- Sedden advantage USD / CAD shows the bull trend, with the US dollar that maintains a slight advantage over the Canadian dollar.

- The price level tests resistance level at 1,3969. In case of violation, it could rise to 1,400.

- Senior American yield of the vault, elevated inflation, and the prices of oil equilibrium, holding a couple in the closed range.

A weekly forecast for USD / CAD suggests that the price is switched to three months, suggesting the bull trend. The couple offers between 1,3890 and 1,3980, indicating a robust demand purchase. Move the booster from the stems from the drop-down Canadian dollar instead of a harder US dollar.

–Are you interested in learning more about automated forex trading? See our detailed guide-

The movement of the front, the US dollar can remain elevated despite the federal reserves that maintains its current outlook. The growth of inflation and instability in the labor market could keep the American vault high.

On the other hand, the Canadian economic dependence on oil exports and global growth challenges could keep CAD on the back. Although the Canadian dollar recovered by the end of the week, it still saw from 0.1% a week.

This signifies his second week loss, hitting the lowest level from May at the beginning of this week. Analysts credited by poor performance loonic on declining raw oil prices and a decline in Canadian trade. Although oil rose by 1% to $ 61.06 per barrel, a weekly flood was broke in the middle of the news that the OPEC + nations could increase production.

In the light of these events, USD / CAD remains a strong candidate for firmness in order, because we enter the fourth quarter, with the probability of provoking level 1,4000.

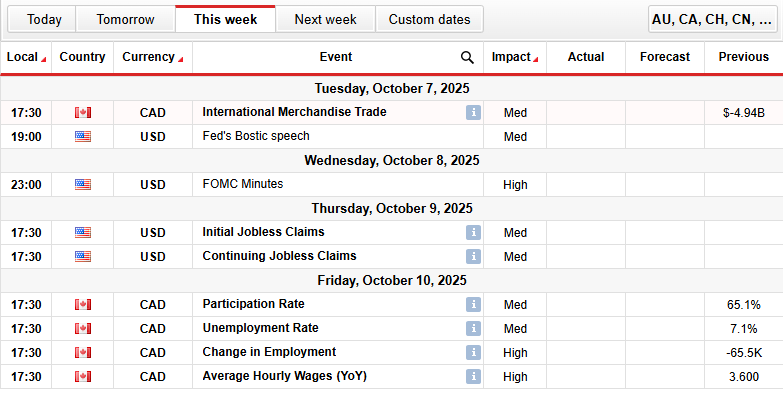

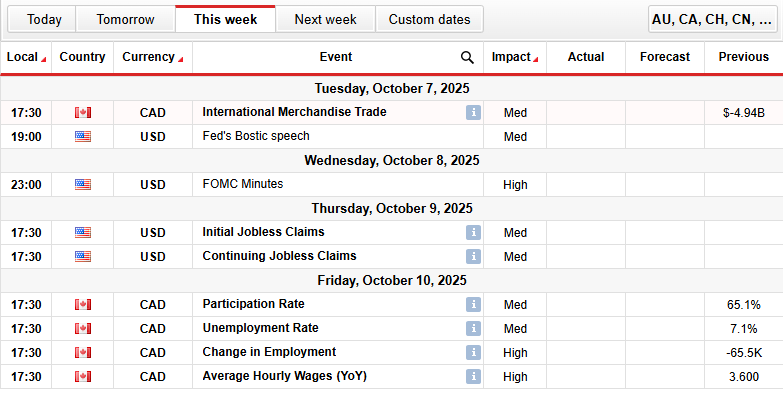

Next week USD / CAD Key events

Some of the main events that happen next week include:

- Fed’s Bostic Speech (Tuesday).

- International trade in goods (Tuesday).

- Minuters Fomc (Wednesday).

- Initial unemployment requirements (Thursday).

- Changing employment (Friday).

- Average Polish salaries (Friday).

- Unemployment rate (Friday).

- The participation rate (Friday).

USD / CAD Sunday technique Technical forecast: Make or interrupt at 1,4000

Technically, in USD / CAD pair, price causes resistance levels near 1.3969, remains closer to height from the end of August. The price consistently increases above the 50-day (green), 100-day (yellow) and 200-day movements on average. The slope of all these mas reveals the power of the bical trend.

–Are you interested in learning more about forex signals? See our detailed guide-

The RSI to 63.84 indicates that the market could increase before the transfer level to 70. However, the current price trades near the resistance level of 1,3970. If prices are over 1,3970, it can directly direct the next level of resilience to 1,4000. However, if it fails to be abandoned from this level, it can lead to withdrawal according to 1,3827 or even lower.

Looking for forex trading now? Invest in Ethorro!

67% of retail orders lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.