- The RBA followed the path of the Federal Reserve, suppressing interest rate cut expectations.

- The RBA announced that it needs more convincing that inflation is falling.

- Australians rallied on gains in Chinese shares.

Tuesday’s AUD/USD price analysis showed a bullish recovery as investors absorbed the RBA’s hawkish signals. Despite the central bank keeping interest rates on hold, the focus has been on its emphasis on the potential for rate hikes.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

The RBA followed the path of the Federal Reserve, suppressing interest rate cut expectations.

Recently, major central banks have said it is too early to consider rate cuts as inflation remains high. On Sunday, Fed Chairman Powell said that the central bank is still not convinced that inflation is on a downward trend.

However, the situation in Australia is a little different. The economy is slowing down, and inflation has decreased in the fourth quarter. However, on Tuesday the RBA announced that more convincing is needed that inflation is falling. Therefore, it is still possible that the bank will increase the rates. Consequently, investors pushed back the timing of the first RBA rate cut from August to September.

The RBA’s rate hikes began in May 2022, increasing interest rates by 425 bps. High rates contributed to reduced demand in the Australian economy, causing inflation to fall from 7.8% to 4.1% in Q4. However, the value is still above the bank’s target of 2%.

Moreover, Australians strengthened the yuan on the rise in Chinese stocks. Shares in China hit a record high on Tuesday as authorities sought to shore up weak markets. This also caused the yuan to rise.

AUD/USD key events today

The RDA policy meeting closed the calendar of major events for the day. Accordingly, the pair is likely to continue to absorb the central bank’s message.

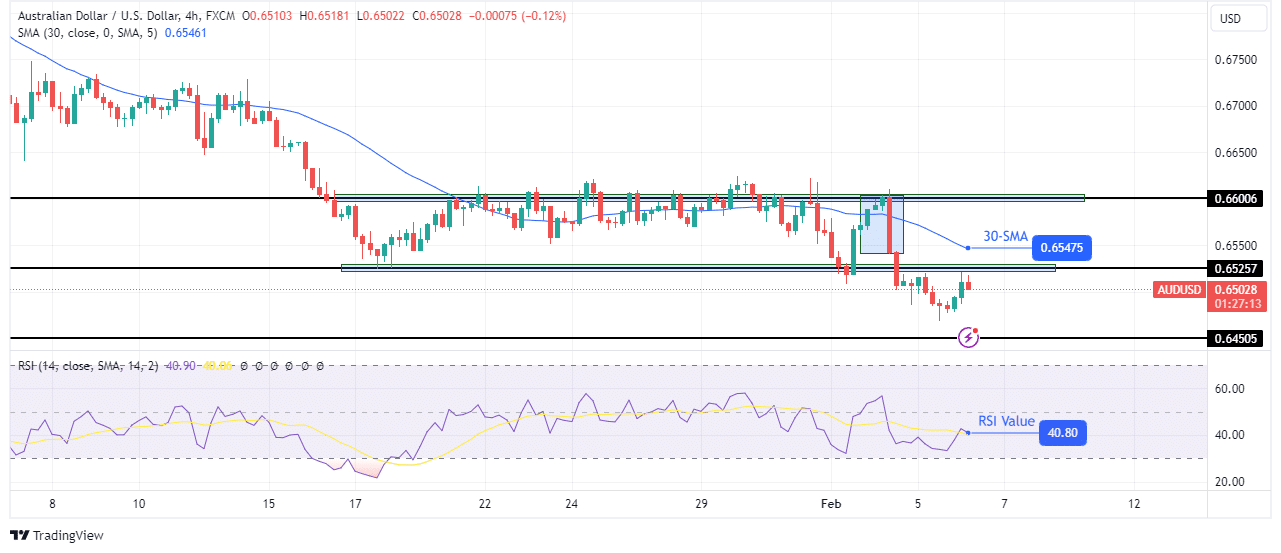

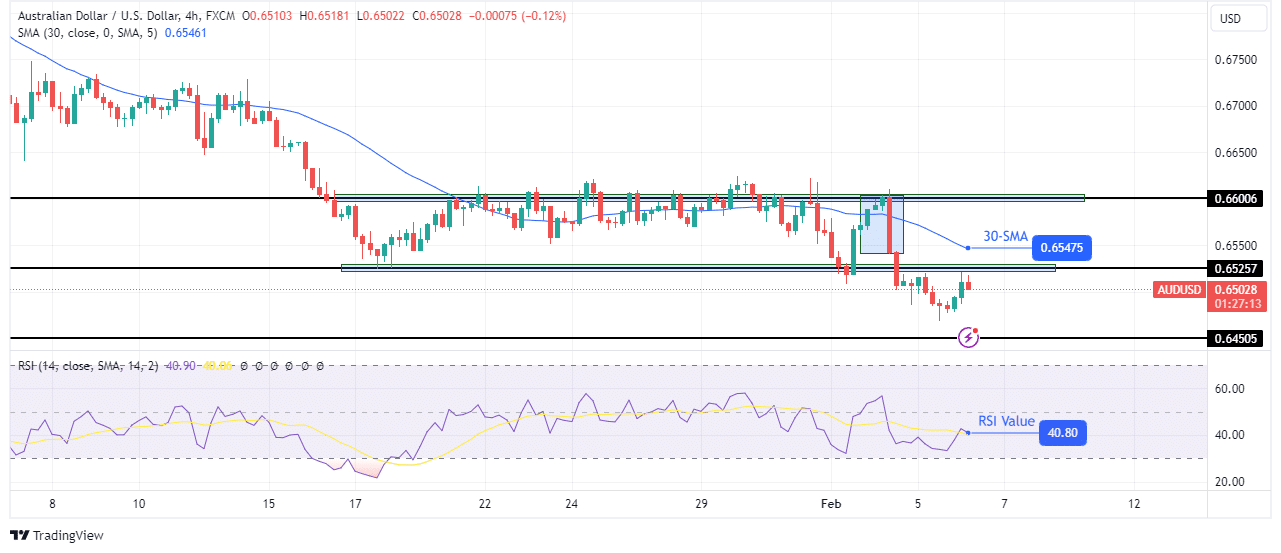

AUD/USD Price Technical Analysis: Downtrend pauses for temporary pullback.

On the charts, AUD/USD is recovering after breaking below the key support level of 0.6525. However, the recovery comes in a bearish trend as the price is below the 30-SMA and the RSI is below 50. Therefore, it may not cross the 30-SMA resistance.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

The recent decline came after the price made a bearish candle at the key resistance level of 0.6600. Consequently, the bears broke below the 0.6525 support to make a lower low. This new low confirmed the continuation of the bearish trend. Therefore, the bears are probably waiting at 0.6525 to continue the downtrend.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money