- RBA Governor Michelle Bullock said there is still a chance the RBA will raise interest rates.

- Markets now have a 38% chance of a February RBA hike.

- Expectations for March Fed tapering fell to 16.5%.

Friday’s AUD/USD price analysis revealed bullish momentum, marked by a resilient recovery after a significant drop in the previous session.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

The currency bounced back, buoyed by hawkish remarks from RBA Governor Michelle Bullock. Bullock said there is still a chance the RBA will raise interest rates as inflation remains an issue. Moreover, the central bank believes that the road to the 2-3 percent target is still long.

Markets reacted to her hawkish remarks by increasing bets for a rate hike at the next policy meeting. A week ago, there was almost no chance that the RBA could raise rates at its February 28 policy meeting. However, markets now have a 38% probability of such an outcome. However, most market participants doubt the possibility of an increase.

Meanwhile, economists adjusted the possible timing of the first rate cut to September. At the same time, the chances of a rate cut in May fell from 50% at the beginning of last week to 20%.

A wave of hawkish remarks from major global central banks dampened expectations for interest rate cuts. Consequently, some experts such as UBS do not expect the first RBA rate cut until November.

In the previous session, the pair fell as the dollar strengthened amid falling rate cut bets. Expectations for a rate cut fell after jobless claims data fell more than expected. At the same time, multiple Fed policymakers, including Thomas Barkin and Susan Collins, issued statements suggesting the Fed was in no rush to cut interest rates. As a result, expectations for a March contraction fell to 16.5%.

AUD/USD key events today

Following Michele Bullock’s speech, the AUD/USD calendar is blank for today. Therefore, traders will continue to digest the new prospect of RBA and Fed rate cuts.

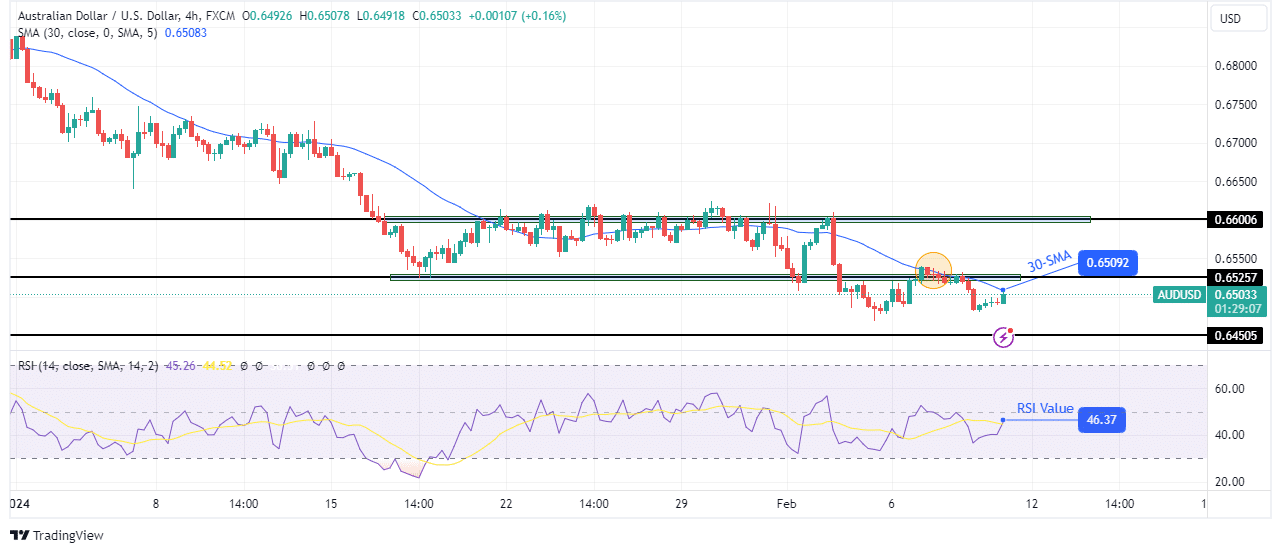

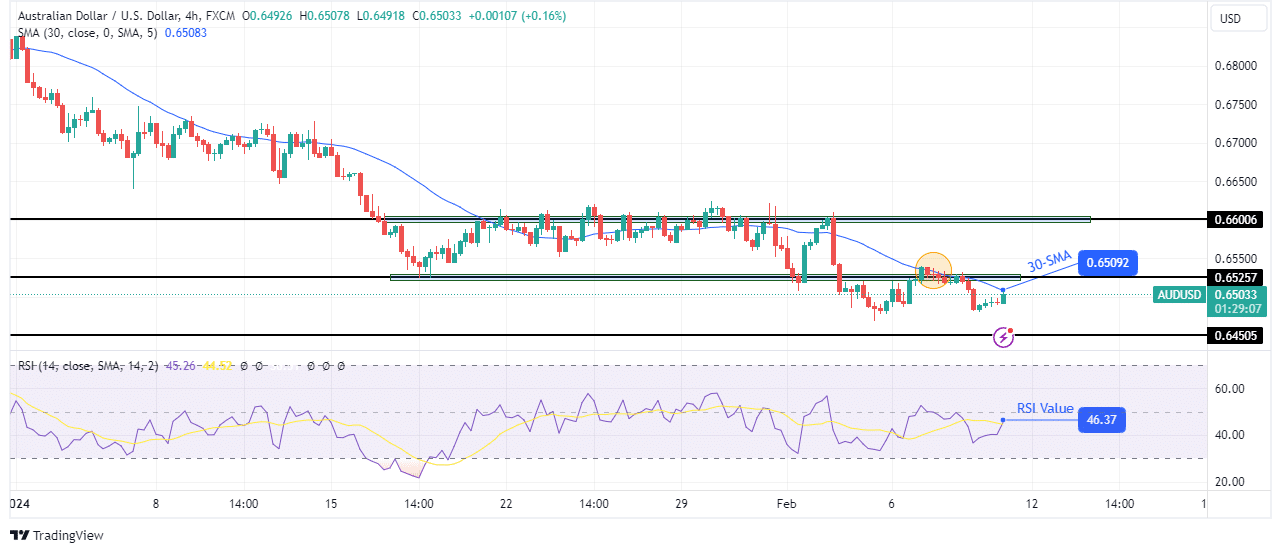

AUD/USD Price Technical Analysis: Price recovers to challenge 30-SMA resistance

On the charts, AUD/USD recovered to the 30-SMA resistance. However, the bias is bearish as the price is in a downtrend, holding below the SMA. At the same time, the RSI mostly remained in the bearish territory below 50.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

Therefore, a pullback to the SMA is likely to lead to a lower bounce. Initially, when the price broke below the 0.6525 support, it pulled back but could not break above the 30-SMA. Therefore, there is a high probability that the price will respect the SMA again and fall to the support of 0.6450, the new low.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.