- Australian retail sales fell in December after a big jump the previous month.

- There is a 70% chance of an RBA rate cut in August.

- The US Department of Labor Statistics will release job creation data later on Tuesday.

Tuesday’s AUD/USD outlook tilts to the downside following the revelation that Australian retail sales fell in December, retreating from the previous month’s gains. As a result, this drop boosted investor confidence that the RBA is unlikely to implement a rate hike next week. Additionally, there is a 70% chance of an RBA rate cut in August.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

Meanwhile, investors are eyeing the long-awaited four-quarter inflation report due on Wednesday. Economists forecast that headline consumer inflation could fall to a two-year low of 4.3%.

On the other hand, the US dollar was mostly left out of employment data and tomorrow’s Fed decision on monetary policy. Traders will be looking for insight into a potential rate cut by the US central bank.

The U.S. will release job vacancies data later on Tuesday, previewing Friday’s upcoming payrolls report. Meanwhile, the Fed is likely to keep interest rates unchanged tomorrow. However, all eyes will be on Fed Chairman Jerome Powell’s message at Wednesday’s press conference.

Markets are currently pricing in a 46.6% chance the US central bank will start cutting interest rates in March, down from 73.4% a month ago. The change comes after data showed the US economy remains resilient.

AUD/USD key events today

- Consumer Confidence USA CB

- US JOLTS Job Openings

AUD/USD technical outlook: Price is trading in a tight range

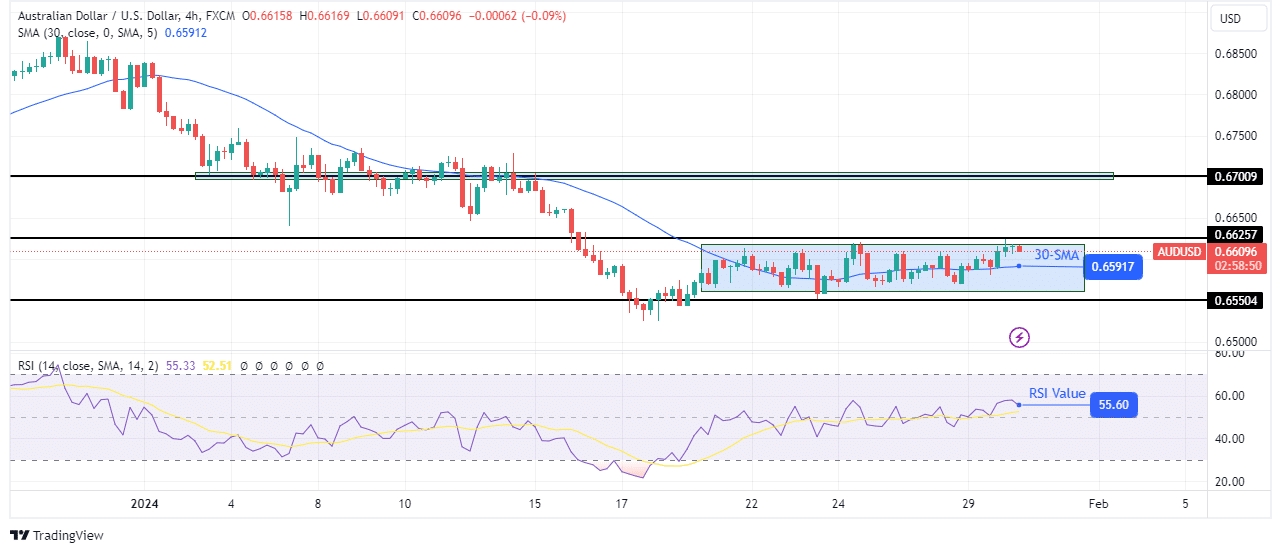

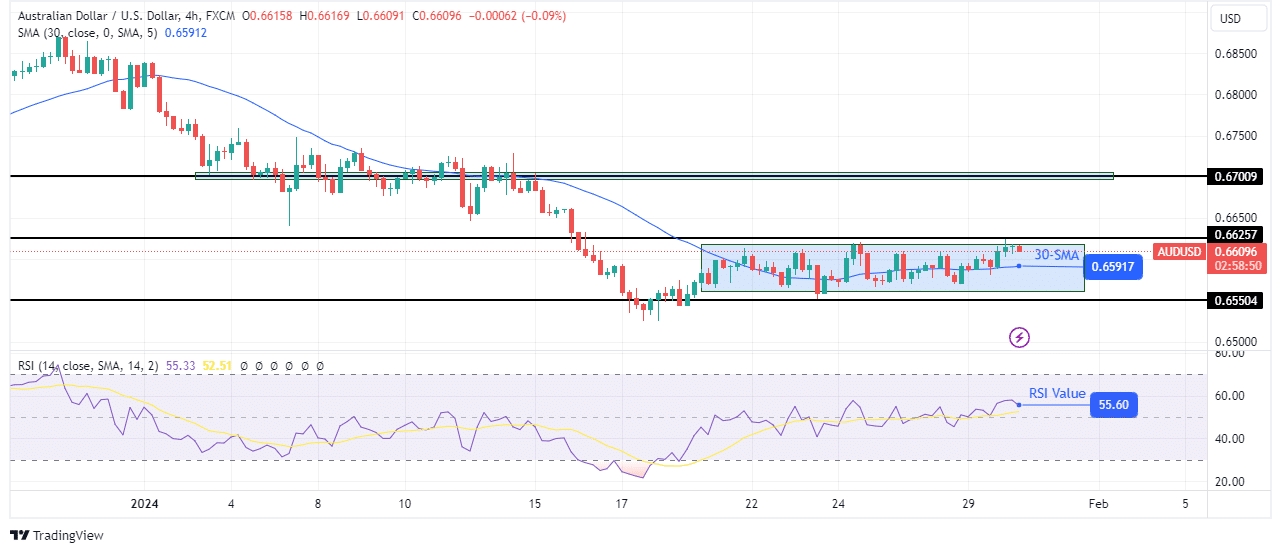

On the technical side, AUD/USD is trapped in consolidation, with the nearest support at 0.6550 and the nearest resistance at 0.6625. The range market came after a strong bearish trend that failed to break below the 0.6550 support level. Consequently, the price pulled back to the 30-SMA. At this point, the price confirmed the range by crossing the SMA. Similarly, the RSI has started cutting through the key 50 level.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

If this consolidation is a break in the downtrend, then the price is likely to break below the range support and the 0.6550 support level soon. On the other hand, the trend will reverse to bullish if the price breaks above the resistance level of 0.6625.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money