- A weekly forecast for USD / JPI suggests that growing pressure for speeds in color is growing.

- Incoming and treasury yields recovered during the week after the feet of fed to 25-BPS.

- The Bank of Japan held interest rates as expected.

A weekly forecast for USD / JPI to lean on the fluff until the internal pressure grows in the Japanese bank to increase interest rates.

UPS and USD / JPI drops

Star USD / JPI had a bicole as the dollar recovered after the expected reduction in the rates of Nah. However, the Bank of the Japanese Policy meeting also briefly stepped on Jen on Friday.

–Are you interested in more about MT5 brokers? See our detailed guide-

Incoming and treasury yields recovered during the week after the feet of fed to 25-BPS. After monthly expectations, traders mostly appreciated in motion. Therefore, when it happened exactly as expected, the dollar pulled back. At the same time, Powell said that the Central Bank would continue to assess the risks of inflation.

Meanwhile, the bank of Japan held interest rates as expected. However, traders were surprised when two policy makers voted for a campaign. As a result, autumn gathered.

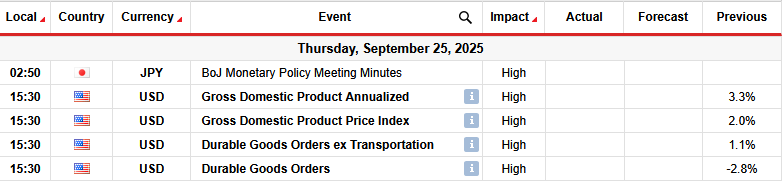

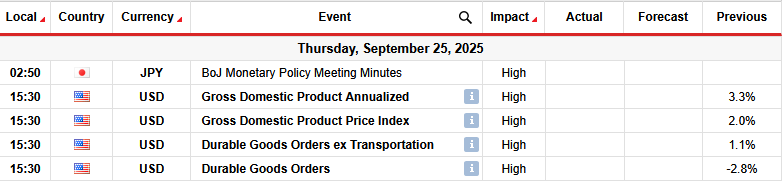

Key events next week for USD / JPI

Next week, the traders will pay attention to the meeting of the meeting of Japanese politics to see what has passed on the Friday Decision. It was already clear that the two policy creators were ready to increase interest rates. Therefore, more pressure within the Central Bank to continue its financial tightening. The records will give better detail about dissenting voices.

Meanwhile, the US will free your GDP report and basic permanent orders of goods. These reports will show the state of the economy, shape the prospects for the future reduction of the rates of the supply rates.

Weekly SOPPLANCE FOR USD / JPI: Books to bounce off the channel support

On the technical page, USD / JPI stories traded in a shallow bilkal channel and recently reiterated the support of the channels. The bulls appeared on the support of the channel and pushed the price above the 22nd. Meanwhile, RSI moved over 50 years, which indicates a stronger bulge swing.

–Are you interested in learning more about Forex signals Telegram groups? See our detailed guide-

If the bulls maintain their swing, the price will climb to re-resistance channels. Such a move would enable the bulls to test the resilience level at 152.06. The above break would strengthen the Bikovska bias. On the other hand, there is a chance that bears will withdraw the channel support.

Before he began to trade on a channel, USD / JPI was in a solid trend. However, it paused when the support level of support from 140.00 took place. Here, the price began a corrective move in the bikal channel. Therefore, another impulsive move could be down.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.