- Gold mitigated below $ 4,000 because the merchant is reserved earnings after record high place, mitigating geopolitical tensions.

- The permanent policy of instability and growing concerns of inflation reaffirm a complaint on gold.

- The traders carefully monitor fed speeches and consumer index Michigan for further politics and direction.

The golden prospects shows a pause in the postendand, correcting below the $ 4,000 mark because traders accepted profit after recent record records above $ 4,060. The withdrawal derived from facilitating geopolitical tensions after American negotiated the fire between Israel and Hamas. The sense of risk has been improved, reducing demand safety. Despite this difficulty, medium-term gold prospects remain positive for supporting several macroeconomic factors.

–Are you interested in learning more about automated forex trading? See our detailed guide-

From the United States, long-lasting uncertainty regarding interest rate keeps XAU / USD on the edge. Although the dollar went more this week, the expectations of federal reserve continue its harmonized cycle in the midst of declining employment data and permanent inflation concerns continue to go down to risks.

The US government is underway, the bet on the supply rates and European political instability. Investors continue to carry out security against policy and fiscal insecurity.

In addition, the purchase of gold central bank, growing inflation and declining trust in traditional currencies have increased prices. Current geopolitical tensions, such as Rusia-Ukraine and concerns, maintain demand for safe havens as they fit optimism from truce gauze.

Despite occasional taking profits, analysts expect that gold correction is modest as protection against the protection of economic costs and uncertainty of politics. Favorable macroeconomic demand and constant interest of investors for gold protective support.

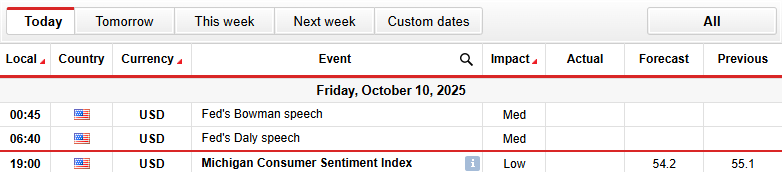

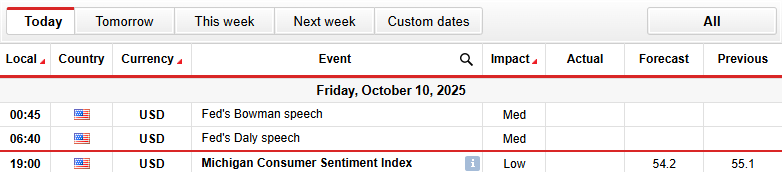

Gold key events in front

- Hedan’s main gook

- Fed’s giving a speech

- Consumer Index Michigan

Traders look in advance on Fedt’s Bowman and Dali speaks and consumer index Michigan for insight into expectations for American monetary policy.

Golden Technical Outlook: Stabilization below $ 4,000 within the Usttrend

Xau / USD 4-hour chart suggests that the price stabilizes after a strong rally. It trades close to $ 4,000, at the time of writing, after immersion at $ 3,950 overnight. The metal remains above the MAS key, except for the weight of the mass. The level of gold support is about 50 per near $ 3,930, and then 100 ma in the amount of $ 3,832, and in 200ths near $ 3.694. They imply that a wider postcrend remains solid.

–Are you interested in learning more about forex signals? See our detailed guide-

RSI remains close to 65. Although it indicates a positive momentum, it also hints about possible overload if they gather. A permanent break over $ 4,000 could run further upside down, with current resistance at every moment near $ 4060 forward of $ 4,100.

Looking for forex trading now? Invest in Ethorro!

67% of retail orders lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.