- Employment rose in Australia, while the unemployment rate fell in February.

- Markets expect a 37bps cut from the RBA, down from 44bps.

- The Fed maintained its outlook for 3 rate cuts in 2024.

The AUD/USD forecast is bullish after Australia posted its biggest monthly employment gain in a decade. At the same time, the dollar weakened after the Fed maintained its rate cut outlook despite recent hot inflation data.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

The Australian labor market showed tremendous strength in February. Employment rose while the unemployment rate fell. Namely, the number of jobs in the country increased by 116,500 in February. This was a significant increase over the previous month’s gain of 15,200. Meanwhile, the unemployment rate fell from 4.1% to 3.7%.

Australia’s labor market showed weakness in January, leading to increased bets for an RBA cut. Accordingly, policymakers were less hawkish at Tuesday’s policy meeting. However, Wednesday’s report found that labor market demand remains strong. As a result, markets now expect a 37 basis point cut from the RBA. Before the data, this figure was at 44 bps.

Meanwhile, the dollar weakened after the FOMC meeting, where the central bank kept rates on hold. After the recent inflation data, there was speculation that policymakers would be less dovish. However, Powell maintained his dovish view, saying inflation was still on a downward trend. Therefore, the Fed maintained its outlook for 3 rate cuts in 2024. Meanwhile, economic projections showed expectations for a strong economy in 2024.

AUD/USD key events today

- US unemployment claims

- US manufacturing PMI

- US flash services PMI

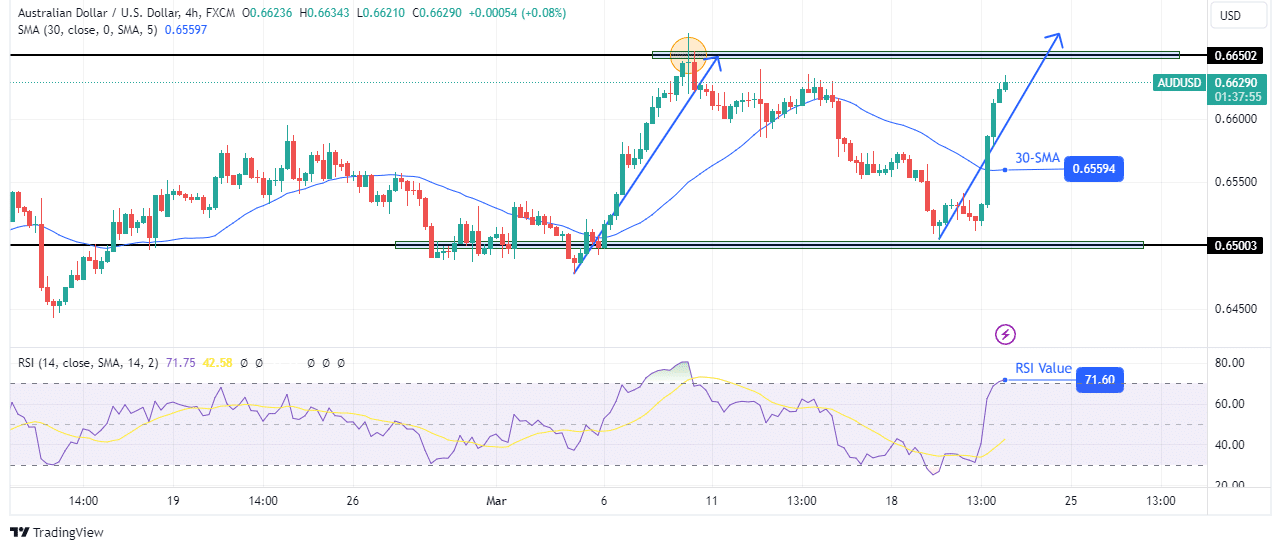

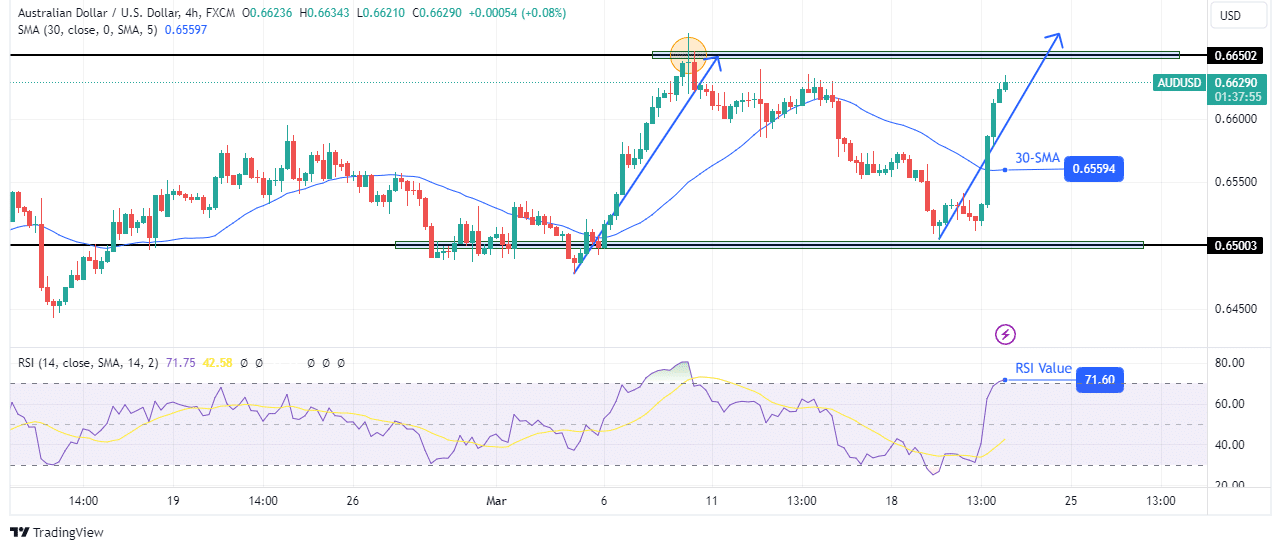

AUD/USD Technical Forecast: Price rises above 30-SMA

On the technical side, AUD/USD had a sharp bullish reversal and is now well above the 30-SMA. At the same time, the RSI jumped to the overbought region, showing solid bullish momentum. Initially, the bears controlled the market. However, the bulls took advantage before the price reached the key support level of 0.6500.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

The takeover was sharp and steep, and the price quickly approached the key resistance level of 0.6650. If the current bullish move mirrors the previous one, the price could break above the key resistance level of 0.6650. In that case, the bullish trend would continue higher. However, if the resistance remains firm, the price could fall to retest the 30-SMA.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.