailed guide-

It is the original amplifier of the pound, with prices of retailers in a possible way late cycle on Boe. However, the members of Boe remained in the future tension, referring to basic disinflation trends and weak salary growth.

Through the Atlantic, American data CPI showed refrigerated inflation, but insufficient to convince the short-term reduction in feedback, especially as the comments on the Fed Fait Power chair leaned Havkish.

The risk of risk is additionally moistened by political titles, including rumors (later rejected) that Trump can replace the Fed Powell chair if selected. The dollar jumped sharply after denying, causing GBP / USD.

Upcoming events for GBP / USD

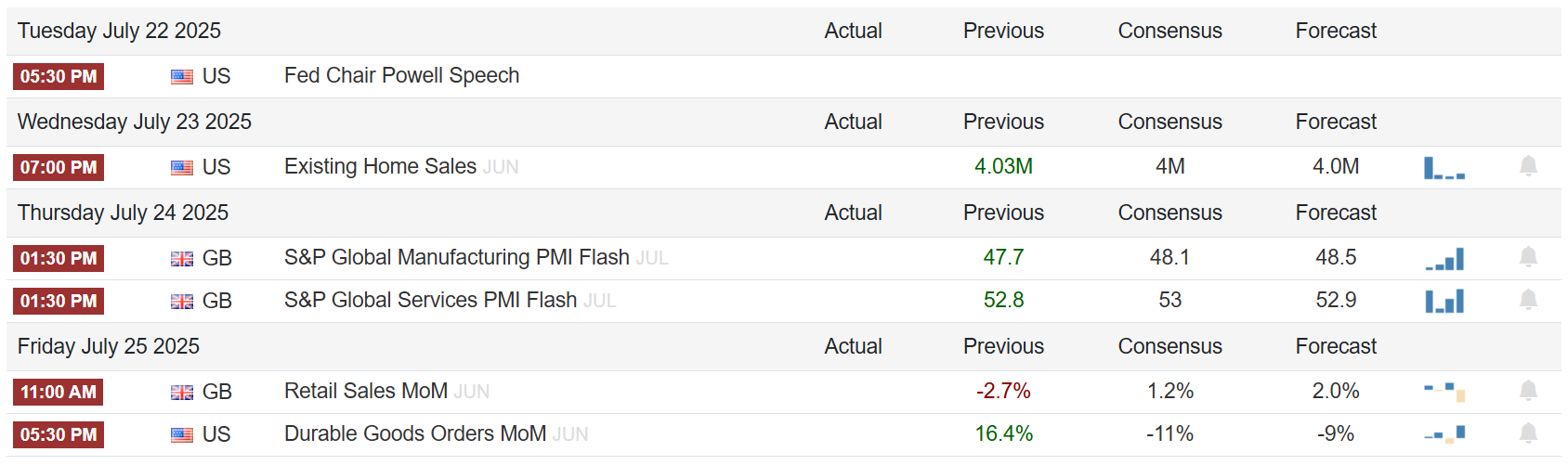

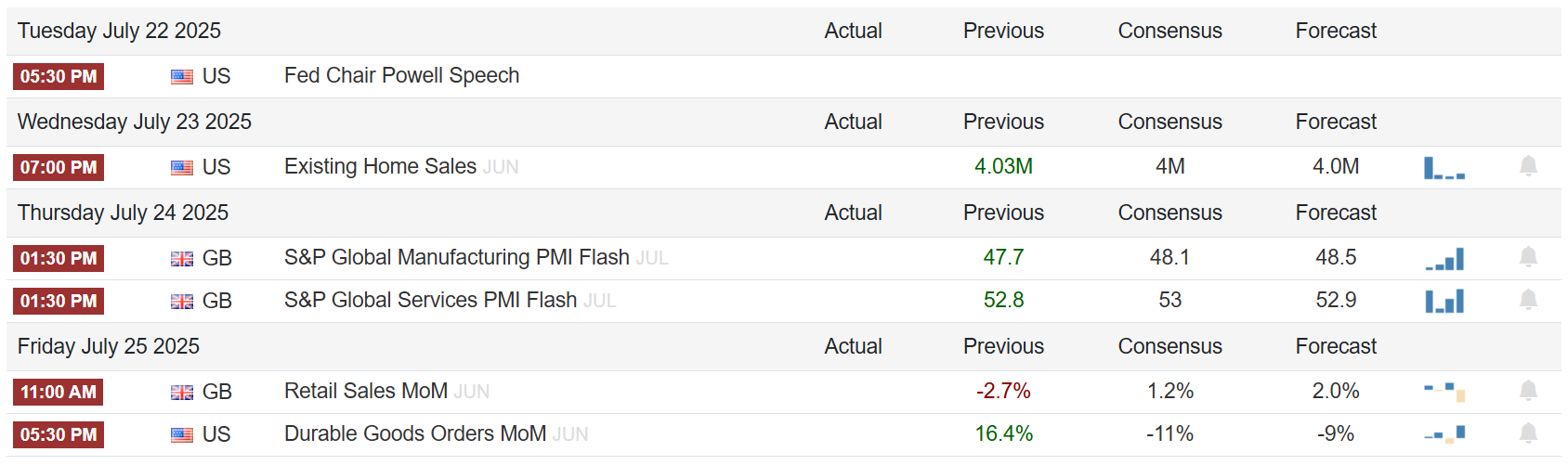

Next week offers a combination of high kick in the UK and American data:

- UK S & P Global Pmis (Wednesday): Soft reading could strengthen concerns about the economic momentum in the UK, weighing at Sterling.

- US S & P Global PMIS (Thursday): The PMI readings can reveal the economic power of the United States, which can potentially affect the Fed Monetary Policy.

- Sales of UK retail (Friday): The data will feed in a wider feeling of weakness on the port of demand in the UK.

Markets will also look for Fed Gord and Comments Boe, especially after recent inflation prints.

GBP / USD Sunday technical forecast: Bears for 100-day SMA

The GBP / USD daily display shows a weakened torque until the pressure bear enhances about 1,3400. However, the current price level coincides with solid support. The last few daily candles show a bear momentum, while 20-day and 50-day SMAS turned the bear.

–Are you interested in learning more about Canada forex brokers? See our detailed guide-

The next target for the bear lies at the 100-day SMA near the 1,3300 regions before the following support at 1.3150. The value of the RSI is close to 40.0, indicating the probability of further cannot be switched off.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.