- EUR / USD Sunday forecast suggests that the weakness of dollars continued.

- The Nepharmage Nefarm number entered significantly below the assessment.

- Merchants are concerned about the efforts of election that could throw France in politically chaos.

EUR / USD Sunday forecast suggests that the permanent weakness of dollars as data on employment is putting pressure on FED to reduce rates.

UPS and Devices EUR / USD

EUR / USD pair had a bicole as a dollar failed in the middle of a discount on American employment information. However, the euro also came under pressure due to political insecurity in France.

–Are you interested in learning more about MT5 brokers? See our detailed guide-

Data in the entire week on vacancies, private employment and unemployment requirements have discovered an unexpected softness in the labor market. In addition, the figure of nepharmage has come significantly below the assessment, which led to attacks in expectations to reduce the rates of the supply dollar and falling dollars.

In the meantime, the euro was fragile as traders concerned about the elections that could throw France in political chaos.

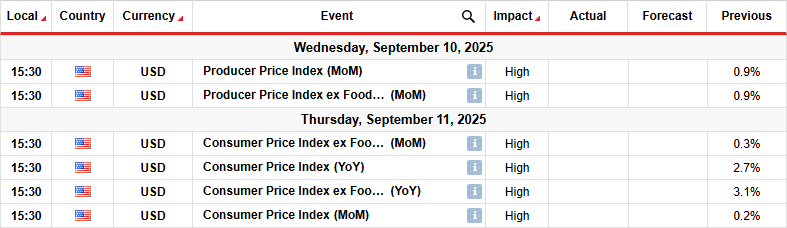

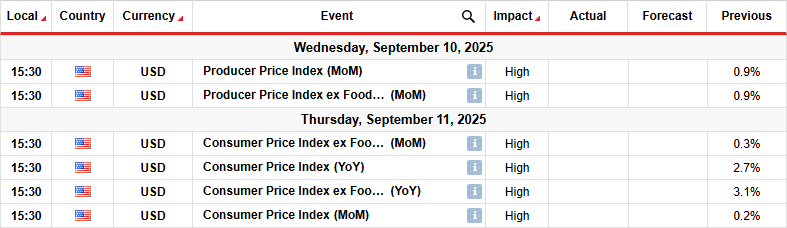

Key events next week for EUR / USD

Next week, traders will focus on information on the USA. The CPI and PPI reports will show consumer status and price manufacturers. In the previous month, the CPI report discovered soft data that were reinforced bets to reduce rates of feedback feet. Participants in the market were convinced that Trump Tariffs have affected pricing pressure slightly.

Another issue for a break will support the current trend of bad employment data, enhanced expectations from the work rate. On the other hand, if the inflation is hot, bet bets, and the dollar will recover.

EUR / USD Sunday technique Technical forecast: Bukova approaching the resistance of 1,1800

On the technical page, the price of EUR / USD price trades above 22nd, with RSI above 50, suggesting Bikovska bias. However, the price of the price also shows that the bulls are struggling to separate from the 22nd. Moreover, they face solid resistance at the key level 1,1800.

–Are you interested in learning more about Thailand forex brokers? See our detailed guide-

Initially, the price broke the SMA, which showed the bears gained momentum. However, the price failed to break below the support level of 1,1400. Here, EUR / USD made a sample of the morning star, showing that the bulls would take control. Shortly afterwards, the price broke above the 22nd.

However, the bulls must pass by the level of resilience at 1,1800 to continue the previous bakery trend. Such a move would solidify the Bikovska bias. On the other hand, if the resistance is held again, the bears can be returned to cause the trend prevailing. Pause below 1,1400 would confirm the turning up to the deficiency.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.