- The dollar strengthened ahead of the US consumer inflation report.

- The Australian dollar was steady after mixed economic reports.

- A report on Australian consumer confidence showed a rebound in February.

On Tuesday, the AUD/USD outlook tilted towards bearish territory as the greenback rose in anticipation of the upcoming US inflation report. Meanwhile, the Australian dollar was steady after mixed economic reports.

–Are you interested in learning more about copy trading platforms? Check out our detailed guide-

The inflation report carries a lot of weight because it heavily influences the Fed’s outlook. Moreover, it will affect market bets for a rate cut. At this point, experts believe the figure will show a drop in inflation, in line with the recent downward trend. Such an outcome is likely to fuel bets on a rate cut, sending the dollar lower. Accordingly, the AUD/USD pair would strengthen. On the other hand, the pair would sink if the figure beats forecasts.

In Australia, the consumer confidence report showed a recovery in February. Consumers are more confident as inflation is falling that rates have peaked. As a result, there is more consumption in the economy. Inflation in Australia fell to 4.1% in Q4 as high interest rates slowed the economy. Although the RBA has hinted at the possibility of another rate hike, markets believe the next move will be a cut.

Meanwhile, another report revealed softer business conditions in Australia in January. This is a consequence of the slowdown in the services sector, which drives a large part of the economy. Despite the slowdown in inflation and the economy, the RBA reiterated on Tuesday that inflation is still too high. It will therefore take time to return to the 2% target.

AUD/USD key events today

- US Core CPI m/m

- US CPI m/m

- US CPI y/y

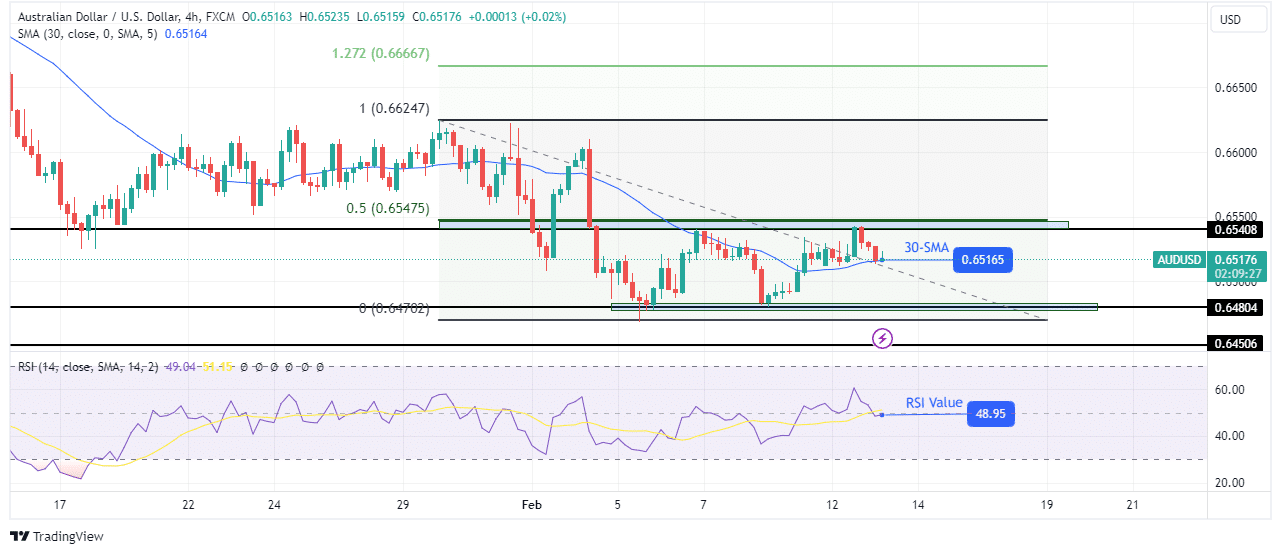

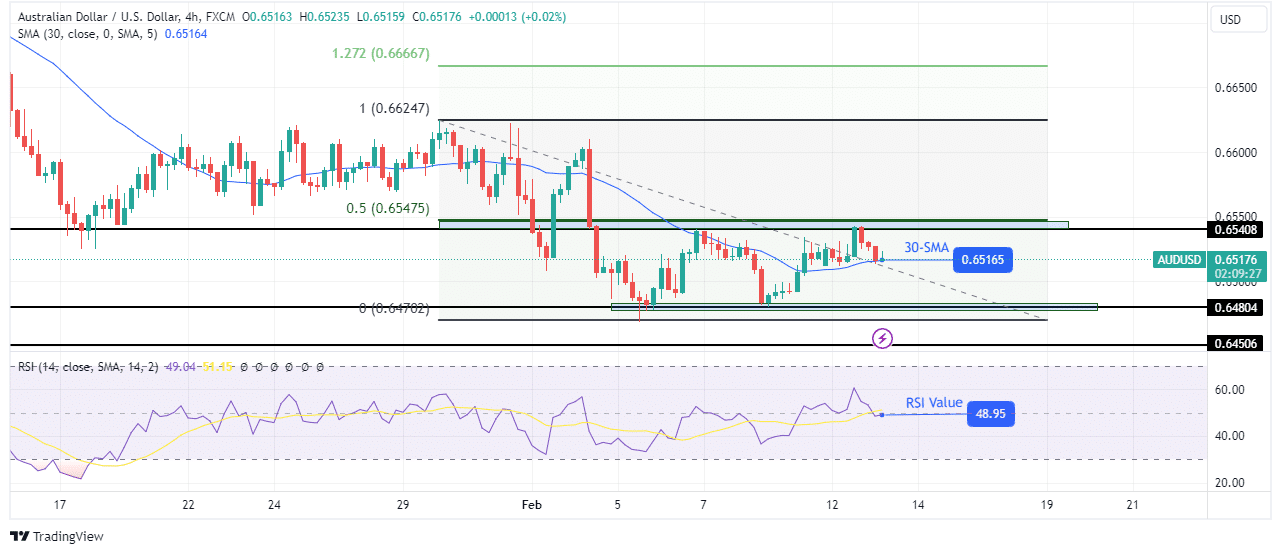

AUD/USD Technical Outlook: New bullish momentum faces tough resistance

On the technical side, AUD/USD fell to the 30-SMA support after retesting the 0.6540 resistance level. Initially, the price was in a downtrend, respecting the 30-SMA as resistance until it paused at the 0.6480 support level. At this point, the bulls appeared, causing a breakout above the 30-SMA resistance. Accordingly, there was a change in sentiment from bearish to bullish.

–Are you interested in learning more about forex broker scalping? Check out our detailed guide-

However, the new bullish move encountered a strong resistance zone consisting of the 0.6540 level and the 0.5 Fib level. Bears will continue their downtrend if this zone holds. However, if the price eventually breaks above, it could start a bullish trend.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money