- The Teden advantage of AUD / USD indicates the probable RBA cross section on Tuesday.

- The markets interpret Trump replacement fed foods as Dovish.

- American unemployment claims that it increased, encouraging concern about the labor market.

The Weekly Forecast AAUD / USD indicates the probable RBA cross-sectional rates on Tuesday that could pull the Australian dollar lower.

UPS and DOWNS AUD / USD

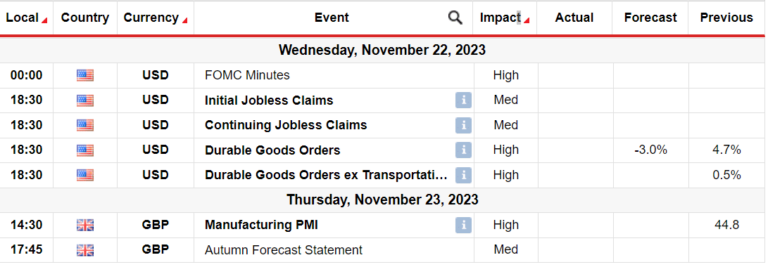

Last week, a couple / USD pair ended green while the dollar fell due to increasing expectations to reduce rates. The dollar has expanded its decline since the previous Friday, when the United States published a Pairola for Padua. At the same time, markets interpreted Trump’s replacement in Fed as Dovish. In addition, they expect Trump to replace Powell after the expression ends with a more witty chair.

–Are you interested in learning more about ECN brokers? See our detailed guide-

Meanwhile, data during the week revealed a weaker business activity than expected in relation to the American service sector. Separately, unemployment claims that it increased, encouraging concerns about the labor market.

Key events next week for AUD / USD

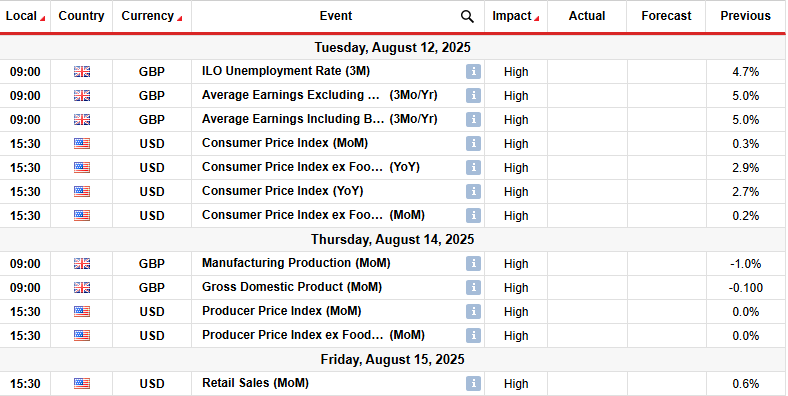

Next week market participants will focus on the spare bank meeting and employment figures in Australia from Australia. In the meantime, the US will free data on consumers and wholesale inflation. Moreover, traders will focus on the US sales report.

Participants in the market expect that RBA will reduce rates on Tuesday to 25-BPS. In addition, they expect another price to cut this year. It will therefore focus on messages during the meeting. On the other hand, American inflation data will continue to shape Outlook to reduce the feedback rates.

AUD / USD Sunday technique Technical forecast: The bulls are causing the resistance within consolidation

On the technical page, the price of AUD / USD paused near resistance of 22 SMA after it has bounced from the support level of 0.6425. Moreover, the price remained aside the transition between the support of 0.6425 and resistance levels of 06600.

–Are you interested in learning more about the brokers for the day? See our detailed guide-

The bulls struggled to maintain their position above the 22nd. However, after the last resistance between the point of contact, the pleasure was weaker, and the bears swung significantly below SMA. Still, it wasn’t enough to start downhill.

The bulls returned to the range of reaching and pushed the price to resume SMA. The pause above will allow the bulls to reset the range resistance. On the other hand, if it keeps the company, the price will probably refuse lower to try to make a lower low. Such an outcome would confirm the beginning of the bear. In addition, it would clean the way to support from 0.6201.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.