- The RBA held rates but was less hawkish.

- RBA Governor Michelle Bullock failed to provide clear guidance on rate cuts.

- The dollar was steady ahead of the FOMC meeting that could shape the Fed’s rate cut outlook.

AUD/USD price analysis points to more downside potential as the pair declines following the Reserve Bank of Australia’s policy meeting. It is significant that the RBA held rates, but was less hawkish, noting that inflation was progressing and the economy was slowing down. Accordingly, bets on a rate cut have increased.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

At its last meeting, the RBA was hawkish, stating that there is still a chance for an increase. However, this tone changed to a more neutral one on Tuesday. Still, RBA Governor Michelle Bullock failed to provide clear guidance on the rate cut. The RBA is likely to take a cautious stance, evaluating the data as it comes in.

Before the meeting, markets had expected the RBA to cut rates by 37 bps in 2024. However, after the meeting, this rose to 43 bps. The RBA is working to reduce inflation to a target of 2 to 3%.

Meanwhile, the dollar was steady ahead of the FOMC meeting that could shape the Fed’s rate cut outlook. While markets expect the Fed to keep rates on hold, there is speculation that policymakers will take a less dovish stance.

In particular, recent data show continued resilience in the US economy with pockets of weakness. At the same time, inflation has exceeded forecasts, leading to a decline in rate cut bets. Currently, the probability of a reduction in June is below 60%. A hawkish Fed at tomorrow’s meeting could push this value below 50%.

AUD/USD key events today

There are no more key events today that could significantly impact AUD/USD. As a result, traders will continue to digest the outcome of the RBA policy meeting.

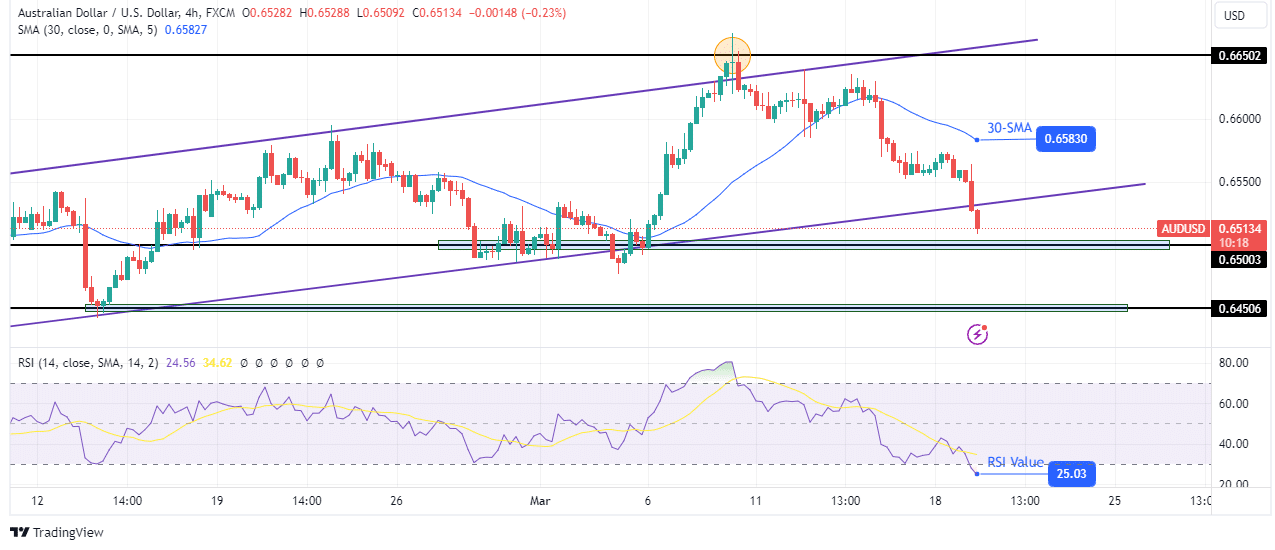

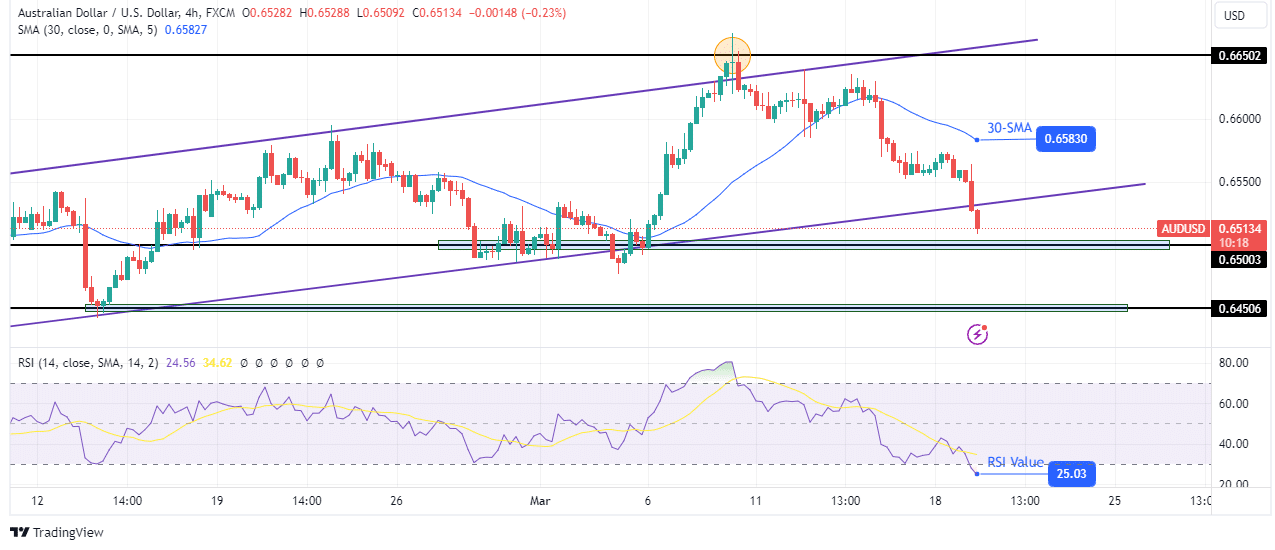

AUD/USD Technical Price Analysis: Bearish breakout signals are changing direction

On the technical side, AUD/USD made a significant bearish move, breaking out of its bullish channel. Accordingly, the bias is strongly bearish. The price is now trading well below the 30-SMA, indicating a sharp decline. Meanwhile, the RSI is showing strong bearish momentum in the oversold region.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

Although the price has broken out of its bullish channel, the bears need to confirm the breakout before it continues lower. To do this, the price must retest the channel support and bounce lower for the lower low. This would allow the bears to retest the 0.6500 and 0.6450 support levels.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.