- The weekly forecast for USD / CAD is neutral because the markets are prepared to reduce the rates in Canada and the United States.

- The Bank of Canada under pressure is to lower the borrowing costs due to the poor labor market.

- The data was discovered something warmer than American consumer inflation.

The weekly forecast for USD / CAD is neutral because markets are prepared to reduce rates from the Canada and Feda Bank.

UPS and Downs of USD / CAD

SALL USD / CAD Had a slight Sunday as well as merchants a balanced layout of a policy for Canada and Feda. Meanwhile, American data added more pressure to FED at lower lending costs.

–Are you interested in learning more about ETF brokers? See our detailed guide-

Canada The Bank is under pressure to lower borrowing costs due to a weak labor market in Canada. Similarly, market participants expect the Fed to cut rates next week. Data during the week revealed a little hot excellent inflation in relation to that. However, the weak unemployment request was overshadowed that she overshadowed, running expectations from reducing rates.

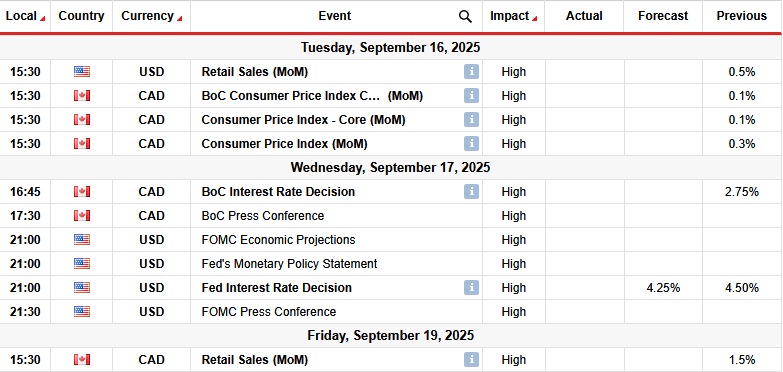

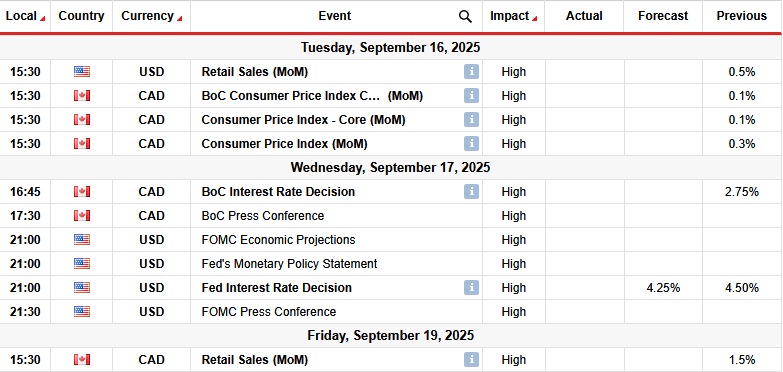

Key events next week for USD / CAD

Next week, market participants will focus on inflation and retail data from Canada, as well as a meeting of the meeting in Canada. At the same time, now will free data on retail, and Fed will take a meeting of the policy on Wednesday.

Merchants expect Boč to deliver the course of course when it meets. Recent data from Canada pointed out a weak labor market, pressure for accumulation at the central bank. The situation is the same with the American labor market. As a result, Fed will also probably lower borrowing costs.

Weekly Technical Forecast USD / CAD: Billish Trend faces 13850 obstacles

On the Technical Page, USD / CAD price cannot be slightly above the 22-SMA with RSI above 50, suggesting a bikov bias. However, the bulls are struggling to break over the level of resilience at 1,3850. Meanwhile, the bears become strong enough to pierce 22 SMA.

–Are you interested in learning more about Canada forex brokers? See our detailed guide-

The trend turned Bullish when the previous decline filled support from the 1,3600 and made a triple bottom. After that, the bulls took over by breaking over the 22-SMA and starting a pattern of larger high and higher falls. However, his pattern paused at the resistance level of 1,3850. If the bulls regain swing, the price will probably break past this level and make a new higher high.

At the same time, such a move would clear the way for USD / CAD to re-examine the level of resilience at 1.4201. On the other hand, if the bulls fail to continue higher, the price will probably be reduced to re-set the support level of 1,3600.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.