- USD / CAD Outlook remains positive close to 1,3950 in the middle of a cautious feeling.

- The dollar remains under pressure due to the continuous shutdown of the American governments and the cutting rates brought.

- Canadian dollar stronger due to stable oil prices and balanced Boc Outlook.

USD / CAD Outlook maintains a positive attitude that the couple is nearby 1.3950, signaling minimum market instability as traders testify to the current exclusion of the American government. The markets were also affected by the current expectations of the Federal Reserve and the upcoming Canadian employment data. Traders remain on the part in the received markets, waiting for monetary policies signals.

–Are you interested in learning more about automated forex trading? See our detailed guide-

In Washington, the political standstill is now entering the eleventh day. That is why the American government has yet to publish a lot provided for September-September payroll report. The situation affects more than 750,000 federal employees due to unpaid work, which further deteriorates economic views. Analysts emphasize that if no agreement is reached in the next 2 weeks, the American economy risks losing up to $ 3 billion, are widely affected by consumer and business market.

Moreover, the US dollar shows signs of exhaustion how the DXI index fluctuates at 98. Market speculated whether the Fed will speed up the reduction of rates to fight potential fiscal withdrawal. CME Fevdatch states that traders provide for 92% probability that the reduction of the BPS rate in the FOMC meeting was held on 29. October and further probability of 81% second cut in December. This shift reflects that Fed could priorities of stability of growth instead of inflation concerns in the middle of a limited approach to current economic data.

At the Canadian side, the Bank of Canada testifies to a balanced appearance. As inflation facilitates growth and growth, policy makers are pressured to favor alleviation. However, the market price in 55% probability of 25 BPS cuts in October. This difference in the expectations of cutting rates between Ottawa and Washington signals to keep the range of interest rates narrow. So, that could favor the Canadian dollar in the medium term.

Oil prices testified after the OPEC decision to increase the production of 137,000 barrels per day for November. Despite a smaller increase, he warned the producers. In addition, he raised an oil meter and reinforced demand for Loonie.

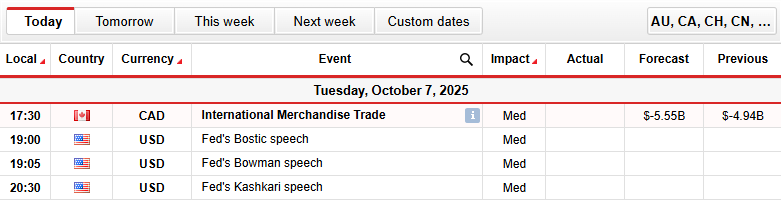

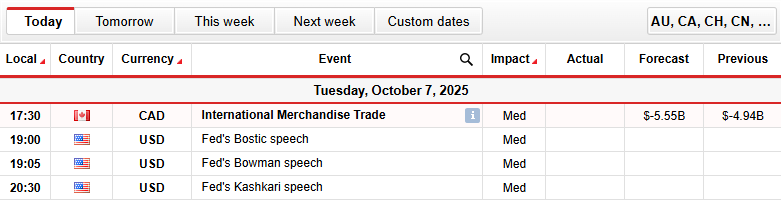

Today is key events USD / CAD

Main events due to the day include:

- International trade in Merchandise

- Fed’s Bostic Speech

- Hedan’s main gook

- Fed’s Kaqaqi Speech

In the coming days, investors will carefully pay attention to fed Christmas officials and Kaškari’s speeches and a report on Canadian affairs for all signals. If the data indicate the growth of the American American and strengthening the Canadian labor market, the US dollar will move forward.

USD / CAD Technical prospects: Bulls shy 1,4000, whose goal is 200-DMA

Daily USD / CAD signifies the solid bils trend since the middle of July. The couple trades near 1,3956, at the time of writing. The price lies above the 50-day and 100-day breaks of average.

–Are you interested in learning more about forex signals? See our detailed guide-

While the swing is bikaran, some resistance can be seen near 1,4000 psychological levels. In addition, the average average of 200 days moving in 1,4100 could stop upside down. RSI above 60.0 suggests a bakery trend, which is near the territory with excessive color.

So a smaller return could happen. If the pair remains above 1,4000, gains can be extended to 1,4200. Contrary, if it does not remain above 1,3800, it can slide towards the 1,3700 support.

Looking for forex trading now? Invest in Ethorro!

67% of retail orders lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.