- A weekly USD / CAD forecast indicates an increase in economic concerns in Canada.

- Canada was one of the unfortunate countries not to sign trade with the US.

- The data revealed the weak growth of American jobs in July.

Seventh for the benefits of USD / CAD indicates an increase in economic concerns in Canada after Trump imposed larger tariffs.

UPS and Downs of USD / CAD

The cheese / CAD pair had a bicovan week until Loonie weakened in the middle of tariff concern. At the same time, the dollar gained most of their peers, further weighing on Canadian currency. Canada was one of the unfortunate countries not to sign trade with the US. As a result, tariff uncertainty weighed at Loonie while Trump announced 35% tariffs on Friday. Meanwhile, the Turif Dock has reinforced the American Cashier and Dollar.

–Are you interested in learning more about the prediction of Bitcoin price? See our detailed guide-

However, the Canadian dollar found a little relief on Friday after the data showed weak growth of American work and the increase in unemployment rate.

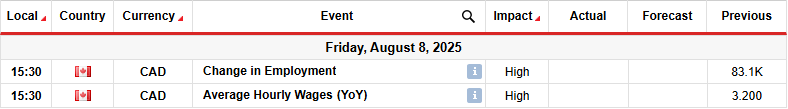

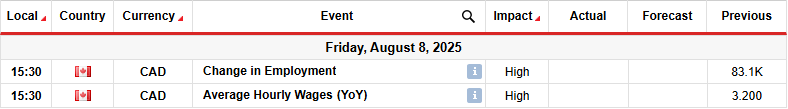

Key events next week for USD / CAD

Next week, Canada will free her crucial monthly employment report. Recent data from the country showed recovery after the Canada bank has reduced borrowing costs. This allowed the Central Bank to pause for a while. Therefore, there is a chance that employment remains robust.

However, Canada is now facing higher tariffs that may affect future economic growth. Therefore, traders will pay more attention to future reports.

USD / CAD Sunny technical forecast: Known Prices 1,3750 After Bullish

On the technical page, the USD / CAD price pulled back to reset recently broken key level 1,3750. It trades above the 22nd, and RSI is over 50 years of age, suggesting baccareability. Therefore, the withdrawal could only be before the movement of the bulling continues.

–Are you interested in learning more about forex basics? See our detailed guide-

The new direction comes after the price has made a triple bottom near the support level of 1,3575. Initially, USD / CAD was on trend and just made a new low. However, the price stopped creating significant swings than SMA. Therefore, it was left in a narrow range and could not be broken below 1,3575.

At the same time, the RSI made more loops, indicating the bakery parting. Divergence was a sign that a bear swing is fading. As a result, the bulls took the breaking of the narrow range. If they stay in lead, the price is likely to restart 1,4000 key psychological level.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.