- Growth in employment costs in the US was stronger than expected.

- Markets have reduced Fed rate cut expectations to just one cut in 2024.

- The Fed and RBA policy outlooks are quite similar.

The AUD/USD forecast is bearish as the US dollar strengthens following encouraging employment data. In addition, investor sentiment is leaning towards a hawkish FOMC stance, further strengthening the greenback and putting pressure on the Australian dollar.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

The US Department of Labor reported a larger-than-expected increase in employment costs. This report was another indicator of high inflation in the country. Consequently, expectations of a Fed rate cut fell. As investors await more US employment data, there is a chance they will continue to beat forecasts. This, in turn, will keep the Fed hesitant to start cutting interest rates.

Currently, markets have reduced expectations of a rate cut to just one cut in 2024. However, after the FOMC meeting, this could change. If Powell is hawkish and points to still-high inflation, the dollar could hit new highs, further weighing on the Aussie.

However, the policy outlooks of the Fed and the RBA are quite similar. Last week, inflation data from Australia beat estimates and eroded expectations for a rate cut. As a result, investors do not expect any cuts from the Reserve Bank of Australia this year. In addition, some set prices with little chance that the central bank will raise interest rates. This similarity in policy outlook will hold the floor for any decline in the AUD/USD pair.

AUD/USD key events today

- US ADP employment change

- US ISM manufacturing PMI

- Job ads in the USA

- FOMC Policy Meeting

- Bank of Canada Governor Macklem speaks

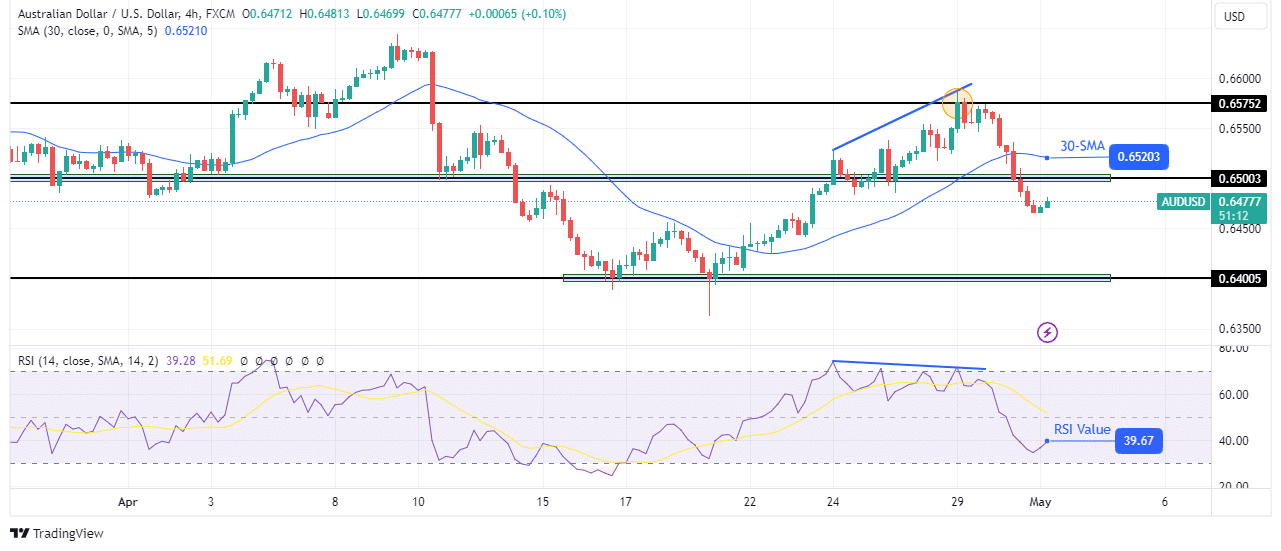

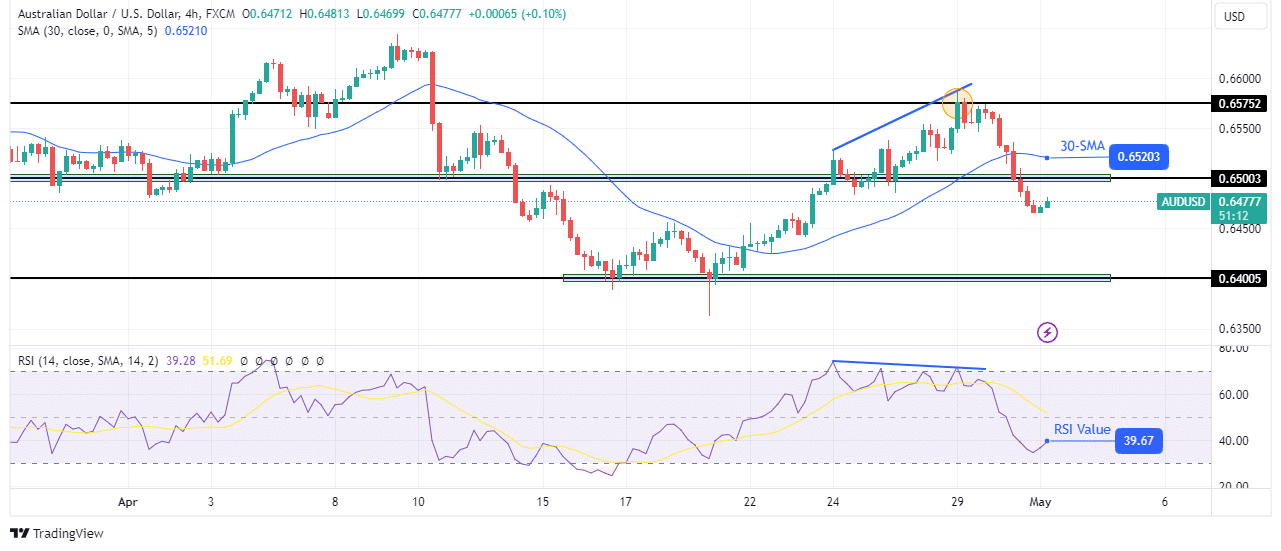

AUD/USD Technical Forecast: Bears are triggering a sentiment shift and eyeing support at 0.6400

On the charts, the AUD/USD price broke below the 30-SMA and the critical 0.6500 level to signal a change in bearish sentiment. This marks the end of the previous bullish trend, which was paused at the critical level of 0.6575. When it stopped at this level, the RSI made a bearish divergence with the price, showing that the bullish momentum is fading.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Soon after, bearish momentum surged, reversing the trend. After breaking below 0.6500, the price could retest this level as resistance before targeting the 0.6400 support level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.