- A weekly forecast for USD / CAD indicates more brought-up attitude in Fed officials.

- The Fed’s Christopher Valler said he expected a cut in September.

- Canadian economics contracted by 0.1%.

A weekly forecast for USD / CAD suggests more goodbye to the Grand officials, which strives on the dollar.

UPS and Downs of USD / CAD

Star USD / CAD Had a Bear Week while the dollar fell in the middle of expectations to reduce the incuration rate. Fed officials, officials of this week, sounded more goodbye, increasing the chance of voting to reduce the rate at the next meeting. John Williams said the price decrease. Meanwhile, Christopher Valler said that he expected a cut in September and the more similar moves in the months in front of us. However, he also noticed that Outlook would depend on incoming data.

–Are you interested in learning more about forex indicators? See our detailed guide-

Meanwhile, data on Friday found that the Canadian economy was contracted by 0.1%, which led to the fall Loonie.

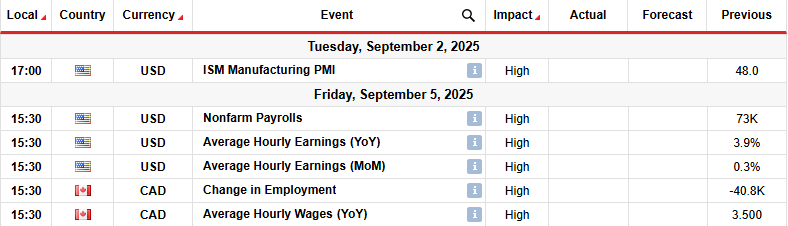

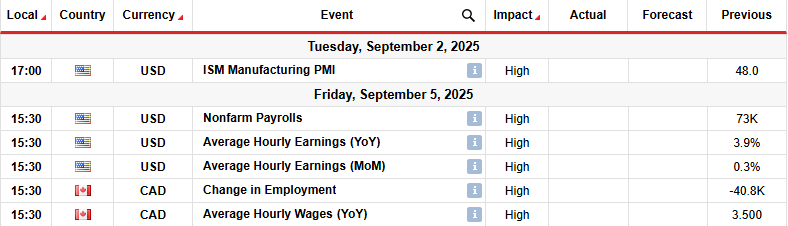

Key events next week for USD / CAD

Next week market participants will focus on business activities and employment data from the United States. Canada will also relieve its crucial monthly employment information.

The US Report Nonfarm Playrolls will play a key role in shaping the appearance of reducing the rates of the feedback rates. Further weakness in the labor market will solidify bets for the incision in September, weighing dollars.

Weekly USD / CAD Technical Forecast: Bears face level 1,3750 after SMA Pause

USD / CAD daily

On the technical page, USD / CAD price has violated below the 22nd, the signs that bears took advantage. At the same time, the RSI broke under 50, which indicates a stronger bear momentum. However, bears face 1,3750 key levels that could be difficult to break.

–Are you interested in learning more about the next cryptocurstical to explode? See our detailed guide-

Earlier, the trend turned Bikov after the three-bottom-level formation at the level of 1,3600. The bulls were terminated above the level 1,3750 and respected the 22nd. Moreover, they made a higher high, confirming the beginning of the new trend. However, that changed when the price broke under SMA. That it is only a deep pull, the bulls are likely to return at the key level of 1,3750. This would allow the price to continue its new trend with the new high. It would also allow the bulls to reset the level of resilience to 1,4000 keys.

On the other hand, if the bears have taken over, the price is likely to re-set the support level of 1,600. The last vacation would continue the previous trend.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.